- United States

- /

- Trade Distributors

- /

- NYSE:MSM

MSC Industrial Direct (MSM) Margin Miss Reinforces Cautious Dividend Outlook

Reviewed by Simply Wall St

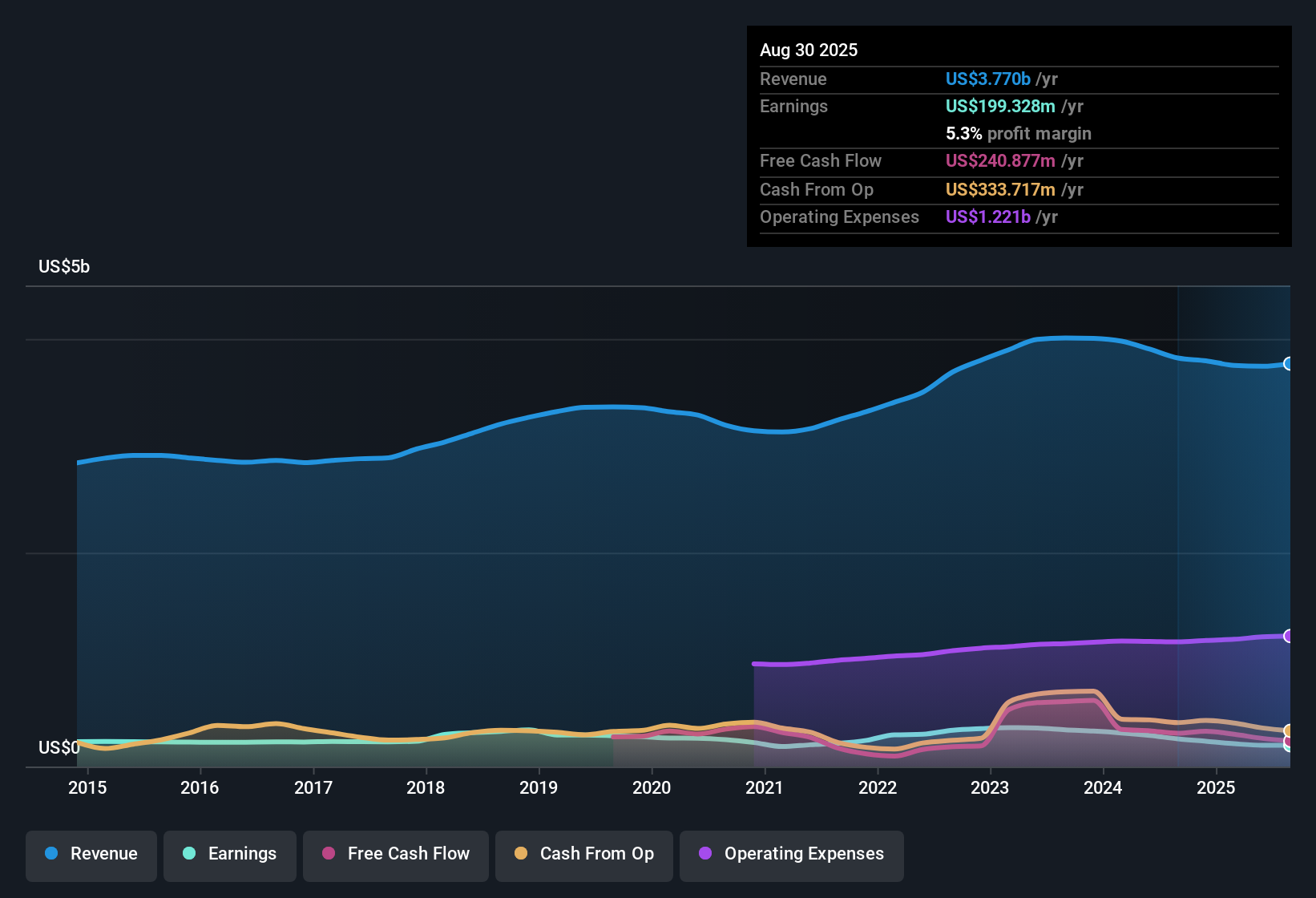

MSC Industrial Direct (MSM) reported a net profit margin of 5.3%, down from 6.8% in the prior year, while earnings have shown modest annual growth of 0.7% over the last five years. Looking ahead, analysts expect earnings to climb by about 10.1% per year. However, this growth rate trails the broader US market forecast of 15.5% annually and remains paired with slower projected revenue growth compared to the general market. These results set the stage for investors to focus closely on future profitability as shares trade above estimated fair value and margin pressures persist.

See our full analysis for MSC Industrial Direct.Next, we will see how these headline results measure up against the prevailing narratives, highlighting where expectations seem to match reality and where the numbers may challenge conventional views.

See what the community is saying about MSC Industrial Direct

Analyst Price Target Just Below Market

- The most recent analyst price target for MSC Industrial Direct is $87.50 per share, slightly under the current share price of $88.

- Analysts' consensus view highlights only a 1% gap between the market price and their target, which signals expectations of muted upside for now.

- Despite anticipated earnings growing 10.1% annually (versus 15.5% for the US market), analysts see $293.5 million in earnings by 2028 supporting $4.3 billion in revenue.

- This target assumes MSC would be valued at approximately 21.0 times projected 2028 earnings, compared to its present 24.6 times price-to-earnings ratio. This suggests a narrowing in valuation premium over time.

To see if Wall Street's measured outlook fits your own narrative for MSC, read the latest perspectives and breakdowns in the full consensus view. 📊 Read the full MSC Industrial Direct Consensus Narrative.

Share Price Trades Well Above DCF Fair Value

- MSC’s current share price of $88 is meaningfully above its DCF fair value estimate of $59.62.

- Consensus narrative notes that the current market price reflects optimism about future margin expansion and revenue recovery.

- The stock commands a 24.6 times price-to-earnings ratio, higher than the US Trade Distributors industry average of 22.8 times, but materially below the peer group’s 66.9 times multiple. Its premium appears moderate in sector context.

- Analysts expect a margin uplift to 6.9% by 2026, up from today’s 5.3%. Network optimization and technology upgrades are cited as key margin drivers.

Dividend Sustainability Is the Main Flagged Risk

- The EDGAR summary highlights uncertainty around dividend sustainability as the only current risk, even as profit and revenue are forecast to grow.

- Consensus narrative underscores potential challenges in maintaining the payout if macroeconomic or cost pressures intensify.

- Operating expenses, higher personnel costs, and depreciation have all limited margin growth. About 10% of costs are exposed to China tariffs, amplifying potential future impacts.

- Soft demand and a 4.7% year-over-year decline in average daily sales could constrain both cash flow and dividend coverage as conditions fluctuate.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for MSC Industrial Direct on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have a different take on the results or outlook? Share your perspective and shape your narrative in just minutes. Do it your way.

A great starting point for your MSC Industrial Direct research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

MSC Industrial Direct’s shares sit above fair value while its dividend faces scrutiny, as cost pressures and soft demand weigh on future cash flow stability.

For investors seeking more dependable income streams and resilient yields, see our handpicked list of these 1989 dividend stocks with yields > 3% delivering over 3% and consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSM

MSC Industrial Direct

Engages in the distribution of metalworking and maintenance, repair, and operations (MRO) products and services in the United States, Canada, Mexico, the United Kingdom, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives