- United States

- /

- Trade Distributors

- /

- NYSE:MSM

MSC Industrial Direct Co., Inc.'s (NYSE:MSM) Share Price Could Signal Some Risk

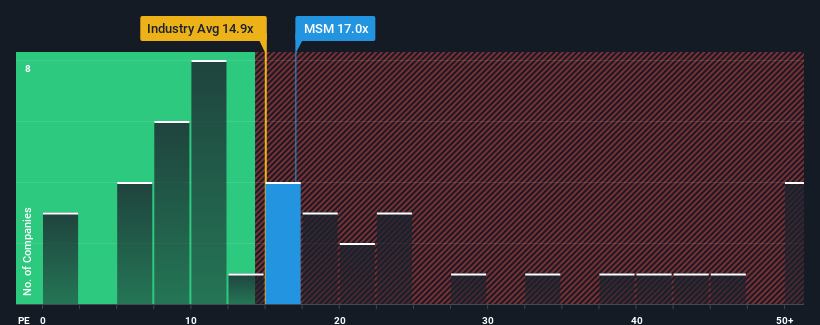

With a median price-to-earnings (or "P/E") ratio of close to 17x in the United States, you could be forgiven for feeling indifferent about MSC Industrial Direct Co., Inc.'s (NYSE:MSM) P/E ratio of 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With its earnings growth in positive territory compared to the declining earnings of most other companies, MSC Industrial Direct has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for MSC Industrial Direct

Does Growth Match The P/E?

MSC Industrial Direct's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Although pleasingly EPS has lifted 34% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 6.3% each year as estimated by the nine analysts watching the company. With the market predicted to deliver 13% growth each year, the company is positioned for a weaker earnings result.

With this information, we find it interesting that MSC Industrial Direct is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of MSC Industrial Direct's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for MSC Industrial Direct that you should be aware of.

If these risks are making you reconsider your opinion on MSC Industrial Direct, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MSM

MSC Industrial Direct

Engages in the distribution of metalworking and maintenance, repair, and operations (MRO) products and services in the United States, Canada, Mexico, the United Kingdom, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives