- United States

- /

- Trade Distributors

- /

- NYSE:MRC

MRC Global (MRC) Net Margin Decline Raises Questions on Premium Valuation and Turnaround Narrative

Reviewed by Simply Wall St

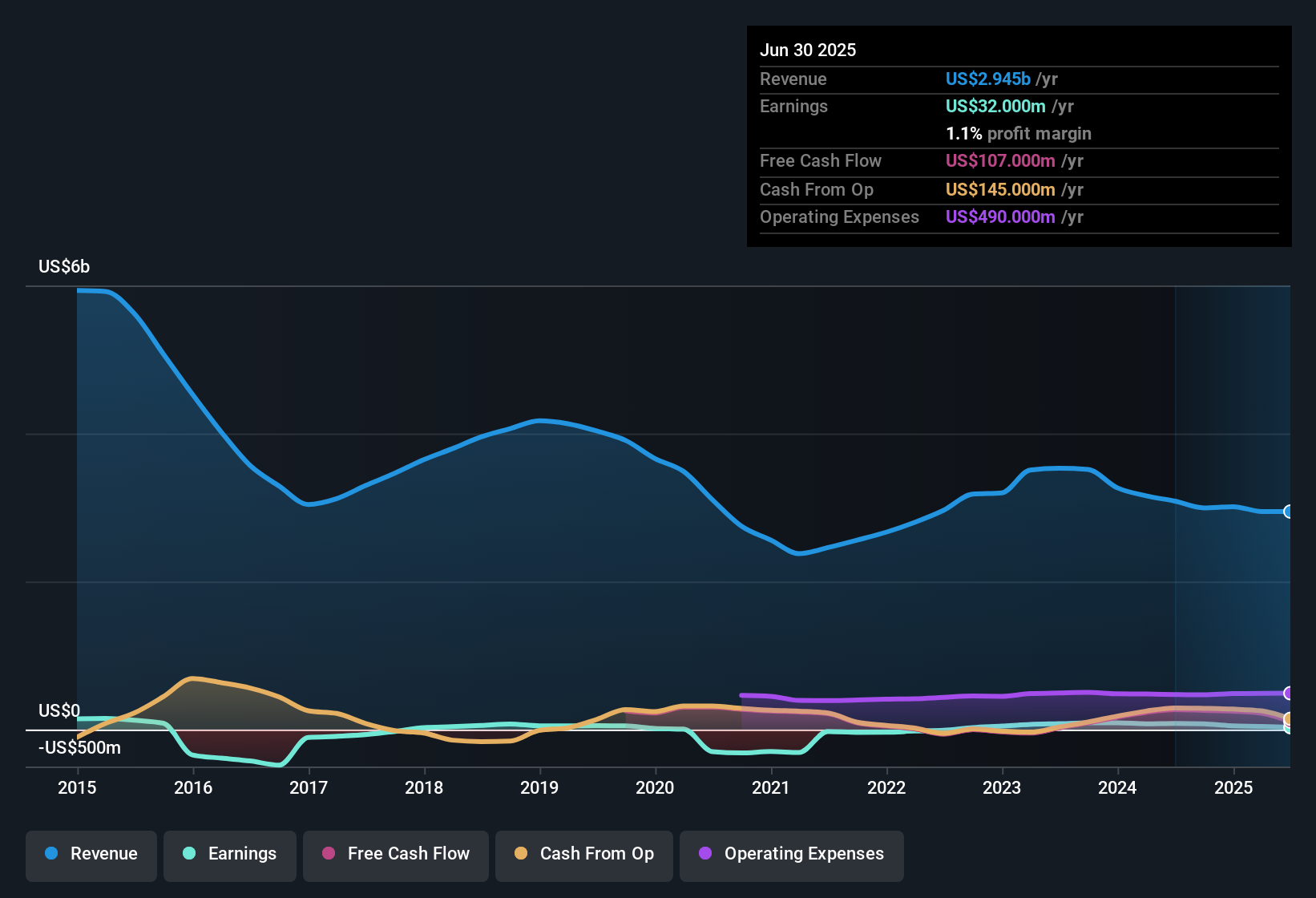

MRC Global (MRC) has delivered a notable turnaround, with earnings climbing at an annual rate of 76% over the past five years and forecasts pointing to ongoing 20% per year growth, well above the broader US market’s 16% outlook. Despite the positive trajectory, revenue growth is expected to trail at 3.9% per year compared to a 10.5% pace for the US market, and net profit margins recently slipped from 2.7% to 1.1%. The stock’s price-to-earnings ratio sits at 36.6x, considerably above peers and industry averages, adding a premium valuation dimension to the operational story.

See our full analysis for MRC Global.The next step is to see how these headline figures compare with the narratives shaping investor sentiment. Where do the numbers reinforce the prevailing views, and where do they spark new debate?

See what the community is saying about MRC Global

Debt Reduction and Buybacks Drive 2025 Outlook

- MRC Global’s $125 million share buyback program and the sale of its Canada business to fund debt reduction are meant to boost cash generation and bolster profitability into 2025 and beyond.

- According to the analysts' consensus view, simplifying the capital structure through preferred share repurchases and redirecting asset sale proceeds toward paying down debt is expected to lift net margins and earnings per share, with projected profit margins increasing from 1.1% today to 3.1% in three years time.

- Consensus narrative notes that these moves, along with strategic initiatives, should materially benefit earnings and financial health, especially if revenue growth from utilities and other sectors continues to gain traction.

- What’s surprising is the degree to which margin expansion projections depend on successful execution of these buybacks and debt cuts, emphasizing operational discipline as a driver of value.

Internal Controls and Sales Declines Raise Caution

- Internal control weaknesses recently emerged after noncompliance was found at two North American sites, coming alongside a 14% sequential sales drop and a 10% year-over-year quarterly decline. This highlights operating risks despite the turnaround story.

- Bears argue that these vulnerabilities could jeopardize financial reporting reliability and slow the margin recovery, with declining project activity and heavy reliance on a few sectors raising the risk of volatile revenue.

- Critics highlight that volatility in customer segments such as U.S. gas utilities could keep revenue subdued if planned capital investments don’t materialize, pressing on both top line and margins.

- The added risk is that dependencies on external market factors such as tariffs and inflation further complicate margin maintenance, challenging the path to sustained profitability even with cost and structure improvements.

Premium Valuation and Analyst Target Gap

- Trading at a price-to-earnings ratio of 36.6x, well above both peer and industry averages, MRC Global’s $13.78 share price stands just 7.4% below the analyst target of $15.67, keeping upside limited compared to sector norms.

- The consensus narrative suggests that to close this gap, earnings must rise from $32 million to $107.3 million by 2028, and the company would need to trade at a much lower future multiple of 16.0x, well below even today’s wider industry standards.

- Consensus narrative highlights that the market is already pricing in a substantial improvement in margins and cash generation, so any under-delivery on those fronts could quickly erode this modest valuation edge.

- The relatively small difference between the current share price and the target implies that, on average, analysts believe the stock is fairly valued at this stage, putting the burden back on execution rather than further multiple expansion.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for MRC Global on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Take just a few minutes to shape your perspective and share your own narrative, then Do it your way.

A great starting point for your MRC Global research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

MRC Global faces hurdles with limited revenue growth, margin pressures, and a stretched balance sheet. Debt reduction and buybacks have become critical to its outlook.

If you want more confidence in a company's financial foundation, check out solid balance sheet and fundamentals stocks screener (1979 results) to discover businesses with robust balance sheets and resilient fiscal health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRC

MRC Global

Through its subsidiaries, distributes pipes, valves, fittings, and other infrastructure products and services in the United States and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives