- United States

- /

- Aerospace & Defense

- /

- NYSE:MOG.A

Moog (MOG.A): Exploring Current Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

Moog (MOG.A) has attracted attention in recent weeks as investors digest its recent stock performance and consider what might be next for the shares. The company’s trajectory offers several points for discussion, especially regarding longer-term returns.

See our latest analysis for Moog.

Moog's share price has been a bit choppy lately, with a 5.35% gain over the past 90 days reflecting some recent momentum. However, the one-year total shareholder return of -7.23% serves as a reminder that longer-term holders have faced headwinds. Still, Moog’s impressive 135.69% total shareholder return over three years puts its recent volatility into a wider context, suggesting the broader trend remains constructive even if sentiment has pulled back in the short term.

If you’re looking for other compelling opportunities beyond Moog, now is a smart time to broaden your investing horizons and discover fast growing stocks with high insider ownership

Given its recent pullback alongside steady long-term gains, the question now is whether Moog shares are attractively undervalued or if the current price already reflects expectations for future growth. Could there be a real buying opportunity here?

Most Popular Narrative: 12% Undervalued

Moog’s fair value is estimated at $228.75, which is meaningfully higher than the last closing price of $200.64. This wide gap between the market and consensus expectations sets the backdrop for a deeper look at what’s driving the valuation.

Moog is positioned to benefit from a sustained increase in global defense spending, with significant order backlog and direct exposure to U.S., NATO, and Indo-Pacific modernization programs. This is likely to drive multi-year revenue growth and increased earnings stability.

Want to know the growth blueprint behind this high valuation? The narrative depends on bold multi-year revenue and margin expansion projections, along with a premium future profit multiple. Curious what numbers analysts are banking on? See inside the full narrative to uncover the pivotal assumptions fueling this upside target.

Result: Fair Value of $228.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff pressures and potential defense budget cuts could still challenge Moog’s growth story. These factors may put near-term earnings and stability at risk.

Find out about the key risks to this Moog narrative.

Another View: What Does the SWS DCF Model Say?

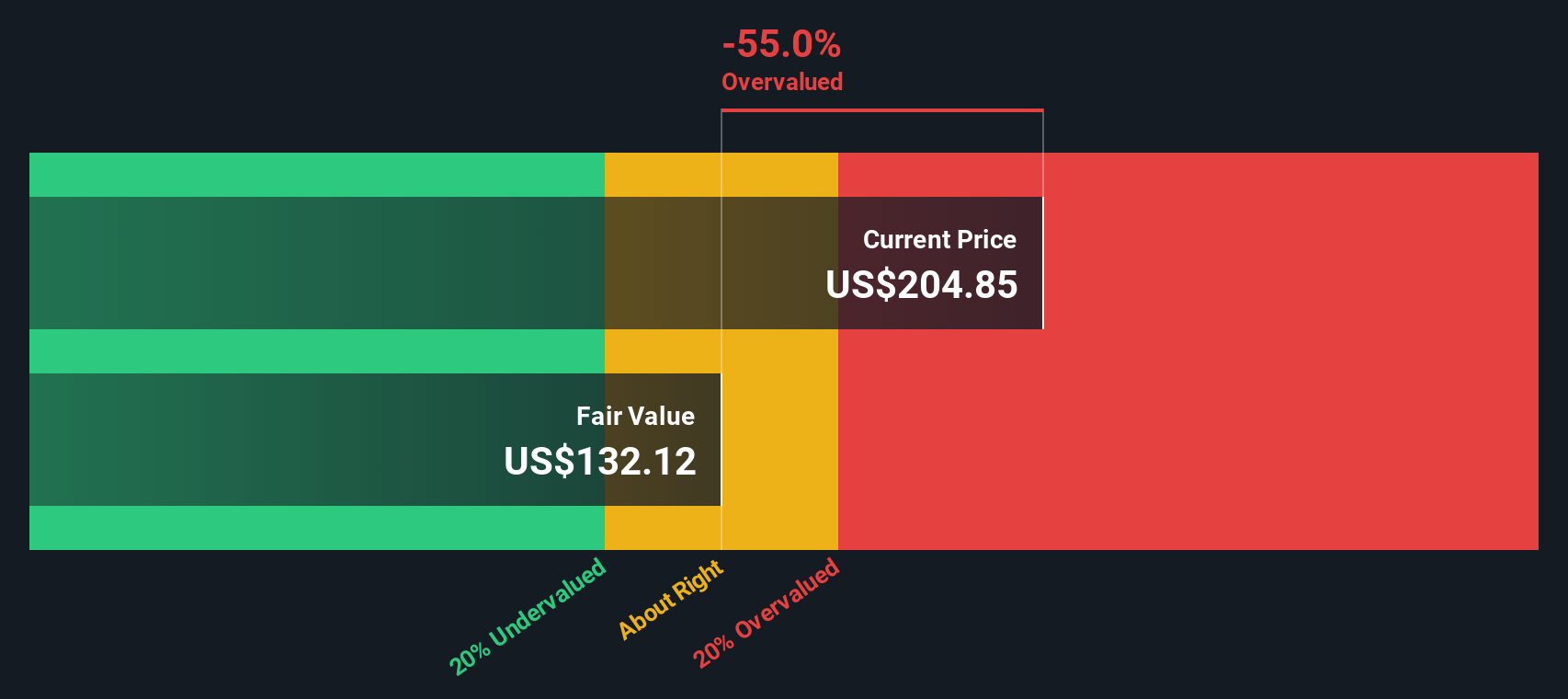

Looking at Moog through the lens of our DCF model suggests a less optimistic picture. The SWS DCF model estimates fair value at just $141.68, which is notably below the current share price. This challenges the narrative that the stock is undervalued and raises questions about the growth assumptions used in each approach. Which perspective will prove closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Moog for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Moog Narrative

If you see the numbers differently or want to dig into the details on your own terms, you can build your own story in just a few minutes, and Do it your way.

A great starting point for your Moog research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't miss your chance to get ahead. Simply Wall Street’s screener reveals hidden gems and fresh trends that could transform your investment strategy this year.

- Tap into digital disruption and track sector leaders by scanning these 27 AI penny stocks promising breakthroughs in artificial intelligence and automation.

- Unlock regular income potential and spot reliable payers by checking out these 15 dividend stocks with yields > 3% with yields that stand out from the crowd.

- Push the limits of innovation and stay ahead of new frontiers by following these 27 quantum computing stocks pioneering advancements in quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOG.A

Moog

Designs, manufactures, and integrates precision motion and fluid controls and controls systems for original equipment manufacturers and end users in the aerospace, defense, and industrial markets in the United States, Germany, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives