- United States

- /

- Aerospace & Defense

- /

- NYSE:MOG.A

Has the Market Priced Moog Fairly After Its Latest Defense Contract Wins?

Reviewed by Bailey Pemberton

- Wondering if Moog is undervalued right now? You're not alone, especially as more investors start running the numbers on this industrial powerhouse.

- The stock's been moving steadily, with a 3.3% gain in the last week and up 6.2% year-to-date. This hints at renewed optimism and perhaps some shifting risk perceptions.

- Recent headlines have highlighted Moog's expansion into defense technologies and several notable contract wins. These developments are fueling both short-term enthusiasm and questions about the sustainability of this momentum, helping drive the stock's price and shaping tomorrow's outlook.

- According to our valuation scorecard, Moog scores a 3 out of 6 on undervaluation checks, meaning there are important signals to analyze before making a judgment. Next, we'll break down exactly how valuation models stack up for Moog and provide a perspective on what traditional analysis might be missing.

Find out why Moog's 8.6% return over the last year is lagging behind its peers.

Approach 1: Moog Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's value, aiming to reflect what the entire business is really worth.

For Moog, this approach begins with the company's reported Free Cash Flow (FCF) of $23.05 million over the last twelve months. Analysts estimate these annual cash flows to rise steadily into the future, expecting FCF to increase to $238.95 million by 2027. To stretch this forecast out to 2035, Simply Wall St extrapolates these trends, projecting a gradual pickup each year.

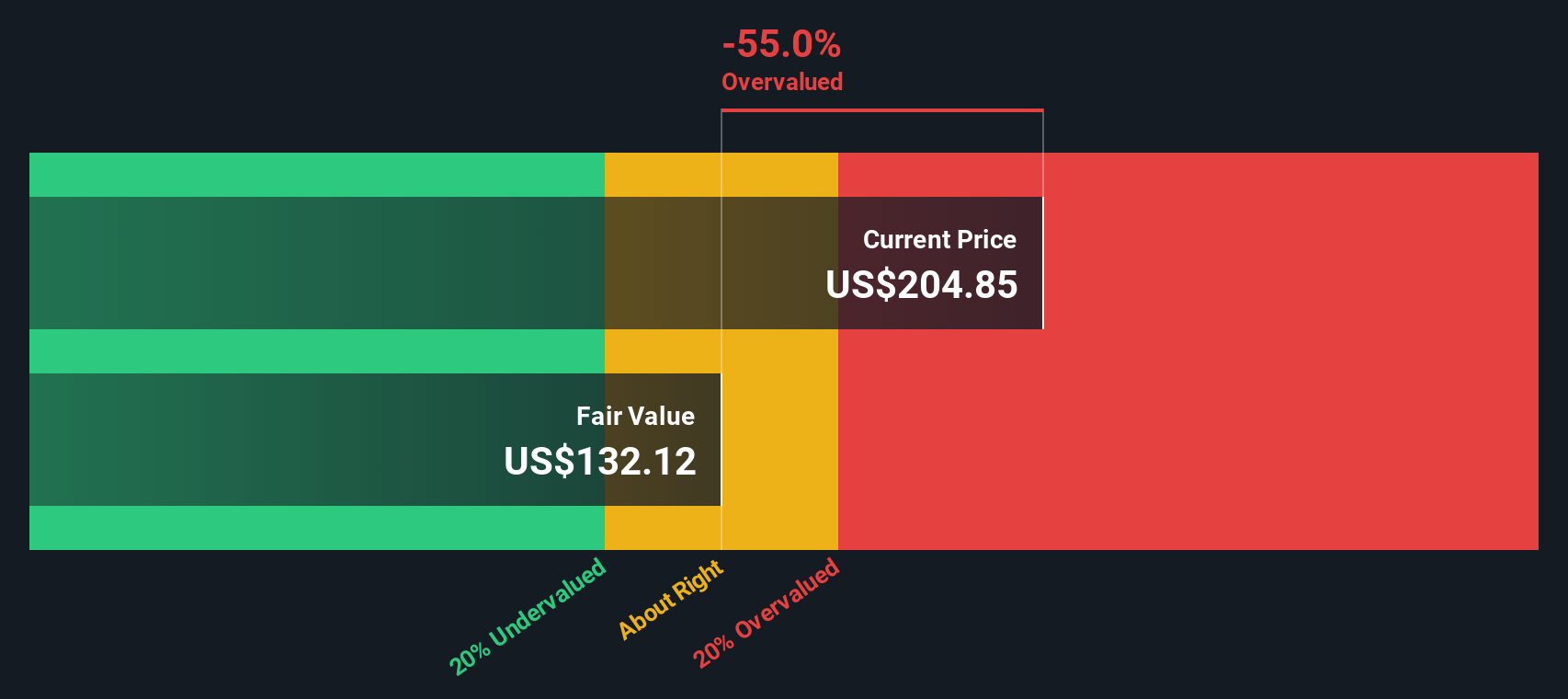

By summing up all these projected future cash flows and discounting them to account for the time value of money, the DCF model calculates an intrinsic value for Moog stock at $132.12 per share. Comparing this to the current share price, the model signals Moog is trading at a 59.1% premium to its calculated value, suggesting the market price is well above what these cash flow projections support.

For investors focused on long-term fundamentals, this DCF assessment gives a clear message: Moog is currently overvalued based on expected future cash generation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Moog may be overvalued by 59.1%. Discover 854 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Moog Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used by investors to value profitable companies like Moog, as it directly relates the company's market price to its earnings power. The PE ratio helps capture how much investors are willing to pay for each dollar of earnings, making it a quick pulse check on whether a stock looks cheap or expensive in the current market context.

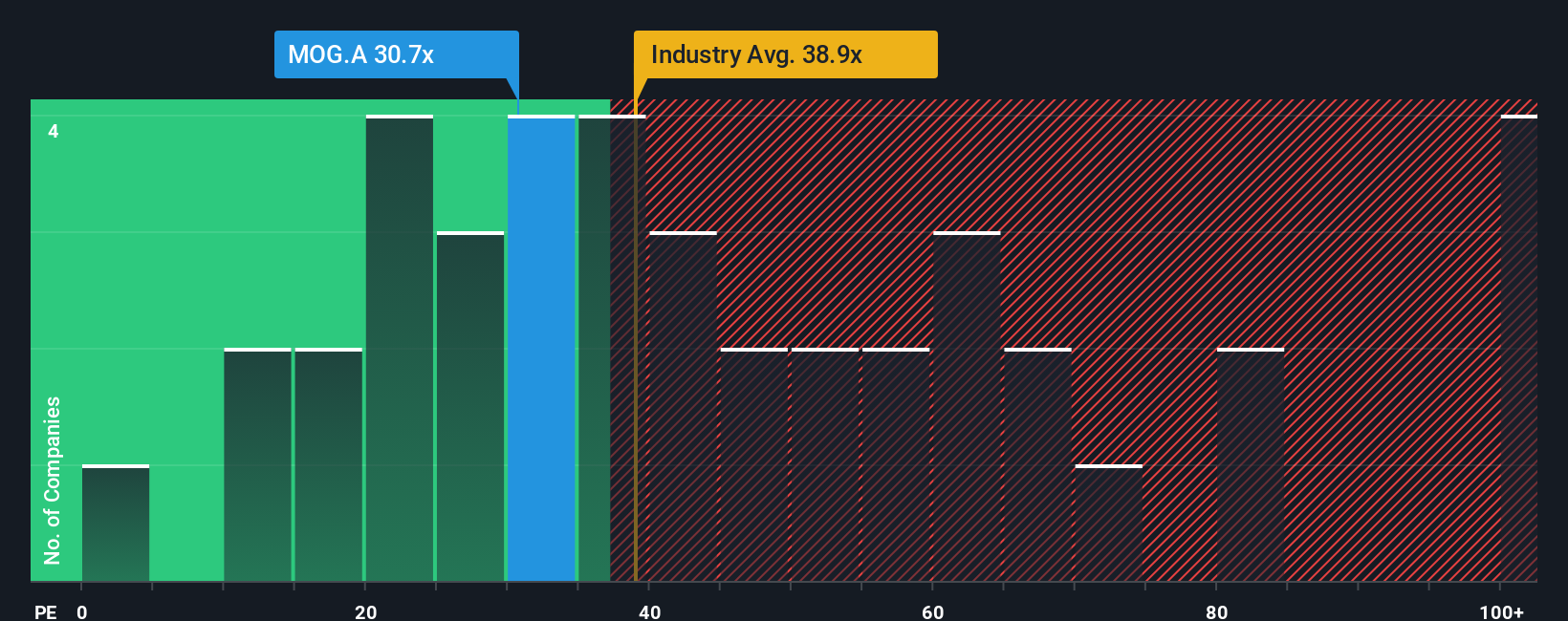

What counts as a "normal" or "fair" PE ratio can vary, since higher growth prospects and lower risk usually justify a higher PE. On the other hand, if a company faces above-average risks or slower growth, investors may expect a lower multiple. Benchmarks help frame these comparisons. Moog’s current PE ratio sits at 31.5x, compared to an Aerospace & Defense industry average of 40.6x and a peer group average of 91.5x, so at first glance Moog appears more conservatively priced.

Rather than just comparing to those averages, Simply Wall St’s Fair Ratio offers a more comprehensive benchmark. This proprietary metric factors in the company’s earnings growth outlook, risk profile, market cap, and margins, setting a “fair” PE for Moog at 31.6x. This tailored estimate provides a more meaningful comparison by accounting for the nuances that simple averages miss, like growth potential and company-specific risks.

Since Moog’s current PE almost matches its Fair Ratio, the data signals that the stock’s price is about right at present, neither notably cheap nor especially expensive based on earnings.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1394 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Moog Narrative

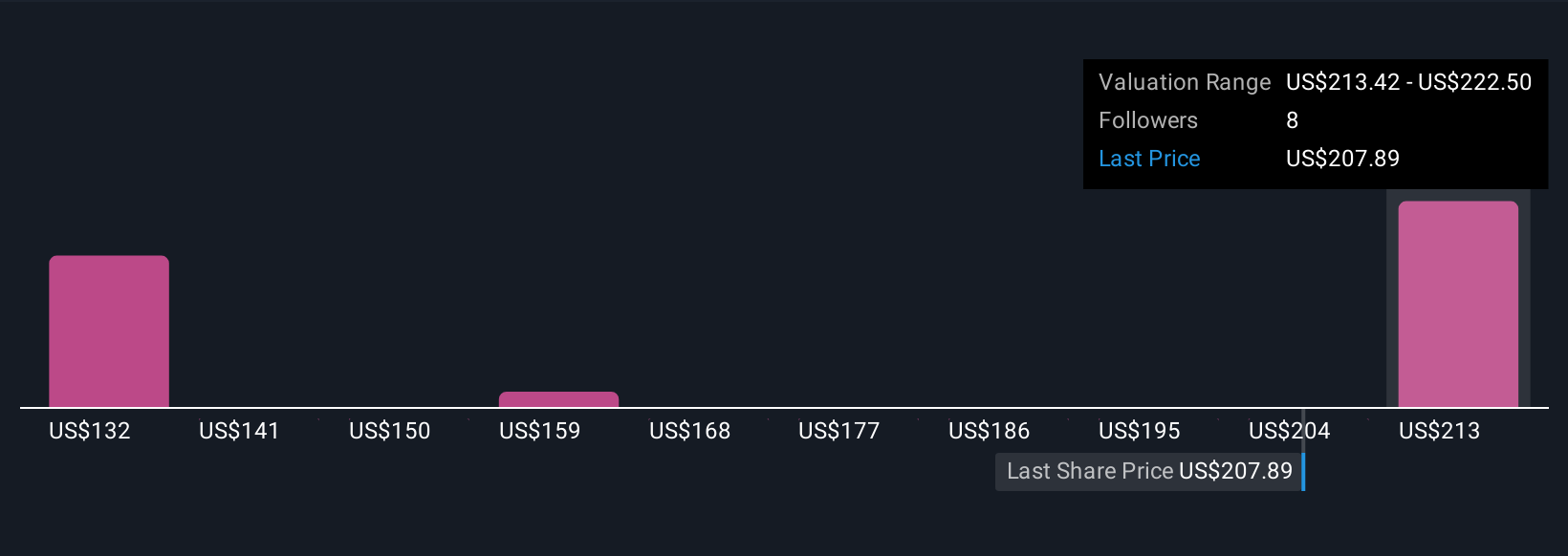

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are simple yet powerful tools that let you tell the story behind the numbers: your view of Moog’s future revenue growth, profit margins, and what you believe is a fair value for the company.

Unlike traditional analyses that focus only on formulas and ratios, Narratives connect what you believe about Moog—the business, its opportunities, or its risks—to a dynamic forecast and a resulting fair value. This means every investor’s perspective becomes uniquely actionable. On Simply Wall St’s platform, Narratives are easily accessible via the Community page, making this approach open to millions of investors worldwide.

What makes Narratives especially useful is how they help you decide when to buy or sell. By continually updating fair values as new company news or earnings reports emerge, you can always see if your story still stacks up against the latest price. For example, one investor’s Narrative might forecast rapid aerospace growth, projecting a fair value of $228.75, while another may focus on industry risks and see fair value far lower at $191.66. This illustrates how diverse stories about Moog translate into different investment decisions, all rooted in the same numbers.

Do you think there's more to the story for Moog? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOG.A

Moog

Designs, manufactures, and integrates precision motion and fluid controls and controls systems for original equipment manufacturers and end users in the aerospace, defense, and industrial markets in the United States, Germany, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives