- United States

- /

- Machinery

- /

- NYSE:MLI

Mueller Industries (MLI): Assessing Valuation Following Robust Results and a Fifth Consecutive Dividend Increase

Reviewed by Simply Wall St

Mueller Industries stock caught attention after management highlighted steady performance despite a slowdown in residential construction and extra imports ahead of tariffs. The company’s recent 25% dividend increase, their fifth consecutive year of growth, underscores ongoing confidence.

See our latest analysis for Mueller Industries.

Mueller Industries’ momentum has been clear, with the stock climbing 22.8% in the past three months and delivering a stellar 28.1% total shareholder return over the past year. Confidence following the consistent dividend growth and ongoing resilience is showing up in the year-to-date share price return of 34.5%. This builds a sense of solid upward trajectory, especially as investors weigh management’s upbeat tone against broader market uncertainty.

If you’re looking for more companies demonstrating strong growth and high insider conviction, this is an ideal moment to expand your search and discover fast growing stocks with high insider ownership

With a strong rally under its belt and dividend hikes maintaining momentum, the key question now is whether Mueller Industries shares are still trading below their true value, or if the market is already pricing in all of this future growth potential.

Price-to-Earnings of 15.9x: Is it justified?

Mueller Industries trades at a price-to-earnings (P/E) ratio of 15.9x, noticeably lower than both its industry peers and the broader US market based on the latest close at $107.26. This suggests the stock is valued attractively relative to comparable companies.

The price-to-earnings ratio measures how much investors are willing to pay today for a dollar of earnings. For an established manufacturer like Mueller Industries, the P/E can provide both a benchmark against competitors and a quick way to evaluate market expectations for future profitability.

In this case, the company’s P/E ratio stands well below the Machinery industry average of 23.9x and the US market average of 18.2x. Even compared to our estimated fair P/E ratio of 21.1x, Mueller Industries looks discounted. This could signal the market is not fully pricing in the company’s robust profit margins, accelerating earnings growth, and impressive return on equity. These metrics could contribute to the valuation moving closer to the fair ratio over time.

Explore the SWS fair ratio for Mueller Industries

Result: Price-to-Earnings of 15.9x (UNDERVALUED)

However, continued sluggish growth in residential construction and unexpected shifts in tariff policy could present challenges for Mueller Industries’ ongoing momentum.

Find out about the key risks to this Mueller Industries narrative.

Another View: What Does the SWS DCF Model Say?

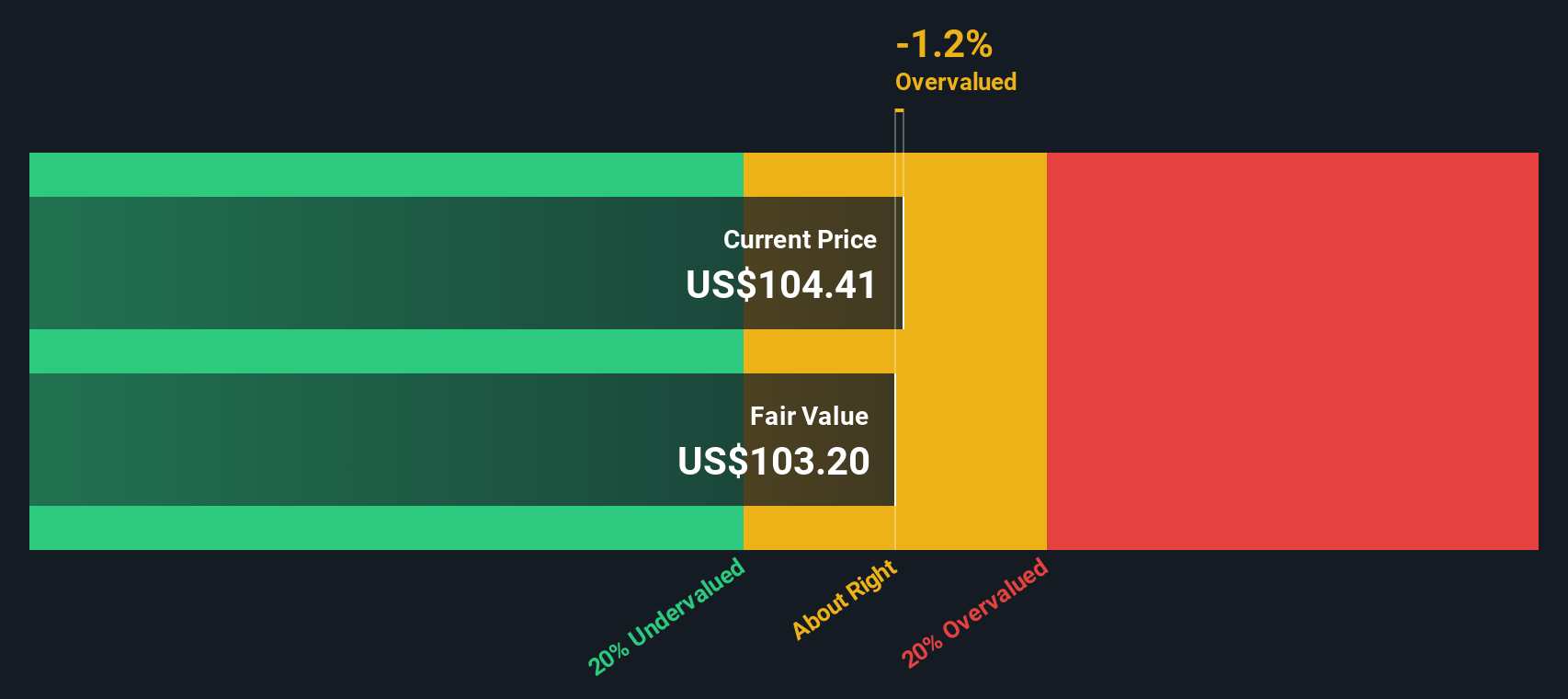

Taking a step back from traditional multiples, our SWS DCF model offers a different perspective. According to this approach, Mueller Industries is currently trading above its estimated fair value of $101.69. This suggests the market may be factoring in more optimism than fundamentals support, or perhaps there are variables the model cannot fully capture. Could this gap signal caution, or is there underlying strength the model overlooks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mueller Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 844 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mueller Industries Narrative

If you believe there's a different story behind Mueller Industries or prefer your own deeper dive, you can build a custom perspective in just a few minutes with Do it your way

A great starting point for your Mueller Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready to Seize Your Next Big Opportunity?

Stop waiting on the sidelines. The Simply Wall Street Screener can help you quickly pinpoint exceptional stocks with growth, innovation, and value before the crowd catches on.

- Supercharge your portfolio as you scan these 844 undervalued stocks based on cash flows, packed with companies trading well below their true worth for serious upside potential.

- Capitalize on game-changing innovation by targeting these 27 AI penny stocks, which are pushing the boundaries in artificial intelligence and disrupting entire industries.

- Lock in steady income streams by finding these 20 dividend stocks with yields > 3%, offering attractive yields for both stability and long-term gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLI

Mueller Industries

Manufactures and sells copper, brass, and aluminum products in the United States, the United Kingdom, Canada, Asia and the Middle East, and Mexico.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives