- United States

- /

- Machinery

- /

- NYSE:MLI

Does Mueller Industries' (MLI) Pause in Share Buybacks Reveal a Shift in Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- Mueller Industries recently reported third quarter 2025 earnings, showing sales of US$1,077.82 million and net income of US$208.12 million, both up from a year ago, while also providing an update that no shares were repurchased in the most recent buyback tranche, though nearly 18.9 million shares have been repurchased overall since 2000.

- This combination of strong operational results and a pause in recent share repurchases highlights the company's focus on core business performance alongside capital allocation decisions.

- We'll examine how the third quarter's higher sales and earnings influence Mueller Industries' investment narrative and outlook for growth.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Mueller Industries' Investment Narrative?

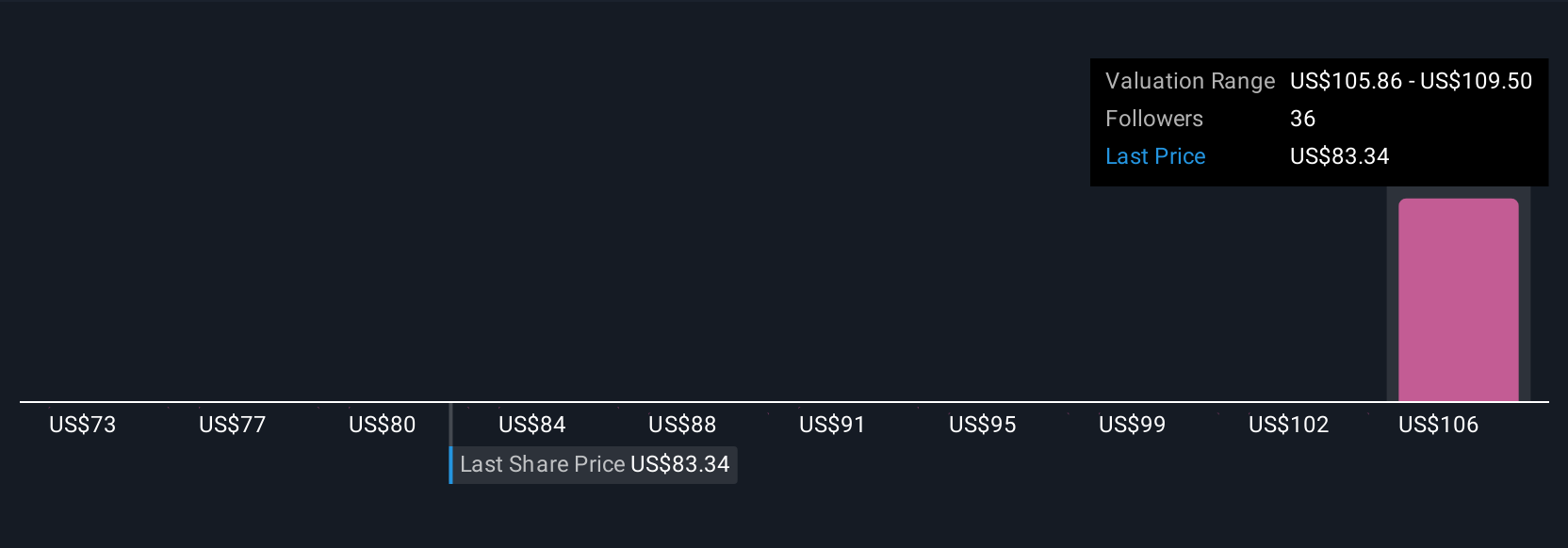

For someone considering Mueller Industries as a potential investment, the story is anchored around consistent profitability, disciplined capital allocation, and operational strength. The latest quarterly results reinforce this, with sales and net income both rising year over year and profit margins remaining robust. The recent pause in share buybacks may shift the short-term focus to organic performance and cash flow deployment, rather than direct shareholder returns via reductions in share count. This latest update doesn’t appear to change the overall risk or growth profile in any material way, as the company’s core business performance, dividend stability, and attractive valuation remain the main focal points. That said, the absence of recent buybacks could suggest a cautious approach to deploying capital at current price levels, or a reassessment of priorities given the slower expected growth rates compared to the broader market, a factor that could shape expectations in the quarters ahead.

But with steady results, the slower earnings growth forecast is something investors should keep in mind. Mueller Industries' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 9 other fair value estimates on Mueller Industries - why the stock might be worth 31% less than the current price!

Build Your Own Mueller Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mueller Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mueller Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mueller Industries' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 23 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLI

Mueller Industries

Manufactures and sells copper, brass, and aluminum products in the United States, the United Kingdom, Canada, Asia and the Middle East, and Mexico.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives