- United States

- /

- Machinery

- /

- NYSE:MKFG

Markforged Holding Corporation (NYSE:MKFG) Might Not Be As Mispriced As It Looks After Plunging 27%

Unfortunately for some shareholders, the Markforged Holding Corporation (NYSE:MKFG) share price has dived 27% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 82% loss during that time.

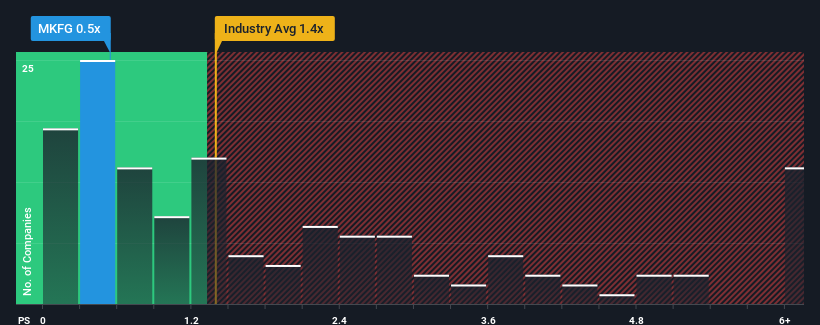

Since its price has dipped substantially, when close to half the companies operating in the United States' Machinery industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider Markforged Holding as an enticing stock to check out with its 0.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Markforged Holding

How Has Markforged Holding Performed Recently?

Markforged Holding hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Markforged Holding's future stacks up against the industry? In that case, our free report is a great place to start.How Is Markforged Holding's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Markforged Holding's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 7.4% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 9.9% as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 0.8% growth forecast for the broader industry.

With this information, we find it odd that Markforged Holding is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Markforged Holding's P/S Mean For Investors?

Markforged Holding's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Markforged Holding currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

There are also other vital risk factors to consider before investing and we've discovered 4 warning signs for Markforged Holding that you should be aware of.

If these risks are making you reconsider your opinion on Markforged Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MKFG

Markforged Holding

Produces and sells 3D printers, materials, software, and other related services worldwide.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives