- United States

- /

- Aerospace & Defense

- /

- NYSE:LOAR

Loar Holdings (LOAR) Delivers Strong Q3 Results but Does This Signal a Shift in Investor Sentiment?

Reviewed by Sasha Jovanovic

- Loar Holdings Inc. announced its third quarter 2025 results, reporting US$126.75 million in sales and US$27.61 million in net income, both significantly higher than the prior year period, and also provided forward guidance above expectations.

- Major institutional investors, such as Artisan Small Cap Fund, responded to Loar's strong performance and guidance by increasing their holdings, highlighting renewed investor confidence despite some industry-wide market pressures.

- We'll explore how Loar's improved net income and raised forward guidance may adjust the company's investment narrative and outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Loar Holdings Investment Narrative Recap

To own Loar Holdings, investors need to believe in the company's continued ability to capitalize on niche aerospace and defense component demand, execute successful bolt-on acquisitions, and achieve margin expansion through proprietary products. The recent surge in sales, net income, and raised guidance bolsters the near-term outlook, but it does not materially alter the main risk: integration hurdles in M&A or delays in regulatory approvals for planned acquisitions remain a key concern for the path ahead.

Among recent announcements, the August amendment to Loar's credit agreement stands out. Securing a US$360 million term loan signals the company’s commitment to funding future acquisitions, an important catalyst, as scale-by-acquisition is central to Loar’s growth strategy and will be closely watched for both opportunity and risk management moving forward.

Yet despite these promising developments, it’s important not to overlook that greater acquisition activity could lead to...

Read the full narrative on Loar Holdings (it's free!)

Loar Holdings' outlook anticipates $656.1 million in revenue and $114.0 million in earnings by 2028. This scenario assumes a 13.2% annual revenue growth rate and a $69.6 million increase in earnings from the current level of $44.4 million.

Uncover how Loar Holdings' forecasts yield a $97.20 fair value, a 48% upside to its current price.

Exploring Other Perspectives

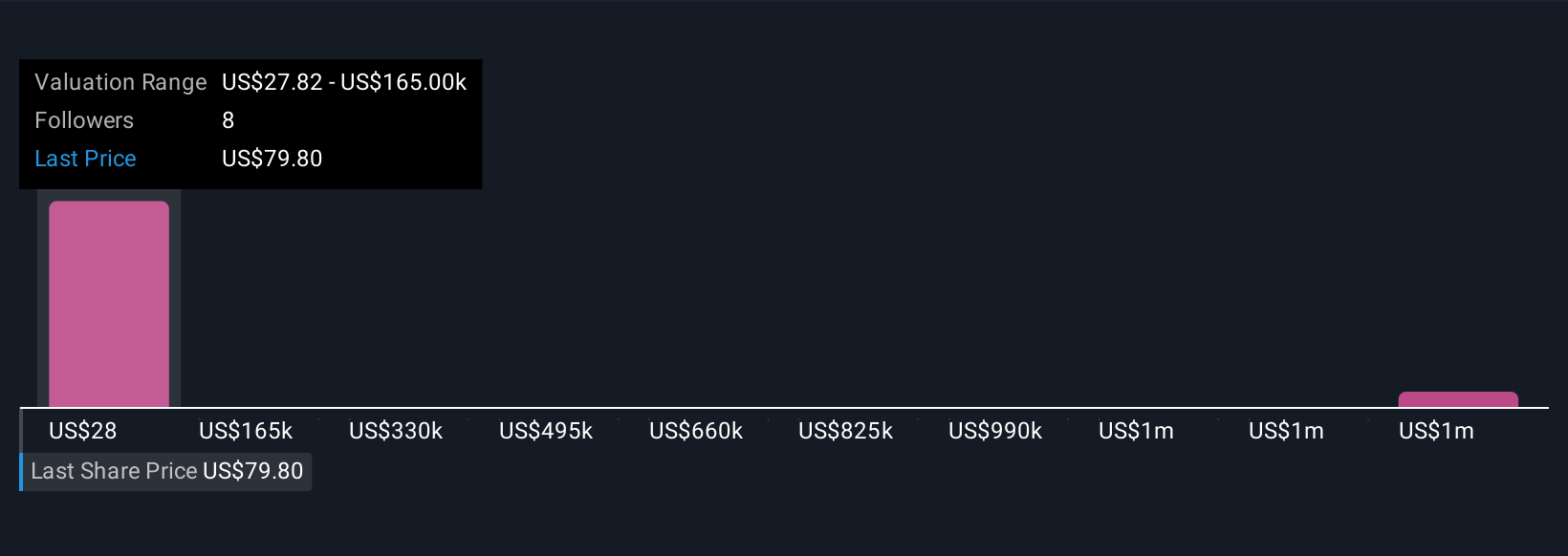

Four individual fair value estimates from the Simply Wall St Community range from US$22.12 to US$116.62. While opinions differ widely, recent robust earnings growth highlights why future deal execution and regulatory risk matter for gauging Loar’s trajectory, explore these diverse viewpoints to inform your own stance.

Explore 4 other fair value estimates on Loar Holdings - why the stock might be worth less than half the current price!

Build Your Own Loar Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Loar Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Loar Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Loar Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOAR

Loar Holdings

Through its subsidiaries, designs, manufactures, and markets aerospace and defense components for aircraft, and aerospace and defense systems in the United States and internationally.

Adequate balance sheet with limited growth.

Market Insights

Community Narratives