- United States

- /

- Aerospace & Defense

- /

- NYSE:LOAR

Assessing Loar Holdings (LOAR) Valuation After Recent Share Price Dip

Reviewed by Simply Wall St

Loar Holdings (LOAR) shares have seen movement recently, which has caught the attention of investors trying to gauge what is next for the aerospace parts supplier. The company’s stock is navigating a patch of modest declines this month, with a recent dip of about 4% over the past month, sparking fresh conversation around its current valuation.

See our latest analysis for Loar Holdings.

This month’s 4.5% drop in Loar Holdings’ share price comes after a generally muted period, as the stock’s year-to-date share price return remains just in positive territory. Momentum has faded, with a one-year total shareholder return of -10% highlighting the cautious mood around its valuation and future prospects.

If you’re keeping an eye on aerospace industry shifts, it’s a great moment to discover opportunities with our aerospace and defense screener. See the full list here: See the full list for free.

Now that shares are lagging, is Loar Holdings actually trading below its true value, or has the recent dip simply caught up with the company’s realistic growth outlook, leaving little room for further upside?

Most Popular Narrative: 22.6% Undervalued

Loar Holdings’ narrative-backed fair value sits at $97.20, offering a significant gap compared to the last close of $75.26 and fueling speculation about further upside. This valuation draws from expectations of aggressive growth and industry catalysts that could shape the company’s market position.

Loar's robust pipeline of new product introductions, currently representing over $500 million of sales opportunities over 5 years, positions the company to capture outsized growth as global air travel demand and aircraft build rates are sustained by expanding emerging-market middle classes and increasing urbanization. This is likely to provide upside to revenue growth beginning in 2026 as certifications and recent market entries ramp up.

Curious what’s fueling such a bold valuation? The narrative hinges on game-changing earnings leaps, wider margins, and ambitious forecasts far above current trends. Want to uncover which assumptions drive projections that rival soaring sectors? Take a closer look at the blueprint behind this price target.

Result: Fair Value of $97.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the heavy reliance on acquisitions and potential customer concentration could quickly swing sentiment. These factors can act as swift catalysts that challenge current bullish forecasts.

Find out about the key risks to this Loar Holdings narrative.

Another View: Deep Dive on Market Multiples

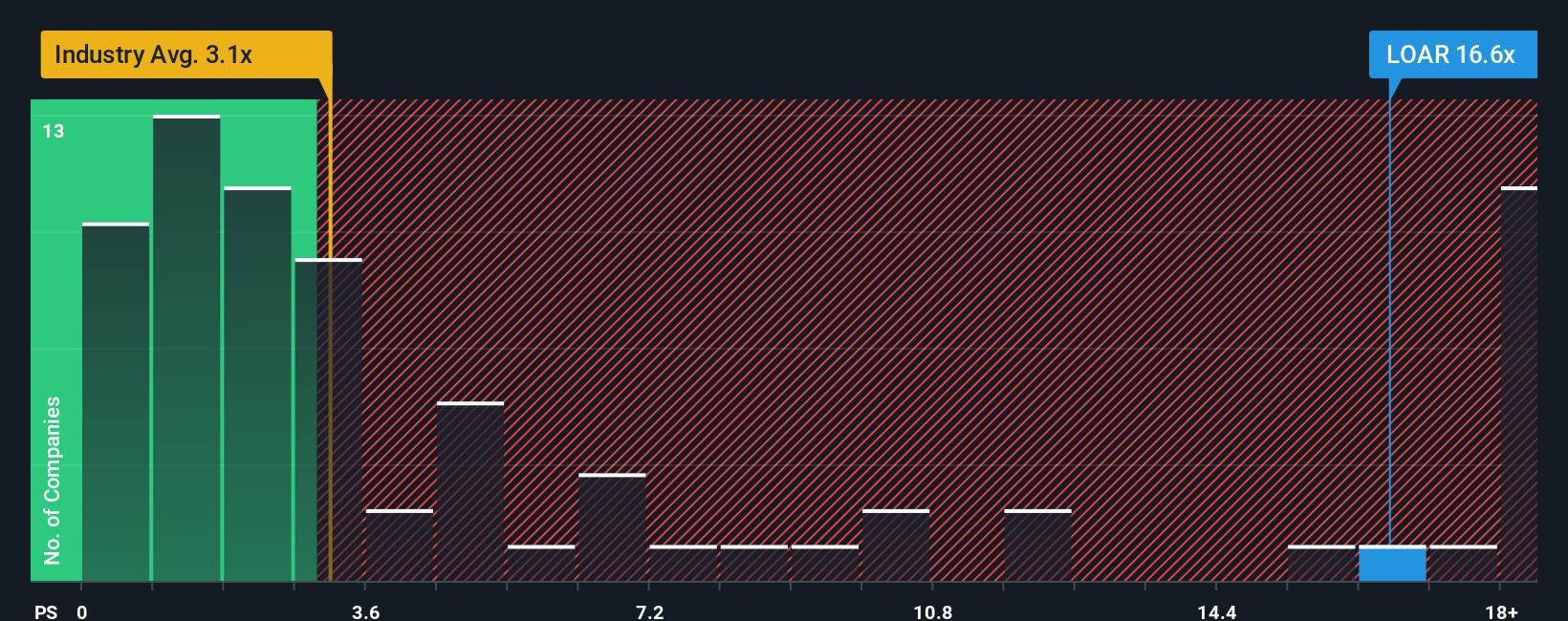

While the bullish narrative values Loar Holdings well above its current price, a look at market ratios paints a very different picture. The current price-to-sales ratio stands at 15.6x, far higher than the industry average of 3.1x and even surpassing the fair ratio of 4.6x. This steep premium may signal valuation risk and implies investors should examine what justifies such a lofty multiple, or if expectations might need a reality check.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Loar Holdings Narrative

If these views don't match yours or you’d rather dig into the numbers independently, you can build your own evidence-based narrative in just a few minutes with our streamlined tools. Do it your way.

A great starting point for your Loar Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Act now and get ahead of the crowd by uncovering unique stocks using our powerful screening tools. This is a proven way to spot under-the-radar winners and bold sector plays before everyone else.

- Tap into rapid tech breakthroughs with these 26 AI penny stocks, which are capturing momentum as artificial intelligence transforms the market landscape.

- Earn while you invest by checking out these 20 dividend stocks with yields > 3%, featuring companies offering robust payouts above 3% yield.

- Ride the next financial revolution with these 81 cryptocurrency and blockchain stocks and track businesses driving progress in secure digital payment systems and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOAR

Loar Holdings

Through its subsidiaries, designs, manufactures, and markets aerospace and defense components for aircraft, and aerospace and defense systems in the United States and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives