- United States

- /

- Aerospace & Defense

- /

- NYSE:LMT

Is Lockheed Martin Fairly Priced After Recent Defense Contract Wins?

Reviewed by Bailey Pemberton

- Wondering if Lockheed Martin is as good a buy as the headlines suggest? You are not alone, and exploring the company’s worth could surprise you.

- The stock has experienced its ups and downs this year, slipping 7.6% over the last 12 months, but gaining 53.7% across five years, which keeps both bulls and bears interested.

- Defense sector headlines have been swirling lately, including government contract wins and shifting geopolitical priorities that are fueling investor debates about Lockheed Martin’s long-term prospects. These news stories help explain some of the recent price swings and keep Lockheed Martin in the spotlight.

- On our valuation checks, Lockheed Martin scores a 4 out of 6 on undervaluation, which you can see for yourself here. We will look at how analysts calculate fair value using different approaches, but be sure to stick around for a smarter, next-level perspective at the end of this article.

Find out why Lockheed Martin's -7.6% return over the last year is lagging behind its peers.

Approach 1: Lockheed Martin Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today’s dollars. This approach is widely used to determine how much a company’s future profitability is worth right now.

For Lockheed Martin, the latest trailing twelve months Free Cash Flow (FCF) stands at approximately $4.55 billion. Analysts have projected that FCF will continue to grow, reaching about $7.51 billion by 2029. While analysts typically estimate only the next five years, longer-term forecasts are extrapolated to give a fuller picture of potential. These projections rely on assumptions about revenue growth, operating efficiency, and capital investment.

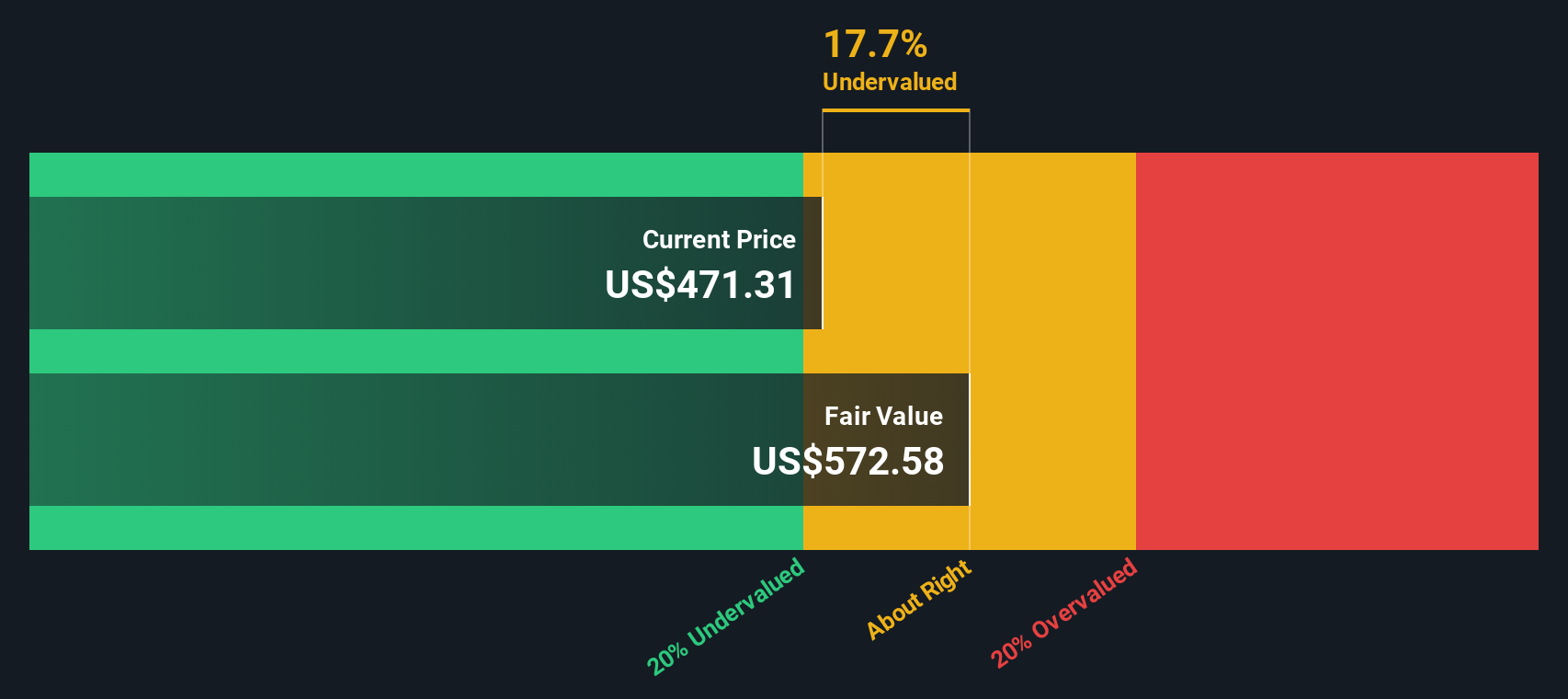

Using a two-stage model for Free Cash Flow to Equity, the calculated intrinsic value per share comes out to $597.72. According to this model, Lockheed Martin shares are trading at an implied 18.4% discount compared to their estimated fair value. This suggests the stock is substantially undervalued by this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lockheed Martin is undervalued by 18.4%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Lockheed Martin Price vs Earnings

Price-to-Earnings (PE) is a widely used valuation multiple for assessing profitable companies like Lockheed Martin because it directly ties a company’s share price to its actual earnings. This makes it a straightforward metric for comparing how the market values each dollar of profit against similar businesses.

What counts as a “normal” PE ratio will vary based on expectations for growth and the risk profile of the company or industry. Generally, higher growth potential justifies a higher PE, while greater risks or more modest growth prospects may call for a lower one.

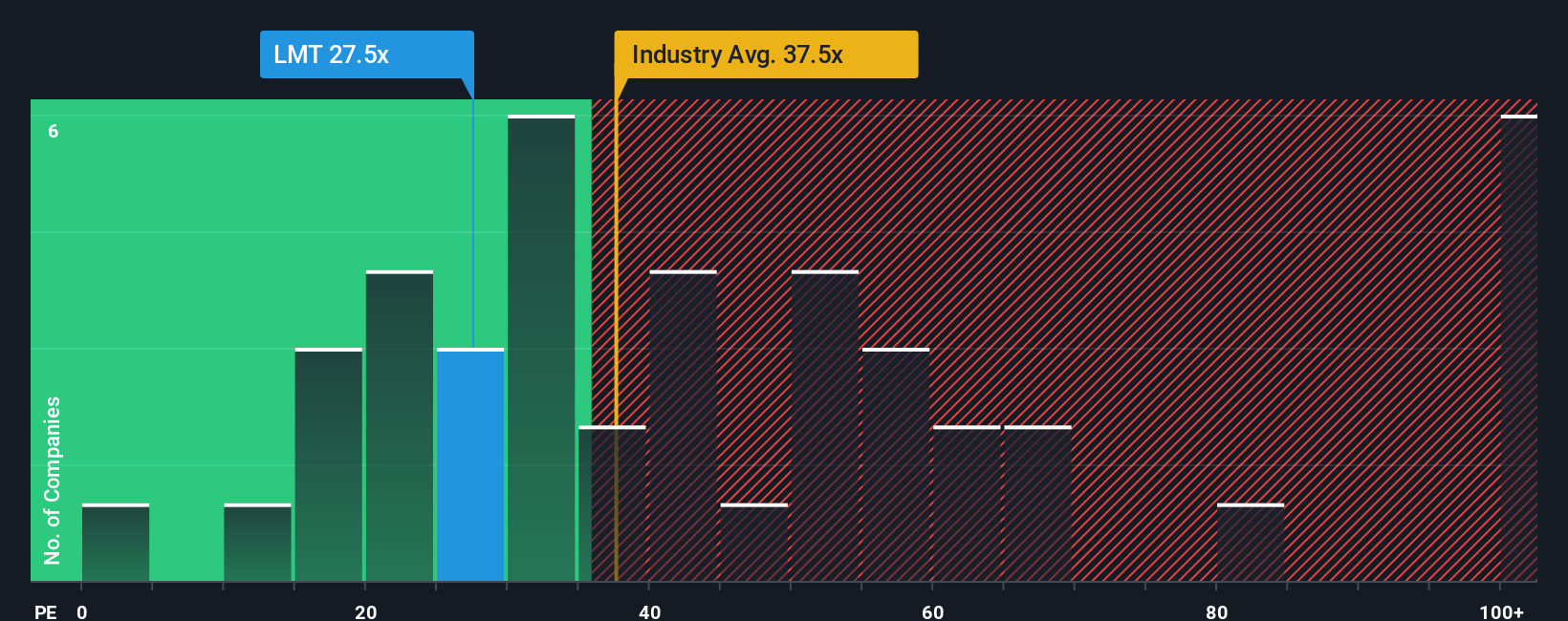

Currently, Lockheed Martin trades at 26.9x earnings. This is below the peer average of 35.4x and the broader Aerospace and Defense industry average of 38.5x. According to Simply Wall St’s Fair Ratio model, which is tailored for Lockheed’s unique growth profile, profit margins, market cap, and industry outlook, a fair multiple would be around 33.7x.

The Fair Ratio stands apart from peer or industry averages by factoring in elements such as forward growth rates, company-specific financial strength, profit consistency, industry volatility, and size. This nuanced approach offers a sharper lens for understanding whether the stock is priced appropriately rather than relying purely on simple comparisons with competitors.

Comparing Lockheed Martin’s current PE of 26.9x to its fair ratio of 33.7x suggests that the stock is undervalued using this metric and may have potential for upside if fundamentals remain intact.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lockheed Martin Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear, personal story that ties together your view of Lockheed Martin's future, your assumptions on revenue growth, profit margins, risks, and competitiveness, with a transparent financial forecast and fair value estimate. Narratives go beyond the numbers by letting you connect all the moving parts. You shape the story, set your expectations, and see how it all drives today's fair value.

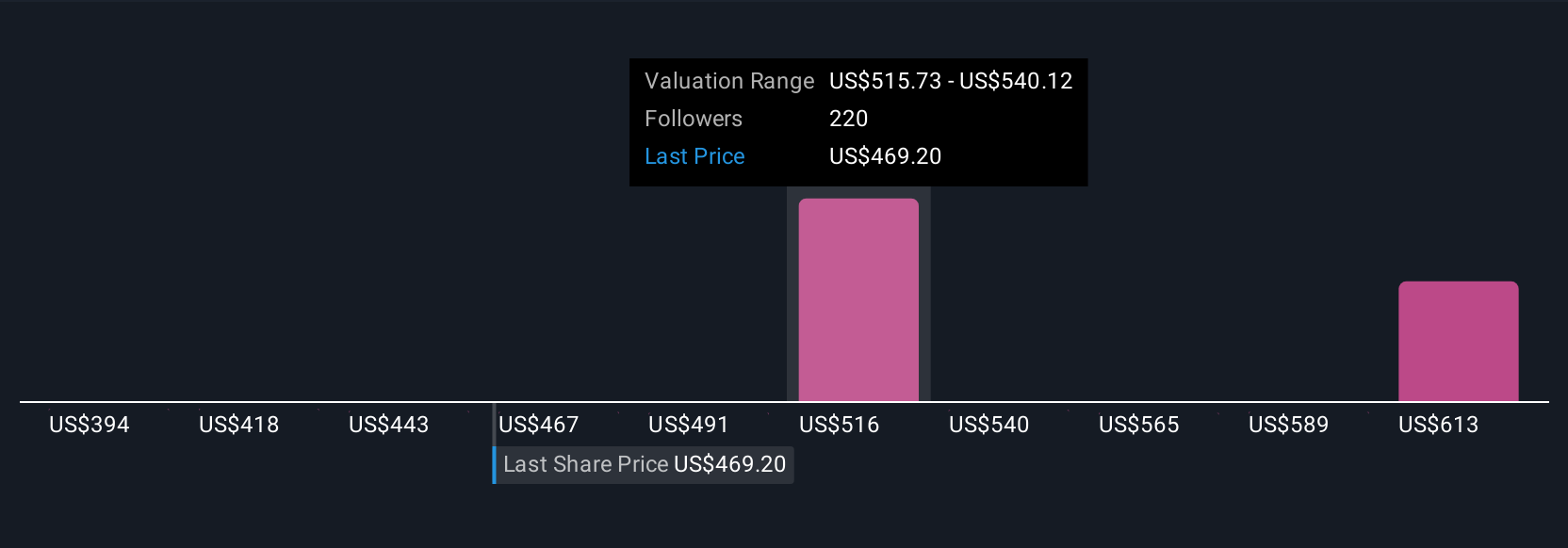

Millions of investors use Narratives on Simply Wall St’s Community page because they make sophisticated valuation easy to follow, showing when your fair value signals a buy or a sell versus the current price. When fresh news, new earnings, or major events hit the headlines, Narratives update dynamically to help you stay ahead. For example, the most optimistic Lockheed Martin Narrative currently values the stock at $544 per share, focusing on robust tech leadership and growing order backlogs, while the most cautious Narrative sets fair value at $398, highlighting operational risks and external headwinds. By exploring different Narratives, investors can find the story they believe in and act with confidence.

Do you think there's more to the story for Lockheed Martin? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMT

Lockheed Martin

An aerospace and defense company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives