- United States

- /

- Aerospace & Defense

- /

- NYSE:LMT

AI Partnerships and X-59 Milestone Might Change the Case for Investing in Lockheed Martin (LMT)

Reviewed by Sasha Jovanovic

- Lockheed Martin reported strong third quarter results, raised its full-year outlook, and advanced several initiatives, including the successful completion of the X-59 quiet supersonic aircraft’s first flight and collaborations in cutting-edge artificial intelligence with Google Public Sector and X-Bow Systems.

- These events underscore the company’s ongoing commitment to aerospace innovation and highlight its expanding leadership in integrating AI and new technologies into defense and commercial solutions.

- We’ll examine how Lockheed Martin’s integration of AI partnerships could reinforce its position in next-generation defense and aerospace innovation.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Lockheed Martin Investment Narrative Recap

To own shares of Lockheed Martin, you need confidence in its ability to sustain high demand for advanced defense platforms while executing on next-generation programs and maintaining profitability, despite sector-specific risks. While Lockheed Martin’s expanded AI collaborations and aerospace innovation initiatives, such as the recent X-Bow Systems and Google partnerships, further reinforce the core growth narrative, they are not expected to materially reduce the near-term risk associated with cost overruns and charges on complex legacy contracts, which remains the most important short-term catalyst and risk area for the business.

One of the most compelling recent announcements is the successful completion of the X-59’s first flight, a milestone that further signals Lockheed Martin’s ongoing investment in technology and new revenue streams. As the company continues to expand its aerospace capabilities, successful program execution and backlog growth are likely to hold greater significance for both upside potential and risk mitigation.

Yet, investors should keep in mind, unlike headline-grabbing contract wins and technological breakthroughs, persistent cost overruns on legacy programs...

Read the full narrative on Lockheed Martin (it's free!)

Lockheed Martin's narrative projects $81.0 billion in revenue and $7.1 billion in earnings by 2028. This requires 4.1% yearly revenue growth and a $2.9 billion increase in earnings from $4.2 billion today.

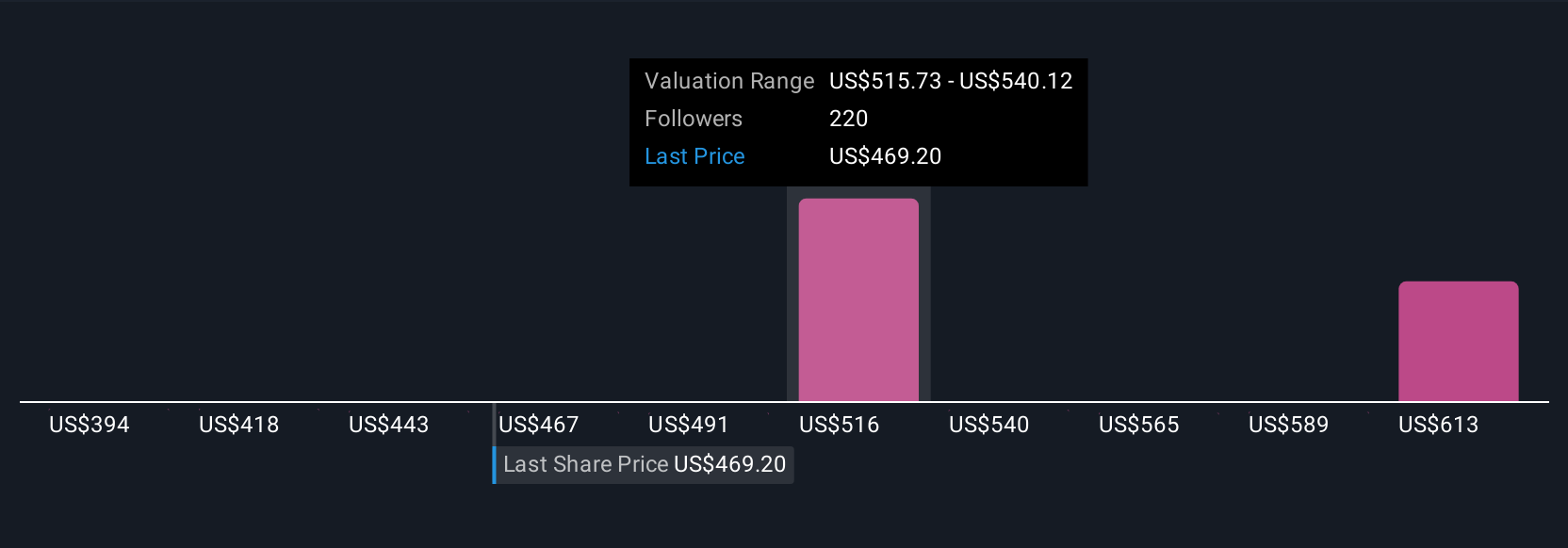

Uncover how Lockheed Martin's forecasts yield a $516.56 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from US$389 to US$593 across 24 independent analyses. While community fair value opinions vary widely, the ongoing risk of financial charges on legacy programs could weigh on results, so consider several views before forming your own outlook.

Explore 24 other fair value estimates on Lockheed Martin - why the stock might be worth as much as 21% more than the current price!

Build Your Own Lockheed Martin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lockheed Martin research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lockheed Martin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lockheed Martin's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMT

Lockheed Martin

An aerospace and defense company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives