- United States

- /

- Aerospace & Defense

- /

- NYSE:LHX

Assessing L3Harris Technologies (LHX) Valuation Following Recent Share Pullback

Reviewed by Simply Wall St

L3Harris Technologies (LHX) has seen its stock move in recent weeks, catching the attention of investors who are curious about its current valuation and how the company is performing amid changing market conditions.

See our latest analysis for L3Harris Technologies.

L3Harris shares have pulled back a bit in the past month, but momentum over the longer term remains strong, with a year-to-date share price return of 32.81% and a 16.66% total shareholder return for the past year. While the recent dip may reflect changing sentiment or some profit-taking, the bigger picture points to robust performance for investors who held on.

Looking beyond L3Harris, now could be a good time to scan the landscape for other leading names in aerospace and defense. You can check out See the full list for free..

The real question now, with L3Harris trading below analyst price targets and showing healthy growth metrics, is whether this pullback signals an undervalued entry point or if the market has already factored in future gains.

Most Popular Narrative: 17.6% Undervalued

L3Harris Technologies' most widely followed valuation narrative sets its fair value nearly 18% above the last close. This draws attention to current market expectations and future catalysts that could justify such a gap.

L3Harris is well-positioned in several key growth areas, such as missile warning and tracking, due to recent investments and capability alignment, likely increasing future revenue. International demand, especially from NATO allies for advanced communication solutions, is expected to continue strong, supporting revenue growth.

Want to know the main reason the consensus sees so much upside? The formula blends healthy profit growth with an efficiency leap that is rare in this sector. The real surprise? It is not just about defense spending. Find out what else is fueling such a bullish price target in the full narrative.

Result: Fair Value of $334 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks from fixed-price contracts and tighter government budgets could challenge L3Harris’s growth outlook if unanticipated setbacks arise.

Find out about the key risks to this L3Harris Technologies narrative.

Another View: What Do The Ratios Say?

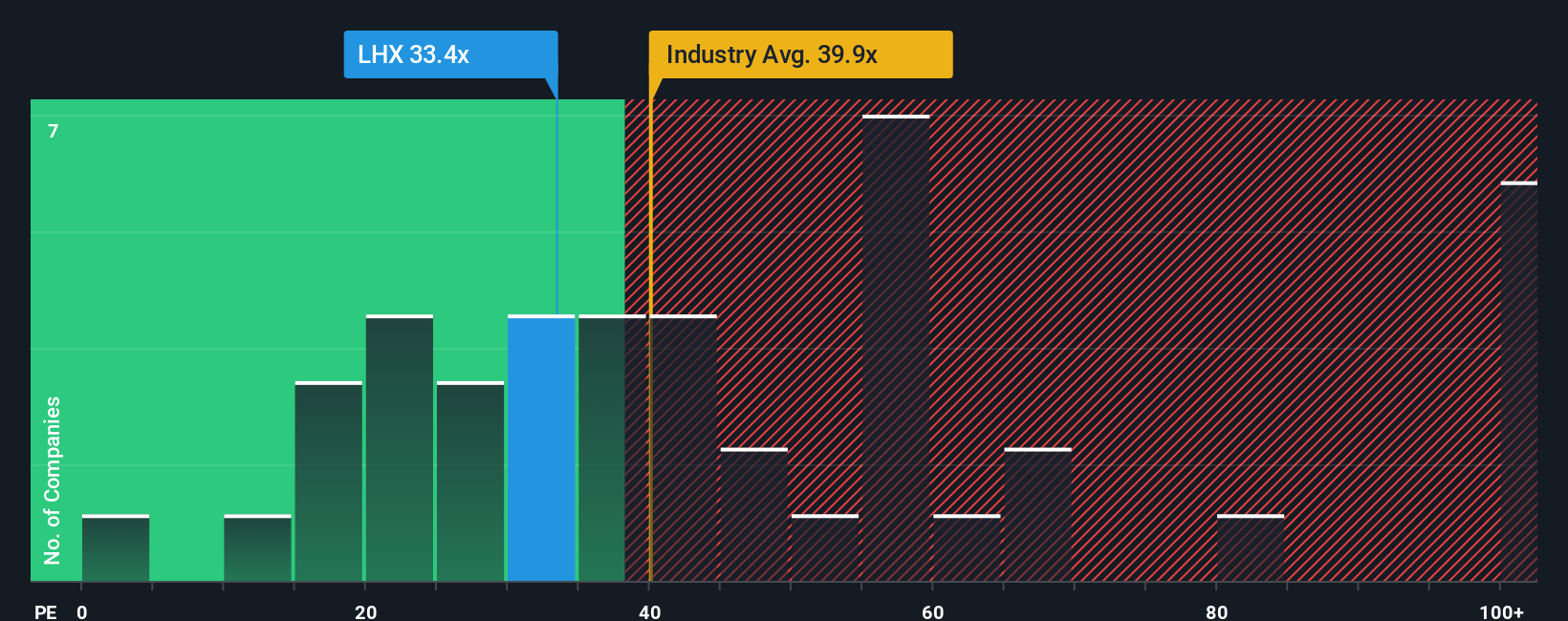

The market’s price-to-earnings ratio for L3Harris stands just above its calculated fair ratio at 29.3x versus 29x. It is also lower than both its peer average (34.4x) and industry average (36.6x). This suggests limited margin for multiple-driven upside, unless future growth or sentiment shifts dramatically. Which measure will investors trust most?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own L3Harris Technologies Narrative

If you think there is more to the story or want to reach your own conclusion, you can build and share your own narrative in just minutes, and Do it your way.

A great starting point for your L3Harris Technologies research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want an edge in the current market, Simply Wall Street’s screener is your shortcut to hand-picked stocks and high-potential opportunities you may be overlooking.

- Catch early-stage growth by tapping into these 3582 penny stocks with strong financials which balance strong fundamentals with big upside potential.

- Boost your income by targeting these 14 dividend stocks with yields > 3% offering reliable yields above 3 percent for building lasting wealth.

- Get ahead of tomorrow’s trends with these 26 AI penny stocks that harness cutting-edge AI breakthroughs for explosive future growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LHX

L3Harris Technologies

Provides mission-critical solutions for government and commercial customers worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success