- United States

- /

- Aerospace & Defense

- /

- NYSE:LHX

Assessing L3Harris Stock After 37% Rally and Major Defense Contract Wins in 2025

Reviewed by Bailey Pemberton

- Curious whether L3Harris Technologies is trading at a bargain right now, or if its recent momentum has already priced in the good news?

- After soaring 37.1% year-to-date and delivering a 17.5% gain over the past twelve months, the stock's performance has definitely caught investors’ attention, even as it is down slightly in the past week and month.

- These price moves follow a series of notable defense contract wins, as well as heightened market focus on geopolitical developments driving attention to the sector. The combination of stronger industry demand and a few large project announcements has clearly put L3Harris in the spotlight.

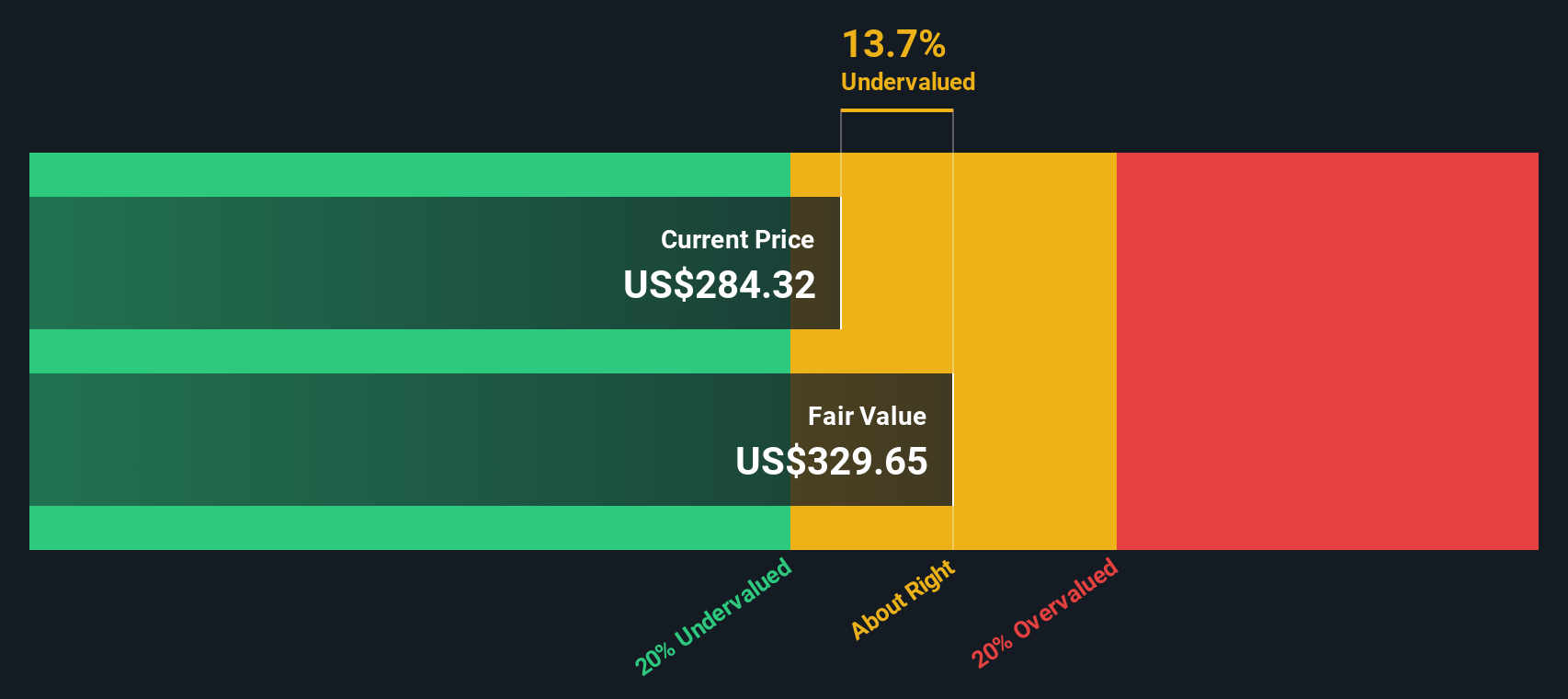

- On our valuation scorecard, L3Harris Technologies scores a 4 out of 6 for undervaluation. This is a solid start, but there is more to the valuation story than just the numbers. Let’s break down a few classic approaches before revealing the smarter, more holistic way to judge value by the end of this article.

Find out why L3Harris Technologies's 17.5% return over the last year is lagging behind its peers.

Approach 1: L3Harris Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a business by projecting its future cash flows and then discounting those amounts back to today's value. This method helps investors understand what a company could be worth based on its capacity to generate cash going forward, rather than purely on current profits or book value.

For L3Harris Technologies, the current Free Cash Flow is approximately $1.85 Billion. Analysts provide forecasts for the next five years, after which Simply Wall St extrapolates estimates through to year ten. According to these projections, the company’s Free Cash Flow is expected to reach nearly $4.55 Billion by 2035. These forecasts highlight reasonable expectations for steady growth, reflecting both industry demand and specific project wins in the defense sector.

Based on these inputs, the DCF analysis estimates L3Harris Technologies’ intrinsic value at $384.26 per share. This suggests that the stock is trading at a 26.0% discount to its calculated fair value at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests L3Harris Technologies is undervalued by 26.0%. Track this in your watchlist or portfolio, or discover 919 more undervalued stocks based on cash flows.

Approach 2: L3Harris Technologies Price vs Earnings

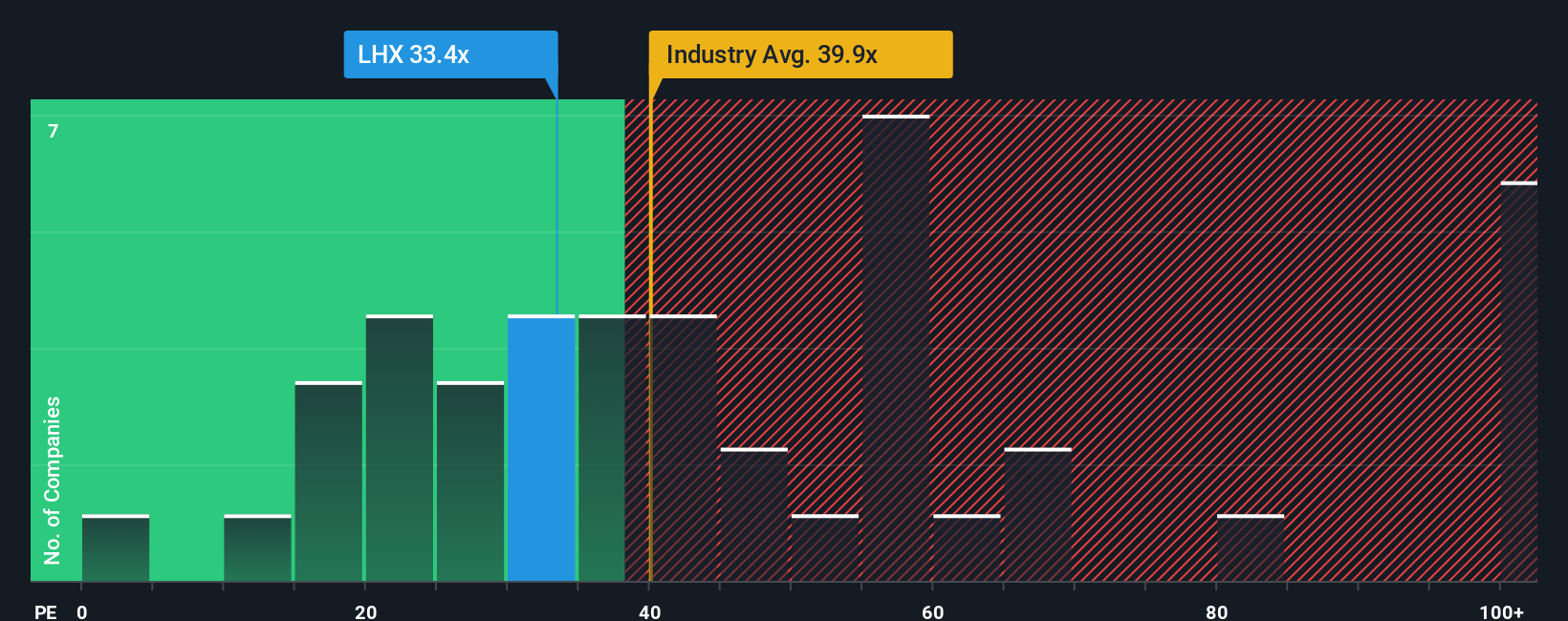

The Price-to-Earnings (PE) ratio is one of the most commonly used metrics for assessing the value of profitable companies like L3Harris Technologies. This ratio gives investors a quick sense of how much they are paying for each dollar of the company’s earnings, making it especially useful for companies with steady profitability.

It is important to recognize that what counts as a “normal” or “fair” PE ratio is influenced by growth expectations and perceived risks. Companies expected to deliver higher earnings growth or those viewed as lower risk generally trade at higher PE ratios. In contrast, slower-growing or riskier companies may see lower multiples.

Currently, L3Harris Technologies trades on a PE ratio of 30.2x. This sits below the industry average PE of 35.4x and is also lower than the peer group average of 34.2x. While this comparison provides some context, it does not fully consider company-specific factors or industry dynamics.

This is where Simply Wall St’s proprietary “Fair Ratio” comes into play. The Fair Ratio (29.2x for L3Harris) is tailored based on key factors, including the company’s expected earnings growth, profit margins, industry, market capitalization, and any notable risks. This approach ensures a more nuanced valuation than simple peer or sector averages and provides a clearer picture of the stock’s relative value.

L3Harris’s current PE of 30.2x is just slightly above the Fair Ratio of 29.2x. This places the valuation in line with what would be expected, given the company’s fundamentals and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your L3Harris Technologies Narrative

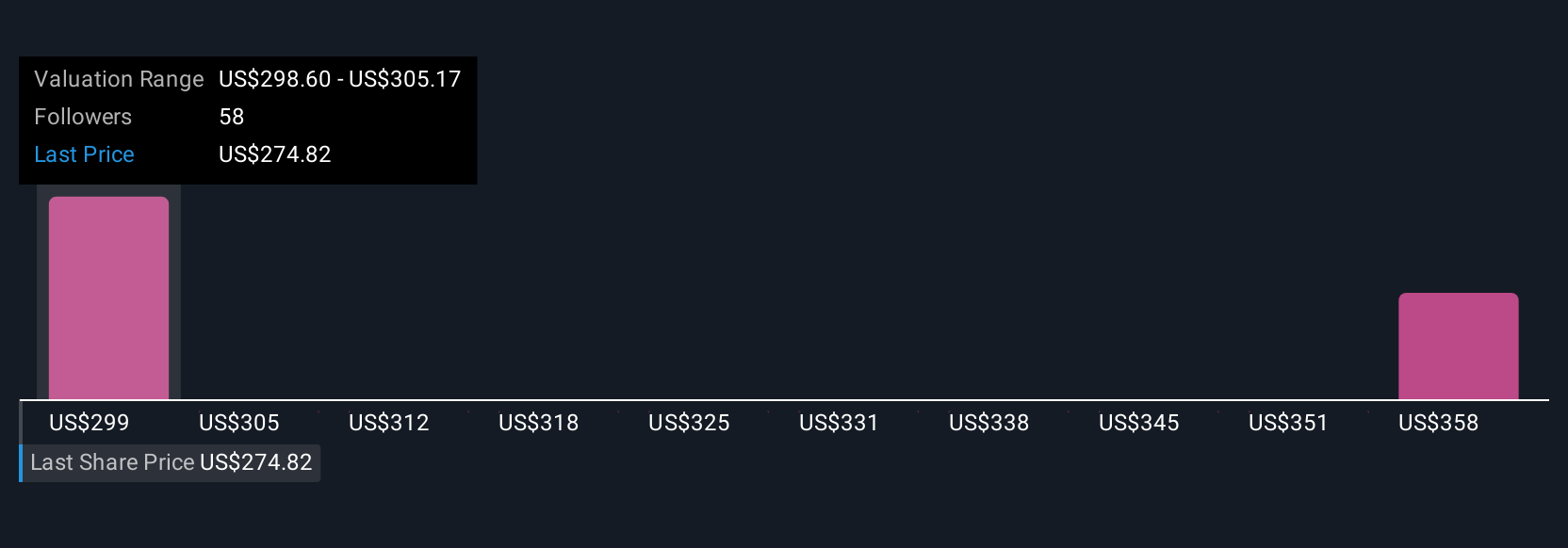

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives, a smarter, more personalized approach used by millions of investors on Simply Wall St's Community page.

A Narrative is an investor’s story about a company, connecting their view of what will drive its future (like new contracts, industry changes, or risk factors) to concrete expectations, such as revenue growth, profit margins, and ultimately, a fair value estimate.

This approach empowers you to think beyond just ratios or forecasts. Narratives help you bridge the company’s actual business story to real financial numbers, and then dynamically compare that fair value to the current share price, supporting smarter buy or sell decisions.

Narratives are easy to create, share, and update, automatically reflecting new information like news or earnings updates, so your investment thesis can evolve in real time.

For example, with L3Harris Technologies, some investors forecast robust growth and see a fair value as high as $327 per share, while others take a more conservative view, setting it closer to $250. This highlights how your own Narrative gives you a powerful way to invest with conviction and clarity.

Do you think there's more to the story for L3Harris Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LHX

L3Harris Technologies

Provides mission-critical solutions for government and commercial customers worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives