- United States

- /

- Aerospace & Defense

- /

- NYSE:KRMN

Karman Holdings (KRMN): Evaluating Valuation After Recent Strong Share Price Performance

Reviewed by Simply Wall St

See our latest analysis for Karman Holdings.

Karman Holdings is riding a wave of momentum, with its share price return up 20% in the last month and an eye-catching 185% so far this year. The impressive streak confirms that investor confidence is building, supported by solid growth fundamentals and recent upbeat trading activity.

If you’re watching strong moves like this, it might be the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

But with Karman Holdings’ rapid rise, is its current share price truly reflecting the company’s intrinsic value? Could there still be unexplored upside for investors looking to capitalize on future growth?

Price-to-Sales of 28.9x: Is it justified?

Karman Holdings is currently priced well above its peers, with a price-to-sales ratio of 28.9x at the last close of $85.79. This valuation sits far above both the industry and peer group averages, signaling the market's strong expectations for future growth or strategic advantages.

The price-to-sales ratio is a popular gauge for growth stocks, as it measures how much investors are willing to pay for each dollar of the company’s sales. In the capital goods sector, it can reflect anticipated expansion, disruptive potential, or market hype. When this multiple is far higher than sector benchmarks, it usually implies that the market is pricing in exceptional results ahead or possibly overestimating prospects.

Compared to its direct peers, who average just 2.2x, and the broader US Aerospace & Defense industry at 3.1x, Karman Holdings' ratio is conspicuously elevated. Based on regression estimates, a fair price-to-sales ratio for the company would be closer to 5x, which is significantly below the current market multiple. Such a wide premium suggests investors should take a hard look at the underlying growth assumptions that are driving KRMN's lofty valuation.

Explore the SWS fair ratio for Karman Holdings

Result: Preferred multiple of price-to-sales 28.9x (OVERVALUED)

However, signs of overvaluation and the stock trading below analyst price targets could trigger a sentiment shift if growth expectations are not fully realized.

Find out about the key risks to this Karman Holdings narrative.

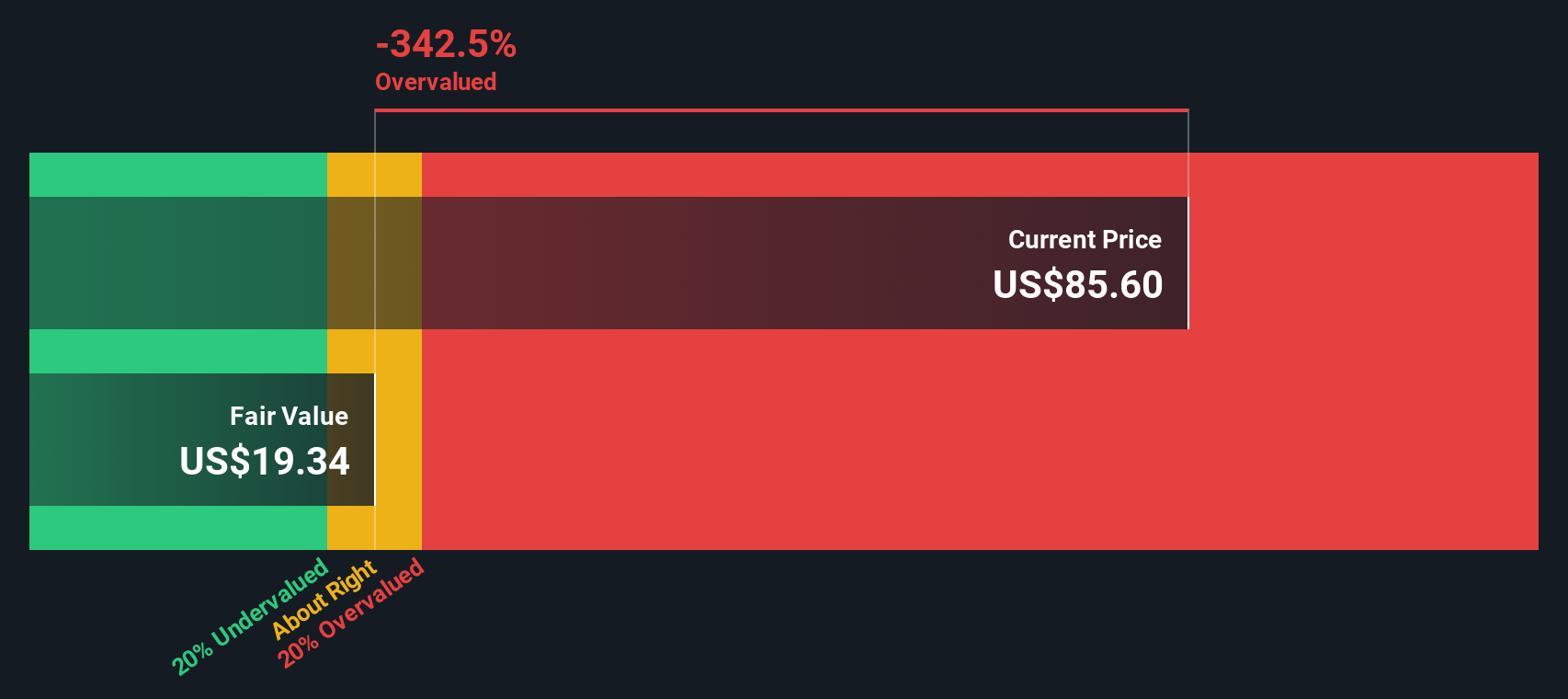

Another View: DCF Suggests Shares Are Overvalued

Looking at Karman Holdings through the lens of our SWS DCF model creates a starkly different picture. The model estimates fair value at $19.42, which is well below the current price of $85.79. This implies the market is pricing in far more growth and optimism than what the company’s actual cash flows might support. Which method will prove right over time?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Karman Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Karman Holdings Narrative

If you want to draw your own conclusions or dig deeper than what’s presented here, you can easily build your own narrative for Karman Holdings in just a few minutes. Do it your way

A great starting point for your Karman Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye out for top opportunities beyond the obvious picks. Use the Simply Wall Street Screener to spot stocks making real moves before the crowd catches on.

- Tap into the future of artificial intelligence by checking out these 26 AI penny stocks. These may have the potential to reshape entire industries.

- Unlock hidden gems that are trading well below their true value by searching through these 848 undervalued stocks based on cash flows using powerful cash flow signals.

- Capture stable income streams and long-term potential by reviewing these 21 dividend stocks with yields > 3% for strong yields and robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karman Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRMN

Karman Holdings

Through its subsidiary, engages in designing, testing, manufacturing, and sale of mission-critical systems in the United States.

High growth potential with very low risk.

Market Insights

Community Narratives