- United States

- /

- Machinery

- /

- NYSE:KMT

Kennametal (KMT): Assessing Valuation After Upbeat Q1 and Raised 2026 Outlook

Reviewed by Simply Wall St

Kennametal (KMT) posted first quarter sales and earnings that came in above expectations, which prompted an upward revision to its full-year sales guidance for fiscal 2026. The improved outlook reflects share gains and stronger end market conditions.

See our latest analysis for Kennametal.

Kennametal’s share price has surged over the past three months, bolstered by upbeat earnings, an accelerated buyback program, and its raised sales outlook for 2026. Momentum is clearly building, with a 31% three-month share price return. However, its total shareholder return over the past year is just shy of flat, which shows that recent gains are still catching up to longer-term performance.

If this positive momentum has you curious about what else is on the move, now could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares rallying and fundamentals trending up, the key question is whether Kennametal's surge leaves the stock undervalued or if future growth is already factored into its price. This could possibly limit further upside for new investors.

Most Popular Narrative: 16.8% Overvalued

With Kennametal’s last close at $27.59 and a widely followed fair value estimate of $23.63, the current price sits well ahead of narrative expectations. The stage is set for a closer look at the optimistic factors driving this viewpoint.

The company is actively rightsizing capacity and executing structural cost reductions, which are projected to produce $125 million in run-rate savings by fiscal 2028. This is expected to support significant net margin improvement as volume returns. Kennametal is investing in product innovation and digital transformation initiatives, creating new avenues for higher-margin growth and improved earnings quality.

Curious about the blueprint behind these bullish projections? The narrative is built on aggressive cost cutting, bold innovation bets, and ambitious margin improvements. Want to see which crucial assumptions and growth forecasts shape this valuation? Get the full story to see what the numbers reveal.

Result: Fair Value of $23.63 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in key end markets or stalled profit margin improvements could undermine the optimistic outlook and trigger a reassessment of Kennametal’s future trajectory.

Find out about the key risks to this Kennametal narrative.

Another View: Multiples Tell a Different Story

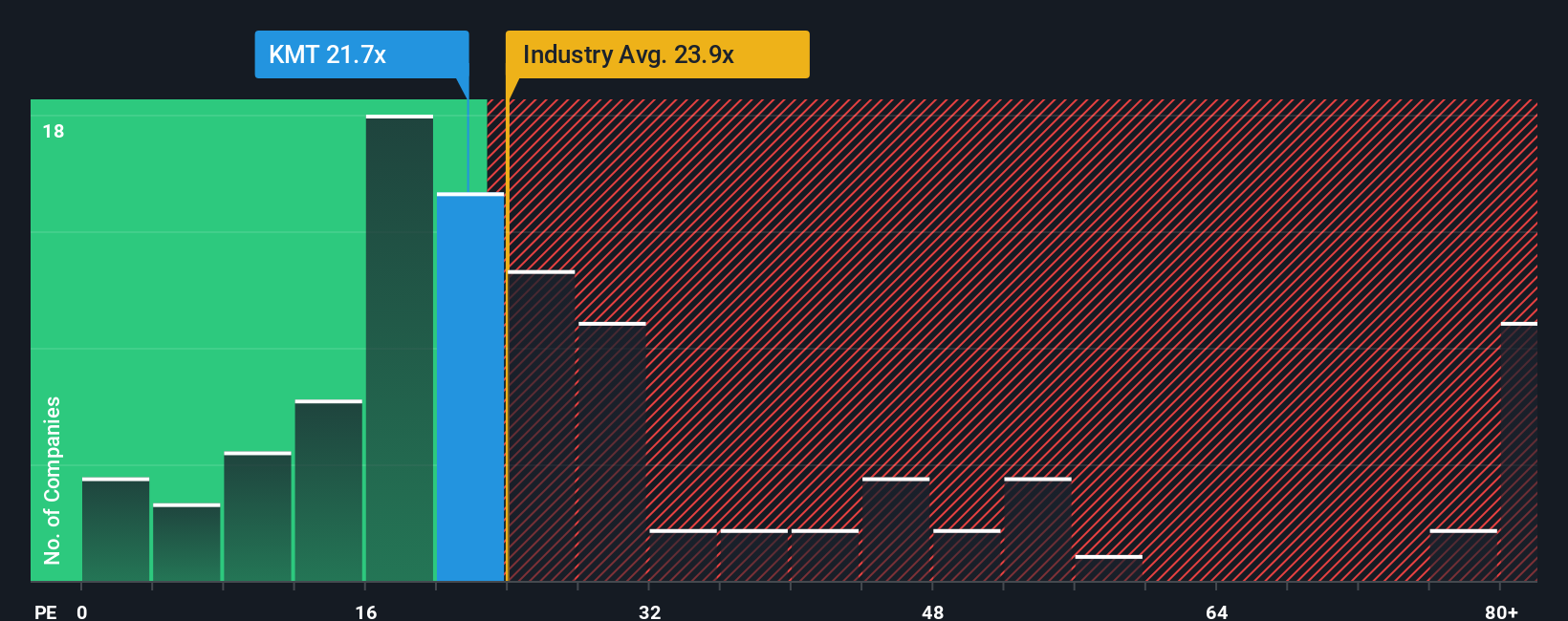

Looking beyond analyst targets, Kennametal’s price-to-earnings ratio sits at 22.3x. This is meaningfully lower than its peer average of 43.3x and just under the US Machinery industry average of 24.6x. However, it also sits slightly above its fair ratio of 21.1x, which points to limited margin for error if expectations slip. Does this suggest a hidden value, or is it a sign the market is cautious for good reason?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kennametal Narrative

If you have your own ideas or want to dig deeper into Kennametal’s numbers, you can craft and test your perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kennametal.

Looking for More Smart Investment Ideas?

Why stop at just one opportunity? The market is full of stocks with game-changing potential. Take a leap. Some of tomorrow’s top performers may be just a click away in these unique categories:

- Catch the momentum of innovation by tracking these 27 AI penny stocks already making waves in artificial intelligence and automation.

- Secure a steady income stream as you pursue these 15 dividend stocks with yields > 3% offering attractive yields above 3% and a history of rewarding shareholders.

- Step ahead of the crowd with these 868 undervalued stocks based on cash flows that analysts think are mispriced and ready for a strong future upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kennametal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMT

Kennametal

Engages in development and application of tungsten carbides, ceramics, and hard materials and solutions worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives