- United States

- /

- Machinery

- /

- NYSE:KMT

3 Dividend Stocks In US Yielding Up To 5.1%

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations ahead of a pivotal presidential election and an anticipated Federal Reserve rate decision, investors are navigating a landscape marked by uncertainty. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for those seeking reliable returns amidst market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.65% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.29% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.19% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 5.11% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.51% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.96% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.93% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.30% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.10% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.94% | ★★★★★★ |

Click here to see the full list of 173 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

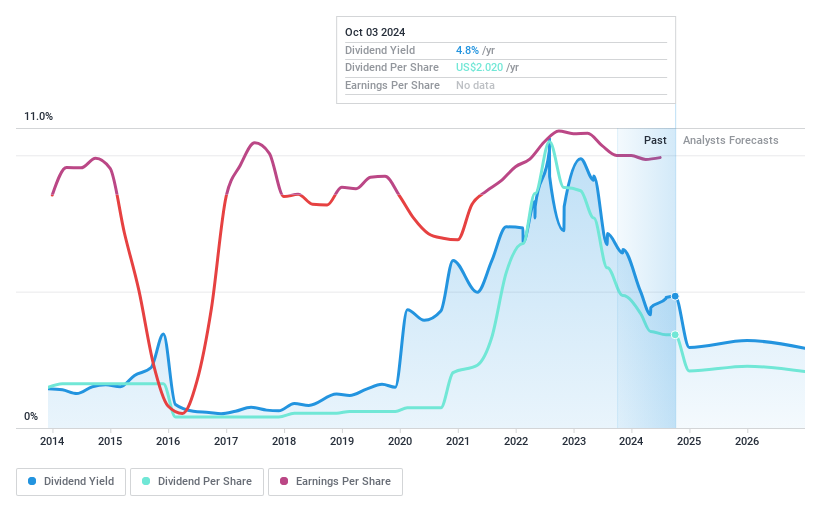

Devon Energy (NYSE:DVN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Devon Energy Corporation is an independent energy company focused on the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States with a market cap of approximately $25.22 billion.

Operations: Devon Energy Corporation generates revenue of approximately $14.75 billion from its oil and gas exploration and production activities in the United States.

Dividend Yield: 5.2%

Devon Energy's dividend yield is in the top 25% of US dividend payers, supported by a low payout ratio of 36.9%, indicating coverage by earnings and cash flows. However, its dividend history has been volatile over the past decade. Recent financial activities include a $1.51 billion shelf registration filing and fixed-income offerings totaling over $2 billion, which may impact future dividends or stock performance due to potential shareholder dilution concerns.

- Click to explore a detailed breakdown of our findings in Devon Energy's dividend report.

- Our valuation report here indicates Devon Energy may be undervalued.

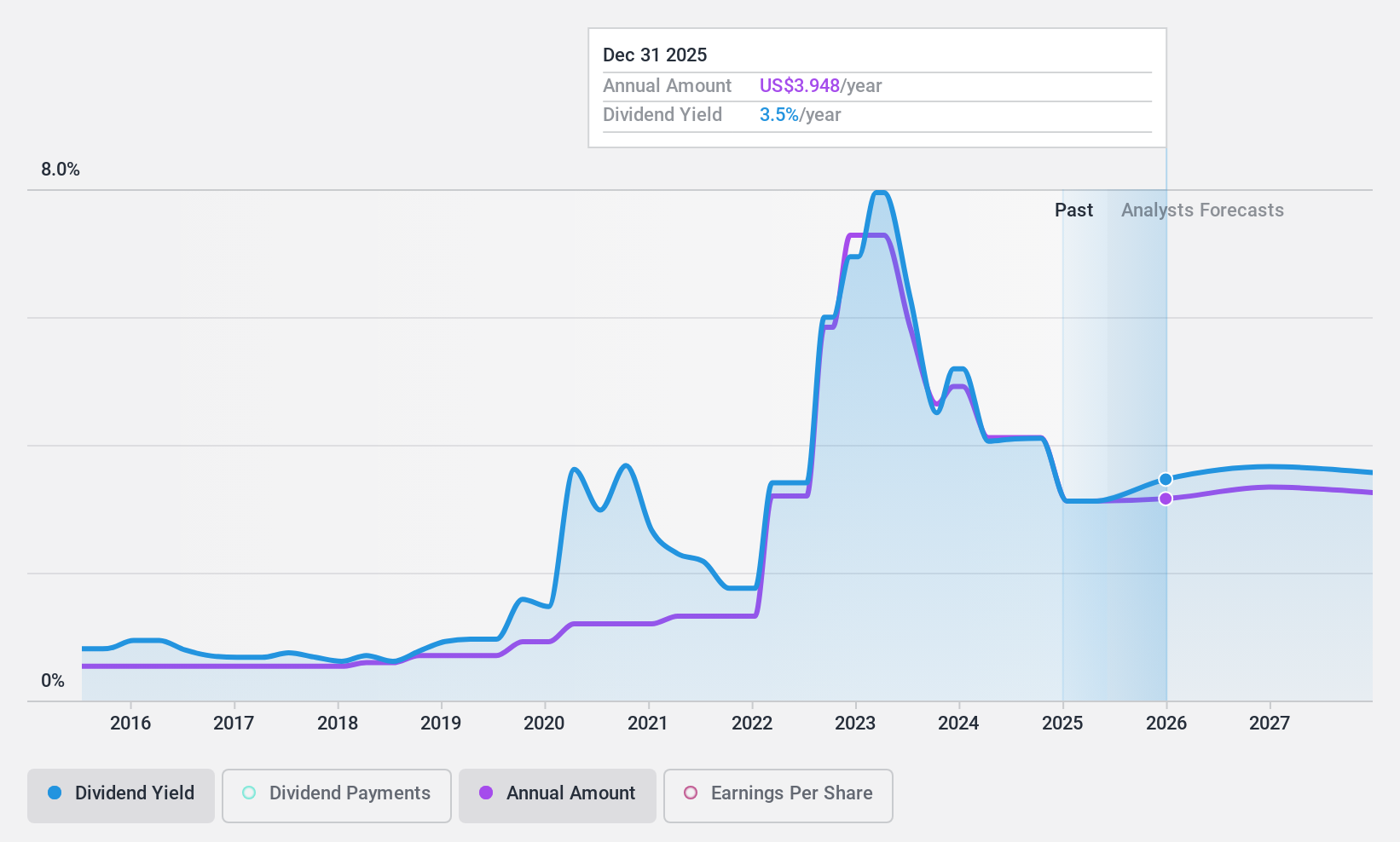

EOG Resources (NYSE:EOG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EOG Resources, Inc. is engaged in the exploration, development, production, and marketing of crude oil, natural gas liquids, and natural gas primarily in the United States and Trinidad and Tobago with a market cap of approximately $68.71 billion.

Operations: EOG Resources generates revenue of $24.11 billion from its crude oil and natural gas exploration and production activities.

Dividend Yield: 4.2%

EOG Resources' dividend payments have been volatile over the past decade, with a current yield of 4.18%, below the top 25% of US payers. Despite this, dividends are well covered by earnings (payout ratio: 27.3%) and cash flows (cash payout ratio: 57.8%). The stock trades at a discount to its estimated fair value and peers, though insider selling has been significant recently. Recent activities include closing several shelf registrations totaling $85.83 million for ESOP-related offerings.

- Dive into the specifics of EOG Resources here with our thorough dividend report.

- Our expertly prepared valuation report EOG Resources implies its share price may be lower than expected.

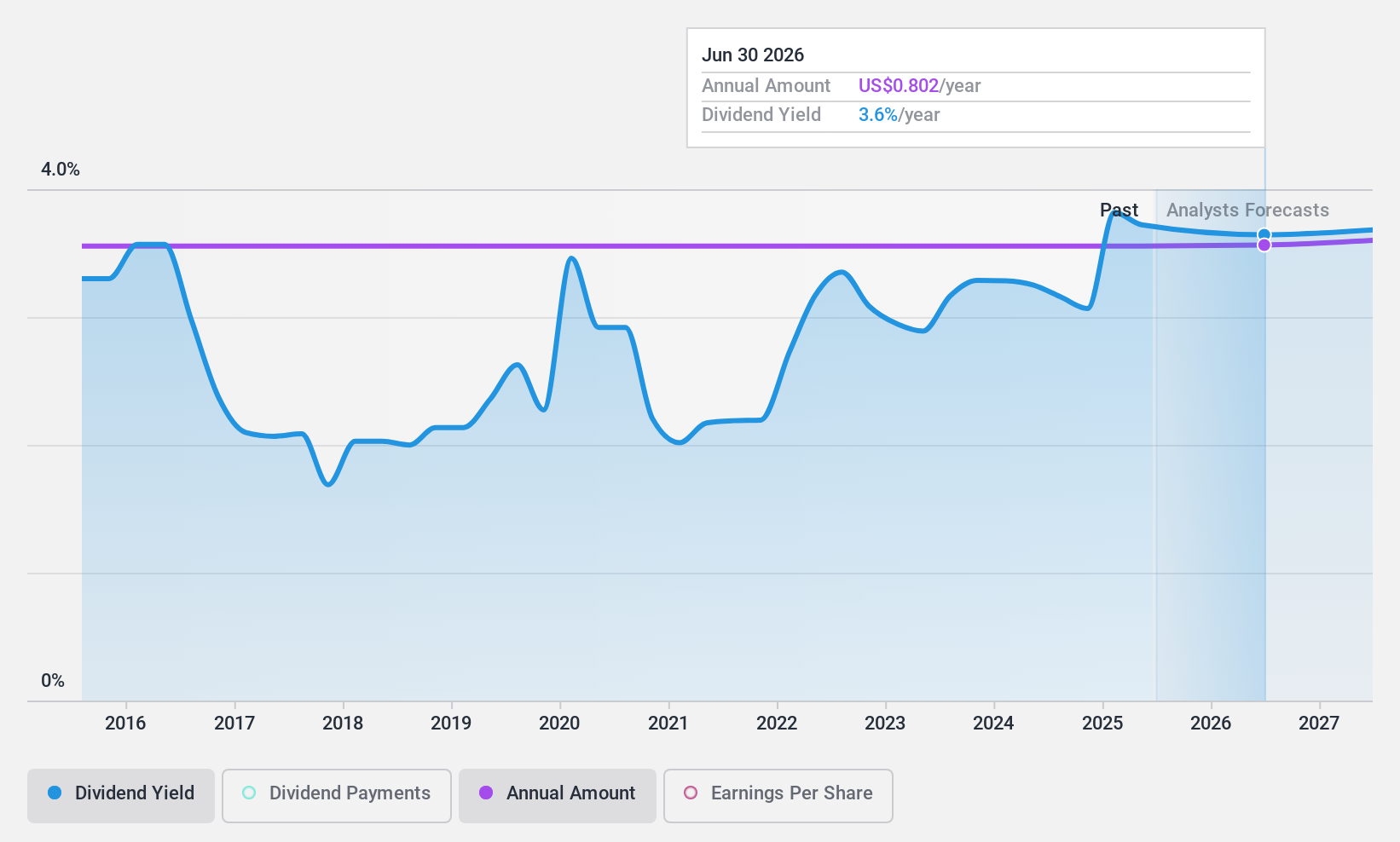

Kennametal (NYSE:KMT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kennametal Inc. develops and applies tungsten carbides, ceramics, and super-hard materials for metal cutting and extreme wear applications to help customers combat corrosion and high temperatures globally, with a market cap of approximately $1.99 billion.

Operations: Kennametal Inc.'s revenue is primarily derived from its Metal Cutting segment, which accounts for $1.28 billion, and its Infrastructure segment, contributing $766.12 million.

Dividend Yield: 3.1%

Kennametal's dividend payments have been stable and growing over the past decade, supported by a payout ratio of 58.1% and a cash payout ratio of 36.8%, indicating strong coverage by earnings and cash flows. The current yield is 3.09%, which is lower than the top quartile in the US market. Recent developments include expanding its product portfolio with advanced machining tools, potentially enhancing future revenue streams without impacting its dividend reliability.

- Click here to discover the nuances of Kennametal with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Kennametal's current price could be quite moderate.

Key Takeaways

- Dive into all 173 of the Top US Dividend Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kennametal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMT

Kennametal

Engages in development and application of tungsten carbides, ceramics, and super-hard materials and solutions for use in metal cutting and extreme wear applications to enable customers work against corrosion and high temperatures conditions worldwide.

Excellent balance sheet established dividend payer.