- United States

- /

- Building

- /

- NYSE:JELD

JELD-WEN Holding (NYSE:JELD investor three-year losses grow to 47% as the stock sheds US$56m this past week

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term JELD-WEN Holding, Inc. (NYSE:JELD) shareholders, since the share price is down 47% in the last three years, falling well short of the market return of around 20%. The falls have accelerated recently, with the share price down 12% in the last three months.

Since JELD-WEN Holding has shed US$56m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for JELD-WEN Holding

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

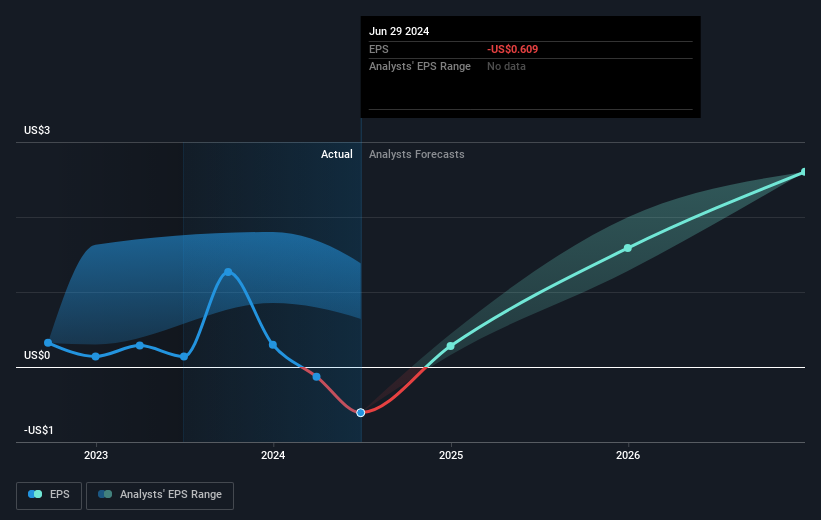

Over the three years that the share price declined, JELD-WEN Holding's earnings per share (EPS) dropped significantly, falling to a loss. Extraordinary items contributed to this situation. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on JELD-WEN Holding's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

JELD-WEN Holding provided a TSR of 29% over the last twelve months. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 4% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand JELD-WEN Holding better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for JELD-WEN Holding you should know about.

We will like JELD-WEN Holding better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:JELD

JELD-WEN Holding

Designs, manufactures, and sells wood, metal, and composite materials doors, windows, and related building products in North America and Europe.

Fair value with moderate growth potential.