- United States

- /

- Building

- /

- NYSE:JCI

Is Johnson Controls a Smart Bet After 43.6% Rally and Fresh Analyst Buzz?

Reviewed by Bailey Pemberton

- Wondering if Johnson Controls International is trading at a bargain, or if its impressive price run means there is little value left? You are not alone, and we are about to dig into what the numbers say about its current valuation.

- The stock has jumped 4.4% in the past week, climbed 4.8% over the last month, and has delivered a jaw-dropping 43.6% year-to-date return. This puts longer-term gains at 51.0% for the year and over 200% for the past five years.

- Much of the recent momentum has been fueled by positive industry news around smart building technologies and increased global investment in energy efficiency, both of which play right into Johnson Controls’ core strengths. A flurry of coverage about major project wins and a fresh round of bullish analyst sentiment have also put the company in the spotlight.

- With all that excitement, Johnson Controls currently scores 0 out of 6 on our core undervaluation checks. This could indicate that things may be a bit overheated, or the market knows something we do not. Let us examine the traditional and alternative ways to value the company, and stick around to see a different perspective that could reshape how you assess its true worth.

Johnson Controls International scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Johnson Controls International Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting those flows back to today’s value. This approach gives investors a framework for deciding what they might pay for those projected profits, with greater emphasis placed on cash earned sooner rather than later.

For Johnson Controls International, the latest reported Free Cash Flow is $2.89 billion. Analysts expect this number to grow each year, reaching $3.31 billion by 2028. While analyst estimates stop there, additional years are extrapolated and project Free Cash Flow to reach approximately $4.68 billion by 2035, based on a declining annual growth rate.

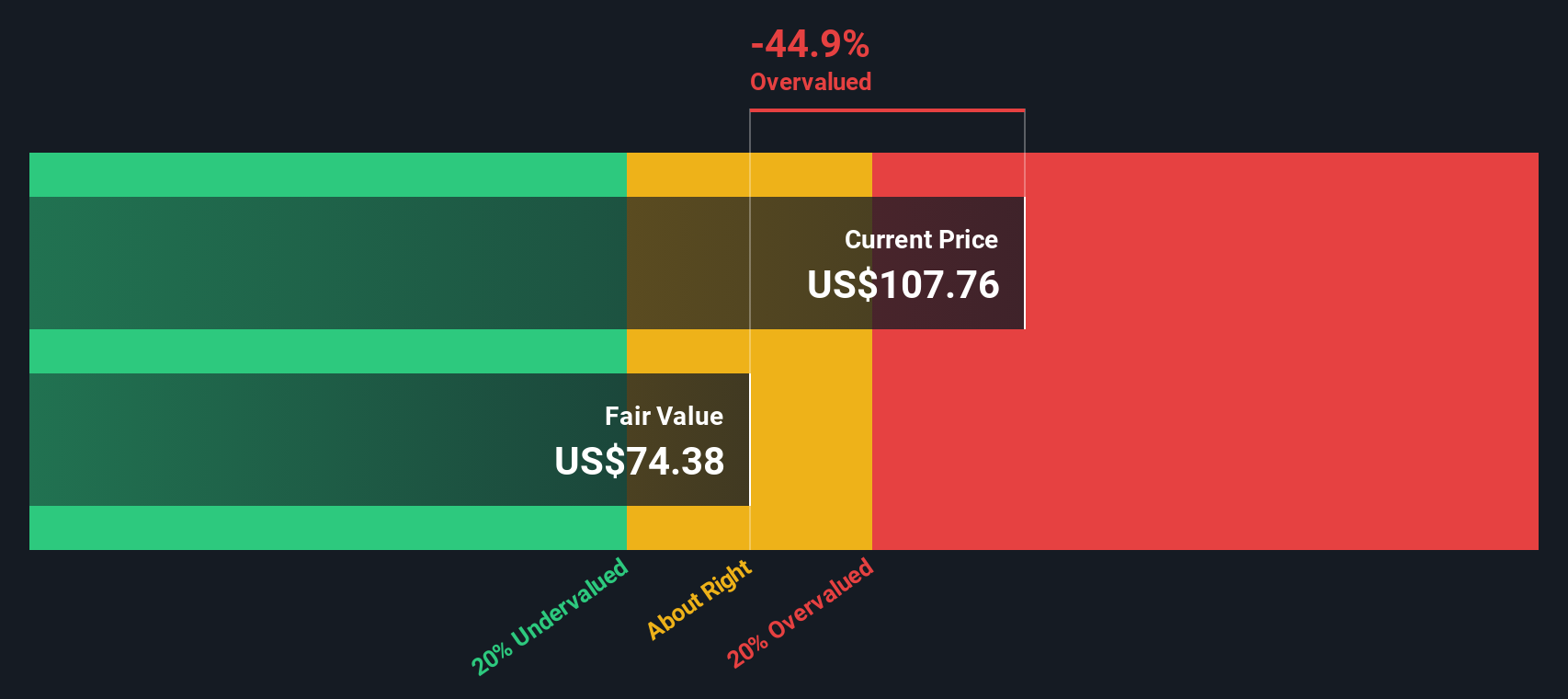

After discounting all future cash flows back to their current value, the model estimates Johnson Controls’ intrinsic fair value at $87.12 per share. The current share price, however, sits roughly 30.1% higher than this calculated value. This suggests the stock is trading well above its underlying cash flow projections, indicating it may be overvalued by this measure.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Johnson Controls International may be overvalued by 30.1%. Discover 855 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Johnson Controls International Price vs Earnings (PE)

For companies like Johnson Controls International that generate solid profits, the Price-to-Earnings (PE) ratio is a reliable way to gauge stock valuation. Essentially, the PE ratio tells investors how much they are paying for every dollar of current earnings. A higher PE can reflect growth expectations, but sometimes also means shares are getting expensive if growth and quality do not justify it. Normal or "fair" PE ratios will be influenced by factors like how fast a business is expected to grow, its risk profile, and how stable its earnings are compared to competitors.

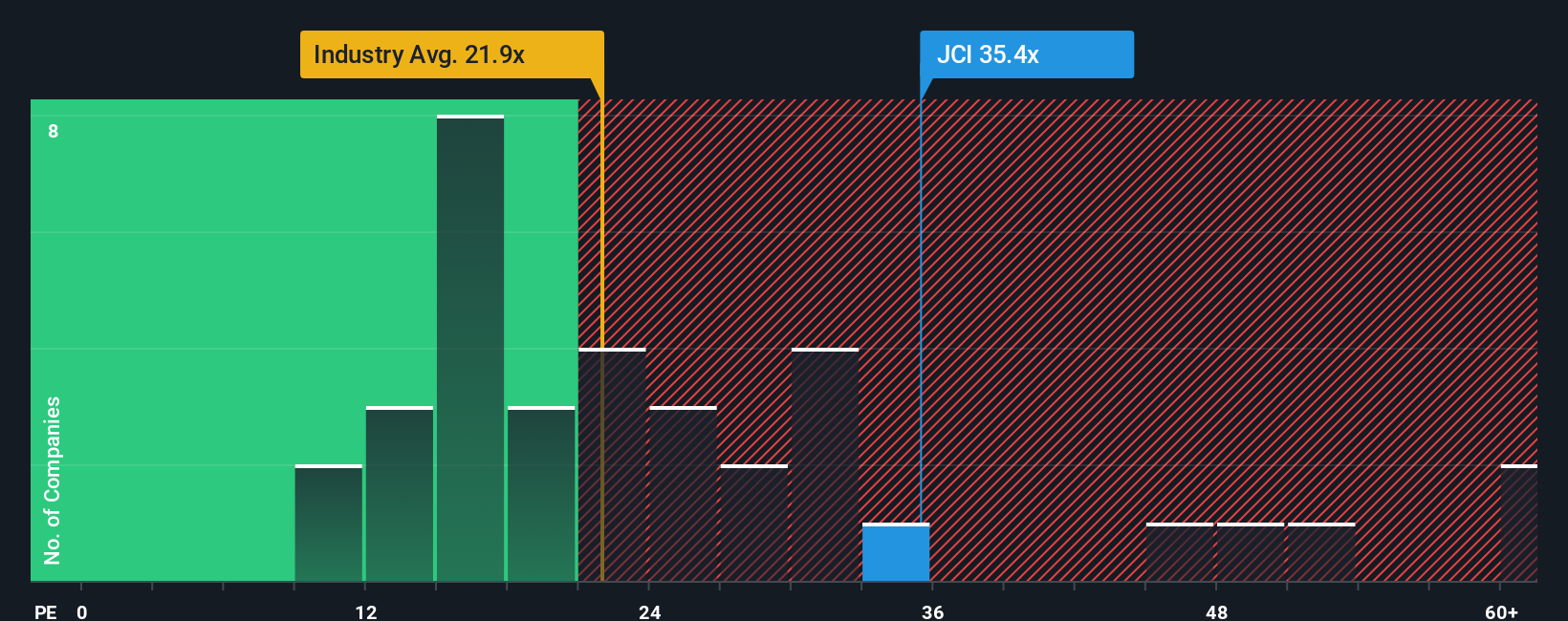

Currently, Johnson Controls trades at a PE ratio of 37.3x. That is significantly higher than the Building industry average of 19.1x and the peer average of 27.1x, suggesting that the market may be pricing in above-average prospects for the company or possibly over-excitement. However, Simply Wall St’s Fair Ratio model takes a different approach. Instead of comparing just with peers, it considers the company’s growth forecast, profit margins, size, and sector risks. For Johnson Controls, the Fair Ratio is calculated at 33.8x, providing a more tailored benchmark that adjusts for strengths and weaknesses that might not be clear in a plain industry comparison.

With an actual PE ratio of 37.3x versus a Fair Ratio of 33.8x, the stock is trading noticeably above where you might expect based on its fundamentals. This points to the shares being somewhat overvalued on a PE basis at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Johnson Controls International Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your own story or perspective about a company, built by connecting your beliefs about its growth, profitability, and risks to specific forecasts and an estimated fair value. Rather than relying solely on generic models, Narratives let you tailor the story behind the numbers by combining your assumptions for Johnson Controls International’s future revenue, earnings, and margins into a living financial projection.

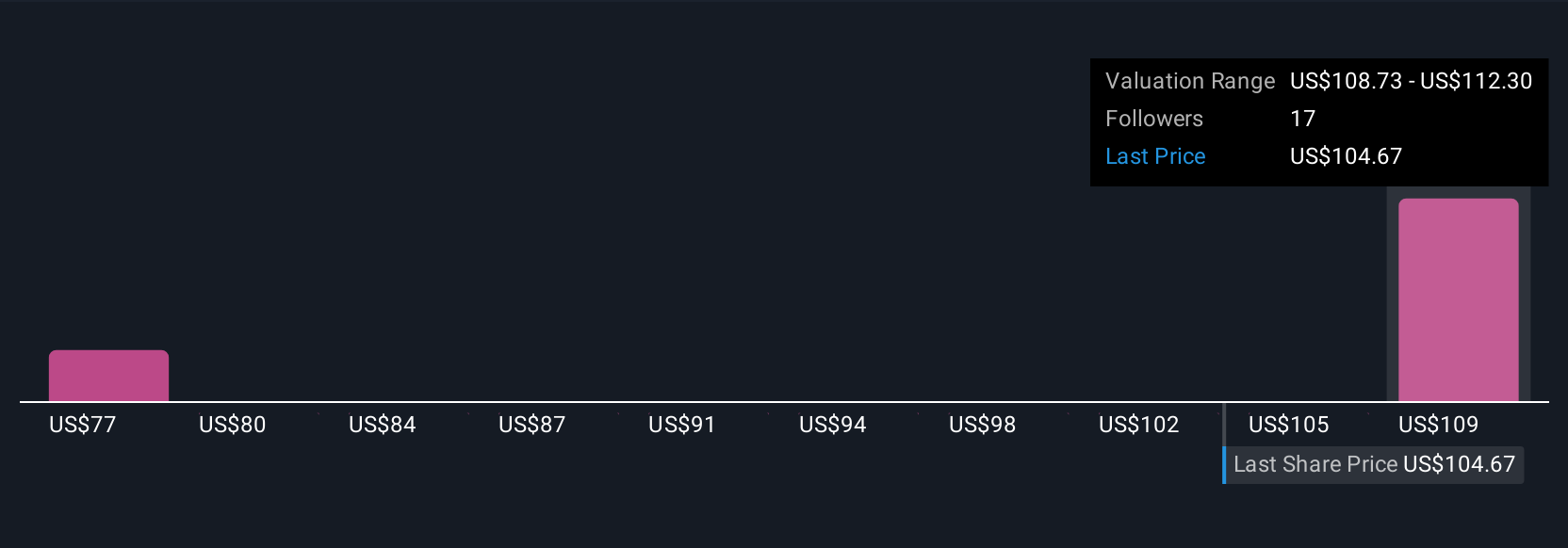

With Narratives, you can easily align the company’s journey to your expectations and then see how your fair value stacks up against the current price, all in one place on the Simply Wall St Community page used by millions of investors. These Narratives update dynamically as new events, such as earnings releases or major news, are factored in. This helps you decide when it might be time to buy or sell. For example, some investors might believe Johnson Controls International deserves a high fair value of $132.00 per share due to strong data center demand and operational improvements, while others see challenges and set a more cautious fair value as low as $79.00. Narratives give you the power and flexibility to invest according to your view, not just the consensus.

Do you think there's more to the story for Johnson Controls International? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JCI

Johnson Controls International

Engages in engineering, manufacturing, commissioning, and retrofitting building products and systems in the United States, Europe, the Asia Pacific, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives