- United States

- /

- Machinery

- /

- NYSE:JBTM

JBT Marel (JBTM): Profitability Forecasted Within 3 Years, Investor Focus on Slow Revenue Growth

Reviewed by Simply Wall St

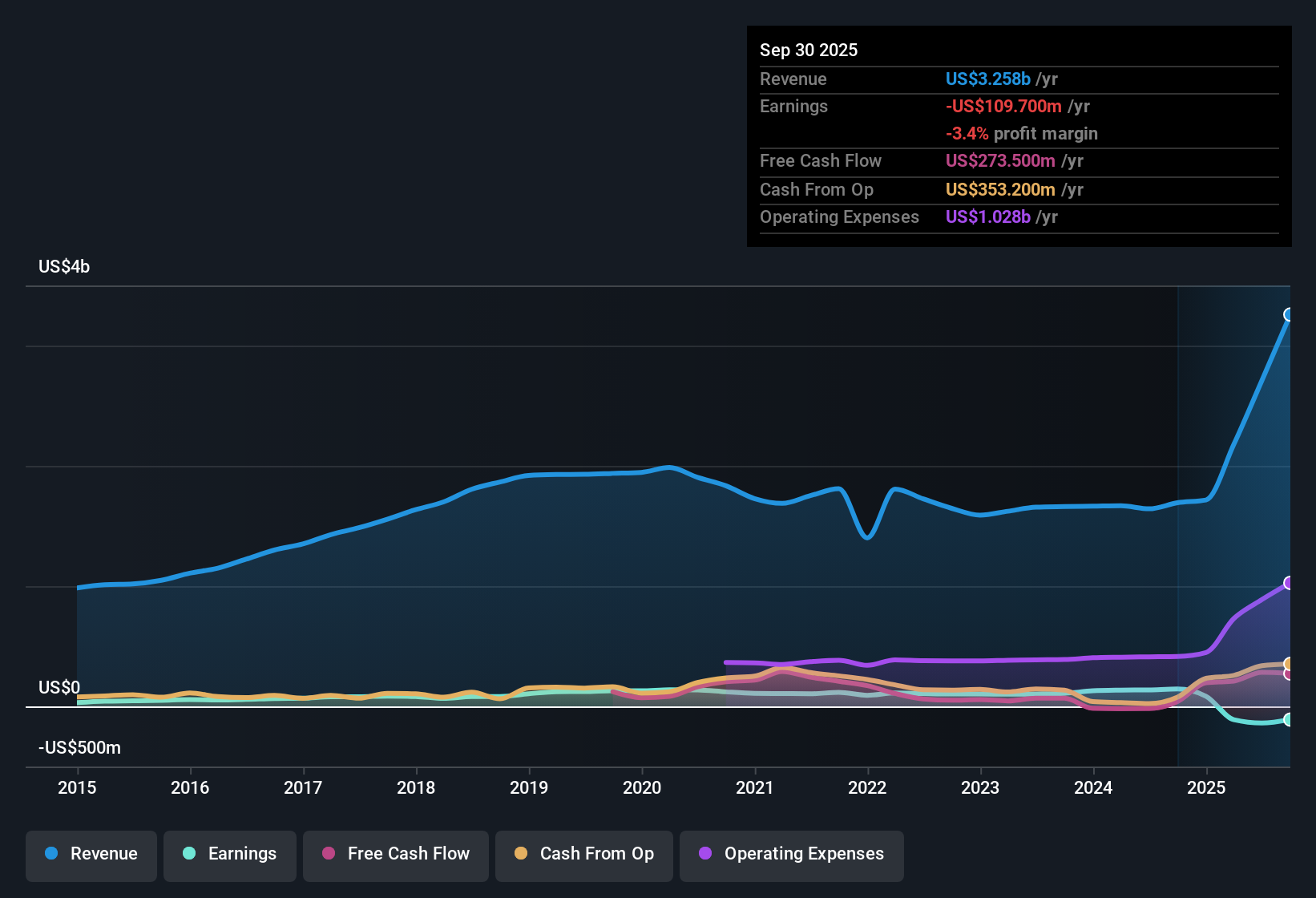

JBT Marel (JBTM) reported another year of losses, with net income declining at an average annual rate of 26.8% over the past five years. Investors are watching closely as the company is forecast to deliver 117.55% annual earnings growth and return to profitability within the next three years, outpacing market expectations. Persistent unprofitability may raise concerns, but optimism centers on the anticipated sharp turnaround in earnings growth ahead.

See our full analysis for JBT Marel.Now let’s see how these results stack up against the prevailing narratives around JBT Marel. Some expectations may be reinforced, while others could face a reality check.

See what the community is saying about JBT Marel

Profit Margins Forecast to Flip Positive

- Analysts anticipate JBT Marel’s profit margins will swing from -5.1% today to 12.9% over the next three years. This dramatic projected improvement is seen as underpinning the path back to profitability.

- According to analysts' consensus view, this recovery is heavily supported by strategic moves such as merger synergies and aftermarket expansion. Both are seen as essential in driving margin gains and stabilizing earnings.

- Consensus highlights realized cost savings from the JBT-Marel merger and momentum in high-margin service revenues as major levers enabling margin expansion through at least 2027.

- However, lingering risks like ongoing tariff pressures and supply chain integration are expected to challenge the pace and consistency of these projected improvements.

- For those following the consensus narrative, the bursting margin outlook could provide real conviction or challenge your view. See how the full case stacks up. 📊 Read the full JBT Marel Consensus Narrative.

Shareholder Dilution Puts Focus on Value

- Analysts expect JBT Marel’s shares outstanding to increase by 7% annually for the next three years, with recent shareholder dilution already flagged as a material risk for investors.

- Consensus narrative emphasizes that while the company targets topline and margin improvements, sustained share issuance may limit upside for existing shareholders even as the business grows.

- Analysts flag that continuous share dilution can offset the benefits of rising earnings, keeping per-share gains modest relative to headline growth rates.

- This tension is particularly notable given management’s focus on strategic investment and integration costs following the JBT-Marel merger, which could still require additional capital raises.

Peer Value Discount With Sector Premium

- JBT Marel trades at a Price-To-Sales ratio of 2.2x, below the peer average of 2.7x, yet above the broader US Machinery industry average of 1.9x. This signals the market considers it attractively valued among direct competitors despite being priced richer than the sector benchmark.

- Analysts' consensus notes this valuation gap reflects a balance between expectations for outsized profit growth and persistent concerns about unprofitability. The current share price of $138.41 sits below the DCF fair value of $143.03 and is a notable 7.9% under the analyst target of $150.25.

- With a potential pricing rebound tied to JBT Marel delivering forecasted earnings gains by 2028, consensus does not see significant mispricing but calls for close tracking as the margin and integration story unfolds.

- The muted premium to analyst targets and DCF fair value suggests that the market remains cautious until concrete profitability is demonstrated.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for JBT Marel on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a unique take on the figures? Shape your outlook in just a few minutes and share your perspective: Do it your way.

A great starting point for your JBT Marel research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While JBT Marel boasts strong profit recovery forecasts, its persistent unprofitability and ongoing shareholder dilution highlight risks to value and steady growth.

If you want to focus on proven performers, check out stable growth stocks screener (2083 results) to discover companies delivering reliable revenue and earnings growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBTM

JBT Marel

Provides technology solutions to food and beverage industry in North America, Europe, the Middle East, Africa, the Asia Pacific, and Central and South America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion