- United States

- /

- Machinery

- /

- NYSE:ITW

Could ITW’s Dividend Growth Amid Guidance Cut Signal Shifting Priorities for Illinois Tool Works?

Reviewed by Sasha Jovanovic

- Illinois Tool Works’ Board of Directors declared a fourth quarter 2025 dividend of US$1.61 per share, equating to an annualized US$6.44 per share, and also reported on recent share repurchases and updated its full-year earnings and revenue guidance following the release of third quarter results.

- Amid mixed quarterly performance and continued demand softness in North America and Europe, ITW maintained its commitment to shareholder returns through consistent dividend growth and ongoing buybacks.

- We’ll consider how ITW’s continued focus on dividends and buybacks shapes the investment case following management’s latest guidance cut.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Illinois Tool Works Investment Narrative Recap

To be a shareholder in Illinois Tool Works, you need to believe in its ability to drive above-market organic growth and margin improvement, even as near-term demand softens in North America and Europe. The recent update, narrowed earnings guidance and continued focus on dividends and buybacks, does not materially change the short-term catalyst of earnings stabilization, though it keeps the main risk of persistent organic growth challenges front and center.

The board’s decision to maintain its dividend at US$1.61 per share for the fourth quarter, on top of ongoing share repurchases, signals a continued commitment to returning capital to investors. This matters in light of tepid organic growth, as management’s willingness to sustain shareholder returns may help offset uncertainty from slower segments.

But with soft demand and ongoing margin pressures, investors should be aware that …

Read the full narrative on Illinois Tool Works (it's free!)

Illinois Tool Works’ outlook anticipates $17.6 billion in revenue and $3.6 billion in earnings by 2028. Achieving these figures requires 3.7% annual revenue growth and a $0.2 billion increase in earnings from the current $3.4 billion.

Uncover how Illinois Tool Works' forecasts yield a $261.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

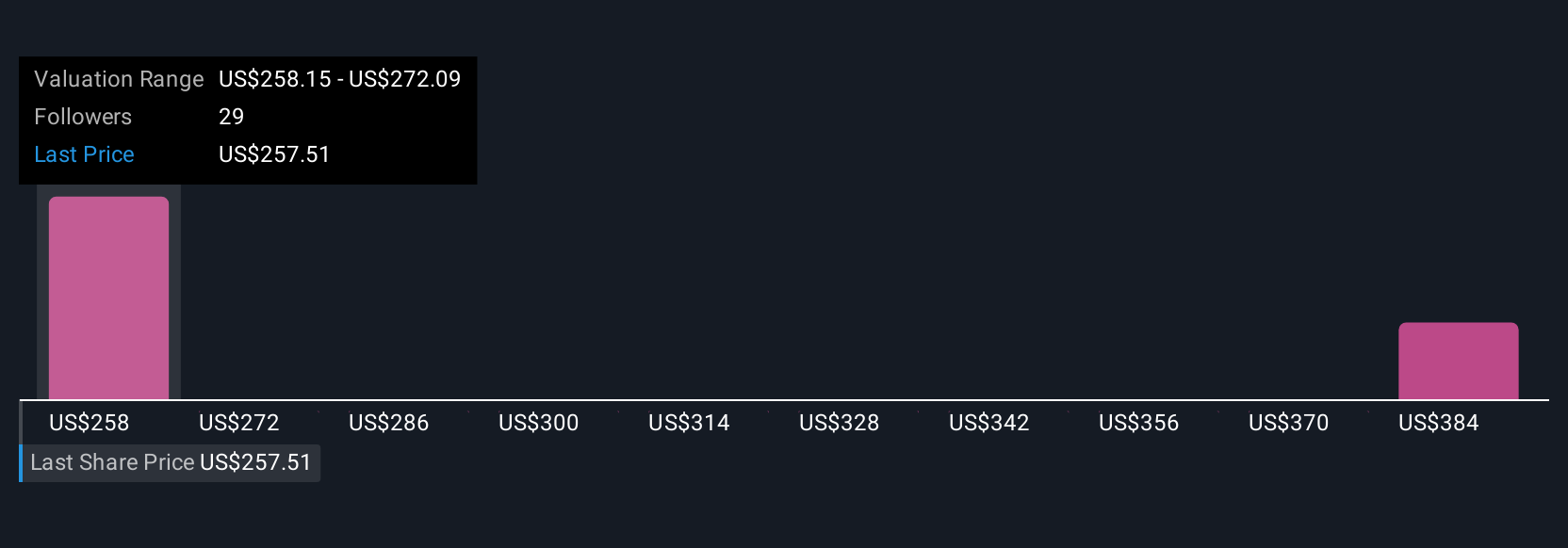

Simply Wall St Community members estimate fair values for ITW between US$261 and US$579, reflecting two sharply differing opinions. Consider how this wide gap intersects with ongoing margin pressures and the company’s slower organic growth outlook.

Explore 2 other fair value estimates on Illinois Tool Works - why the stock might be worth over 2x more than the current price!

Build Your Own Illinois Tool Works Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Illinois Tool Works research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Illinois Tool Works research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Illinois Tool Works' overall financial health at a glance.

No Opportunity In Illinois Tool Works?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ITW

Illinois Tool Works

Provides industrial products and equipment in North America, Europe, the Middle East, Africa, the Asia Pacific, and South America.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives