- United States

- /

- Machinery

- /

- NYSE:ITT

How ITT's Saudi Facility Expansion Could Shape Long-Term Growth and Orders for ITT (ITT) Investors

Reviewed by Sasha Jovanovic

- ITT Inc. recently completed the second phase of a US$25 million expansion at its Industrial Process manufacturing facility in Dammam, Saudi Arabia, doubling its capacity and reinforcing its presence within the Middle East market.

- This move aims to capture rising demand in the region, as the site has secured US$160 million in orders in 2024 and set ambitious growth targets for 2030.

- We’ll assess how the facility expansion and resulting capacity increase may influence ITT’s long-term order pipeline and revenue outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ITT Investment Narrative Recap

To own ITT shares, you need confidence that the company can sustain order growth and margin improvement despite its larger project-based backlog, which still brings volatility risks. The recent Dammam facility expansion may support future revenue streams by increasing capacity and providing better access to the fast-growing Middle East market, but does not in itself fully offset the earnings volatility risk from project delays or cancellations, which remains significant in the short term.

Among recent announcements, ITT’s October 2025 guidance update is highly relevant; management projected 6% to 7% revenue growth and higher EPS, citing a robust backlog and execution momentum. This guidance raises the stakes for the Middle East expansion, as growing project revenues and timely order delivery will be crucial for ITT to hit these targets and address investor concerns about order visibility.

However, even with strong booked orders, the unpredictability of large-scale projects, especially if market conditions change, means that investors should be mindful of...

Read the full narrative on ITT (it's free!)

ITT's narrative projects $4.4 billion revenue and $651.2 million earnings by 2028. This requires 6.3% yearly revenue growth and a $134.7 million earnings increase from $516.5 million.

Uncover how ITT's forecasts yield a $208.91 fair value, a 14% upside to its current price.

Exploring Other Perspectives

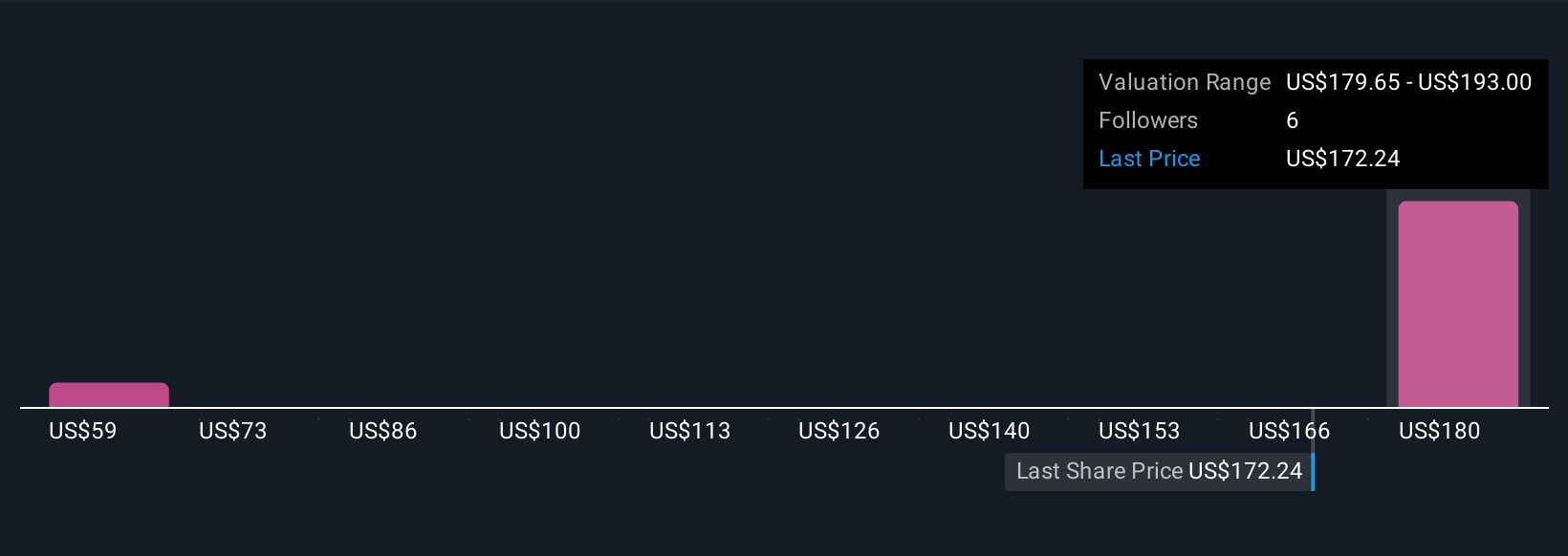

Simply Wall St Community members shared three fair value estimates for ITT ranging from US$59.46 to US$208.91. As you compare these diverse opinions, remember that increasing reliance on project-based revenue can heighten volatility in earnings and business outcomes.

Explore 3 other fair value estimates on ITT - why the stock might be worth less than half the current price!

Build Your Own ITT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ITT research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free ITT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ITT's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ITT

ITT

Manufactures and sells engineered critical components and customized technology solutions for the transportation, industrial, and energy markets.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success