- United States

- /

- Machinery

- /

- NYSE:IR

Ingersoll Rand (IR): One-Off $334.6M Loss Pressures Margins, Challenges Bull Case

Reviewed by Simply Wall St

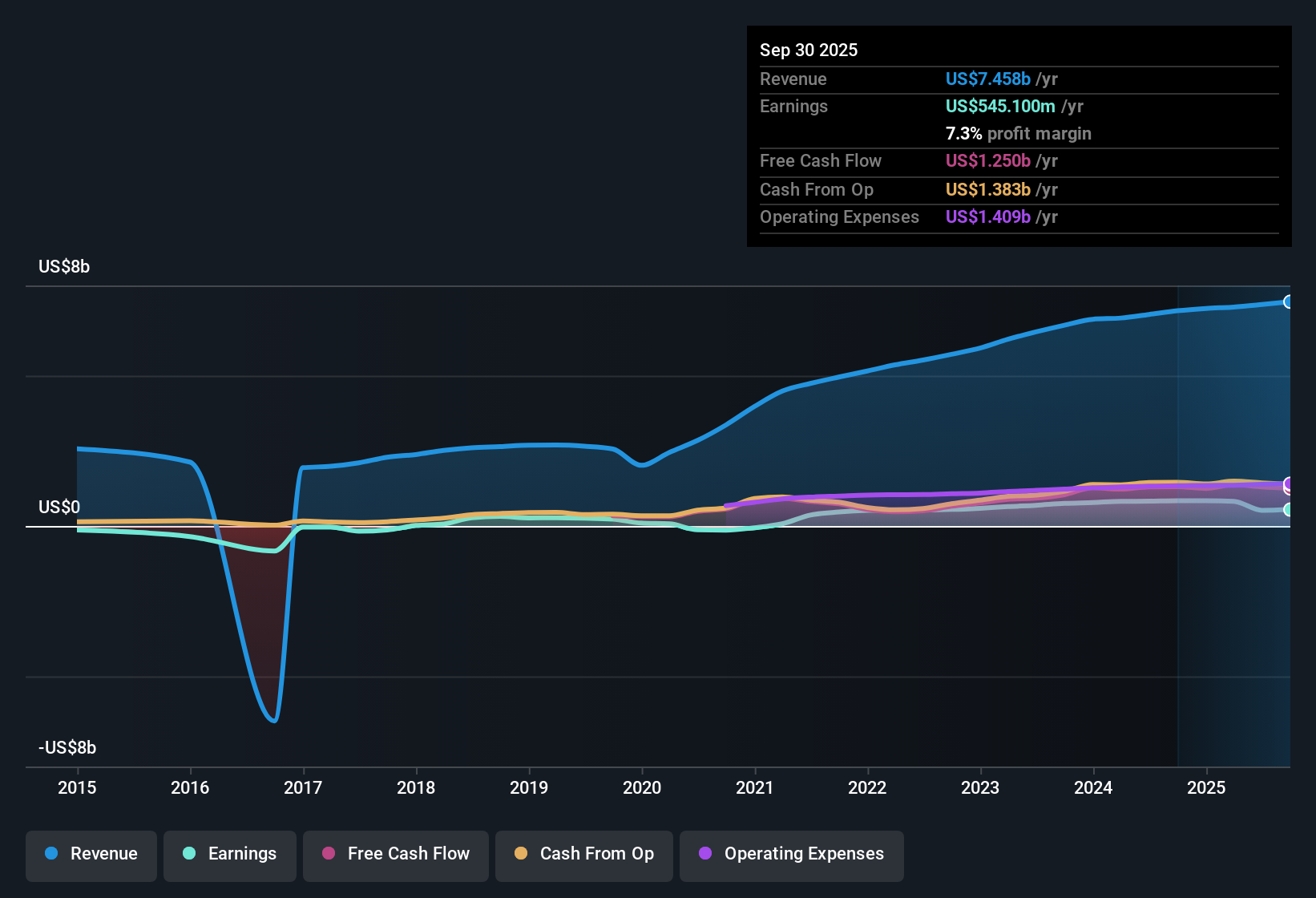

Ingersoll Rand (IR) is forecasting annual earnings growth of 26.1%, far outpacing the US market average of 15.9%. However, revenue is expected to increase by just 6.1% per year, which lags the broader market pace of 10.4%. The company’s net profit margin has fallen to 7.3% from 11.7% a year ago, reflecting pressure from a single one-off loss of $334.6 million in the last 12 months. While the growth outlook has investors eyeing future profit expansion, the rich 55.3x Price-to-Earnings Ratio and recent margin compression are important factors shaping sentiment.

See our full analysis for Ingersoll Rand.Next, we’ll put these headline results side by side with the current market and community narratives to see which themes hold up, and which might be up for debate.

See what the community is saying about Ingersoll Rand

Analysts Expect Margin Rebound to 16.2%

- Consensus forecasts indicate profit margins will rise from 7.1% today to 16.2% in three years, suggesting a substantial improvement is expected despite the recent margin dip.

- Analysts' consensus view highlights that pricing power from energy-efficient innovations and a growing share of aftermarket services, now 37% of revenue, are likely to help drive this turnaround.

- This margin outlook directly addresses current concerns over the recent single one-off loss of $334.6 million and a profit margin drop from 11.7% to 7.3%.

- Analysts believe that recurring high-margin revenue from digital and service solutions will underpin durable profitability, even as new equipment demand fluctuates.

- For those watching for signs of durable growth, analysts note that ongoing investment in innovation and recurring aftermarket revenue streams have become central to the long-term story for margins.

For a balanced breakdown of how this margin story fits into the broader debate, see how the full consensus narrative weighs these moving parts. 📊 Read the full Ingersoll Rand Consensus Narrative.

Acquisitions Add Over $200 Million Revenue This Year

- Ingersoll Rand’s acquisition strategy has brought in more than $200 million in projected annualized revenue in the year to date, extending a five-year run of over 70 transactions and broadening exposure to new technologies and markets.

- Analysts' consensus view suggests this rapid-fire M&A both diversifies the business and creates risks if integration or valuation missteps occur.

- The company’s history of accretive deals is seen as a strength, but recent goodwill and asset impairments, including at ILC Dover, highlight why overpaying or integration stumbles could pressure margins and capital returns.

- Consensus notes that aggressive acquisitions have helped expand both geographic reach and recurring revenue, cushioning the impact of any one region’s slowdown. This approach also exposes the business to macroeconomic and regulatory headwinds in more markets.

Premium 55.3x PE Despite DCF Fair Value Gap

- Ingersoll Rand trades at a 55.3x Price-to-Earnings ratio, significantly above US Machinery industry peers (24.7x), while the share price ($76.33) remains below the estimated DCF fair value of $89.11 and analyst price target of $90.27.

- According to the analysts' consensus view, the premium valuation is justified by forecasts of earnings growing to $1.4 billion by 2028. However, the gap between current multiples and long-term targets means expectations for execution and growth are unusually high.

- Consensus underscores that to reach the $90.27 price target, Ingersoll Rand would need to reduce its PE to 30.6x in 2028 as earnings rise, which is still above current industry norms.

- With the stock trading below both DCF fair value and price target, some valuation cushion exists. Still, the high current multiple puts pressure on management to deliver on ambitious growth and margin rebound targets.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ingersoll Rand on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the data? Share your perspective and build your own narrative in just a few minutes. Do it your way

A great starting point for your Ingersoll Rand research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Ingersoll Rand’s lofty valuation and recently squeezed profit margins mean investors face high expectations and limited room for disappointment.

If you’d prefer companies trading at attractive multiples relative to their growth potential, check out these 840 undervalued stocks based on cash flows for ideas that could offer better value and upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IR

Ingersoll Rand

Provides various mission-critical air, fluid, energy, and medical technologies services and solutions worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives