- United States

- /

- Machinery

- /

- NYSE:IR

A Look at Ingersoll Rand's Valuation Following Third-Quarter Earnings Growth and Maintained Outlook

Reviewed by Simply Wall St

Ingersoll Rand (IR) reported third quarter results showing higher sales and net income compared to last year, while also maintaining its full-year revenue growth outlook. The company’s steady operational performance continues to support investor confidence.

See our latest analysis for Ingersoll Rand.

Despite the latest operational gains and a steady dividend announcement, Ingersoll Rand's share price momentum has cooled in 2025, with a recent dip to $76.33 and a 1-year total shareholder return of -18.7%. Still, the long view has been much stronger. The 3-year total return stands at an impressive 44.7%, and over five years, shareholders have seen returns of more than 90%. This reflects the company’s enduring growth story even amid short-term bumps.

If you’re interested in what else could be fueling big returns, now’s a smart moment to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading nearly 15% below analyst price targets and long-term returns intact, the key question is whether Ingersoll Rand is undervalued at these levels or if the market has already accounted for future growth expectations.

Most Popular Narrative: 15.2% Undervalued

Ingersoll Rand’s most widely followed narrative puts its fair value at $90, significantly above the recent closing price of $76.33. This creates a valuation gap that is drawing attention to what might be driving future upside.

Ingersoll Rand is capitalizing on accelerating global demand for energy-efficient and sustainable industrial equipment, supported by new breakthroughs like the CompAir Ultima oil-free compressor and the EVO Series electric diaphragm pump, both delivering notable efficiency gains. These innovations reinforce pricing power and are anticipated to drive revenue growth and margin expansion as regulatory and customer focus on sustainability intensifies.

What powers that higher price? The narrative leans heavily on ambitious expansion, next-gen product launches, and a profit forecast that would place Ingersoll Rand among sector standouts. There is much more to this growth story than first meets the eye. See what is behind the boldest projections yet.

Result: Fair Value of $90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, aggressive acquisitions and rising regulatory pressures could challenge Ingersoll Rand's profit margins and slow the pace of its future earnings growth.

Find out about the key risks to this Ingersoll Rand narrative.

Another View: Multiples Suggest a Different Story

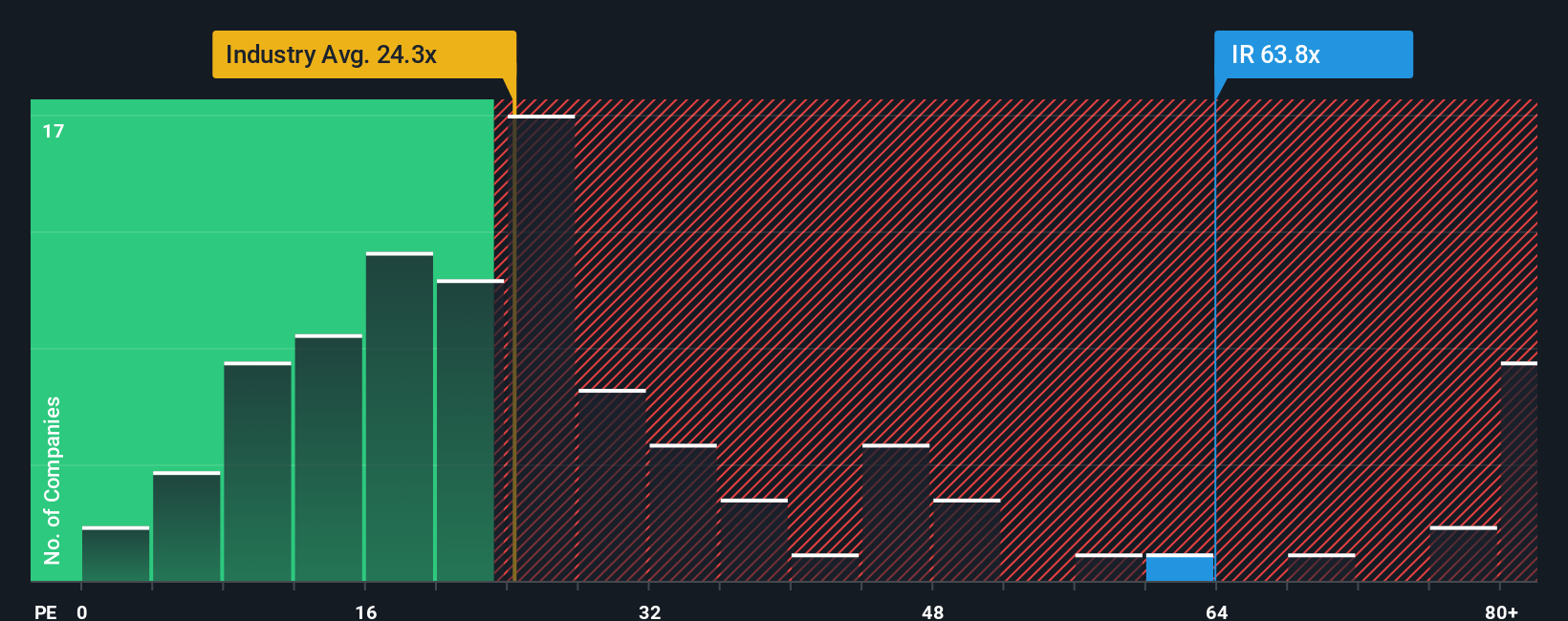

While a fair value of $90 is suggested by future earnings forecasts, a look at the price-to-earnings ratio tells a more cautious tale. Ingersoll Rand’s P/E stands at 55.3x, far above both the US Machinery industry average (24x) and its peer group (26.6x), and well above the fair ratio of 38.7x. This premium implies investors are paying a lot today for future growth, which may or may not materialize as quickly as hoped. Could this high valuation set unrealistic expectations, or is the market onto something that hasn’t yet fully played out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ingersoll Rand Narrative

If you see the numbers differently or want to dive deeper into the data, you can craft your own take on Ingersoll Rand in just a few minutes. Do it your way

A great starting point for your Ingersoll Rand research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next move count: seize opportunities others overlook, and don’t let smart investment possibilities pass you by. Your future portfolio will thank you.

- Tap into tomorrow’s technology leaders by uncovering potential with these 26 AI penny stocks that are transforming industries with artificial intelligence.

- Unlock income stability and resilience by checking out these 22 dividend stocks with yields > 3% that offer robust yields and steady returns for long-term investors.

- Expand your horizons in digital finance and new markets by starting your search with these 81 cryptocurrency and blockchain stocks powering breakthroughs in the world of cryptocurrency and blockchain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IR

Ingersoll Rand

Provides various mission-critical air, fluid, energy, and medical technologies services and solutions worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives