- United States

- /

- Machinery

- /

- NYSE:HY

Hyster-Yale (HY): One-Off $38.5M Loss Drives Margin Miss, Challenges Bullish Recovery Narratives

Reviewed by Simply Wall St

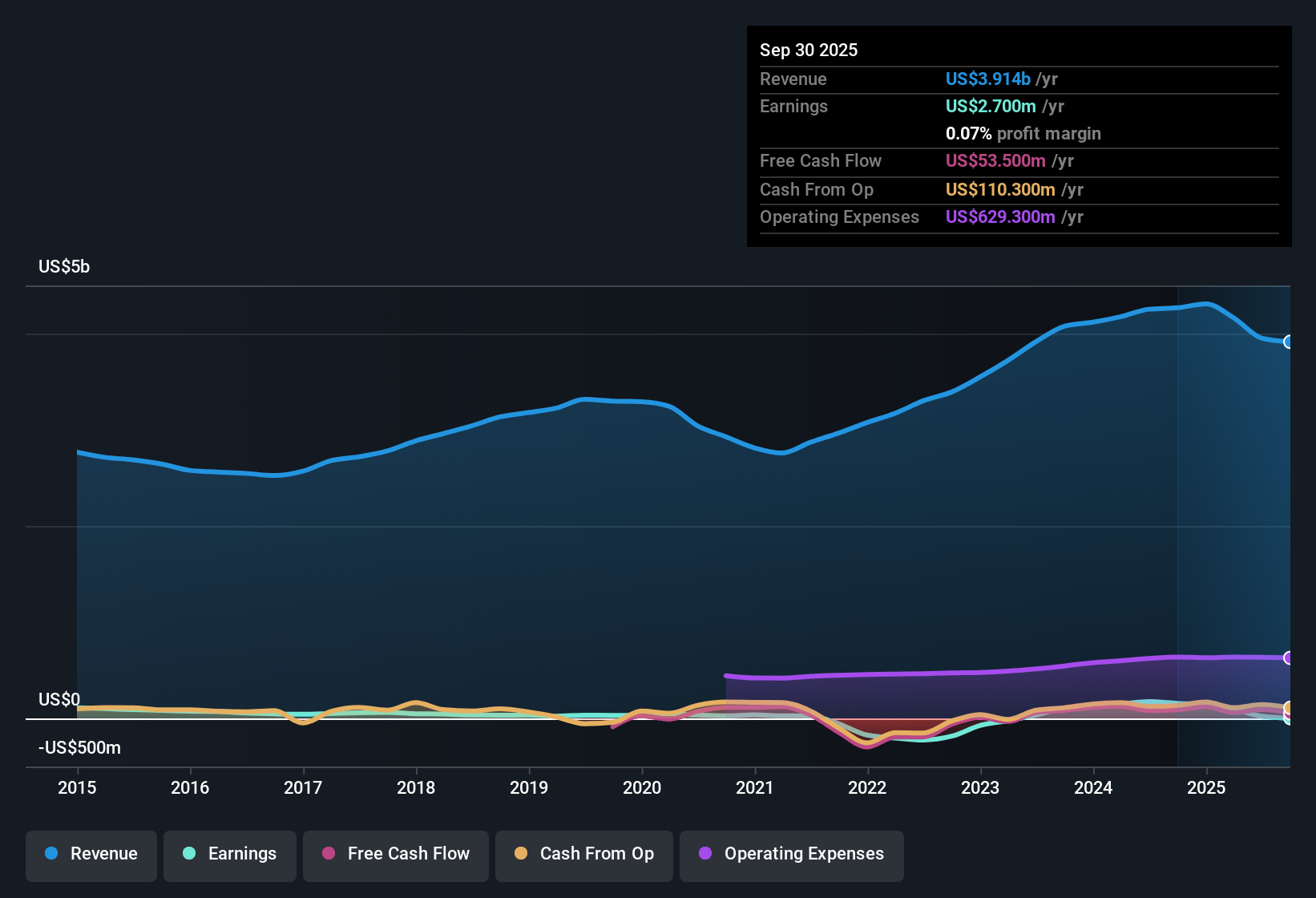

Hyster-Yale (HY) reported earnings shaped by a mix of standout historical growth and recent setbacks. Over the past five years, earnings have climbed at a 42.2% annual rate, but the latest period saw earnings dip due to a one-off $38.5 million loss. Net profit margins slipped to 0.6% from 4.1% last year, highlighting the recent profitability pressure. With revenue expected to grow at 2% per year and earnings forecast to accelerate at 31.7% annually, well above the U.S. market average, investors are presented with both strong long-term growth signals and ongoing margin concerns.

See our full analysis for Hyster-Yale.Next, we’ll see how these latest results stack up against the most popular community narratives. Sometimes the numbers align, while other times they raise new questions.

See what the community is saying about Hyster-Yale

One-Off Loss Reshapes Margins

- The company logged a $38.5 million one-time loss in the past year, compressing net profit margins to 0.6%. This is well below the machinery industry and Hyster-Yale’s recent average.

- According to the analysts' consensus view, one-off items like this are expected to be temporary as restructuring and in-region manufacturing drive annualized cost savings of $30 to $40 million by 2027.

- Consensus narrative notes these initiatives should structurally reduce the breakeven point and support a net margin recovery, with profit margins forecast to rise from 0.6% to 2% within three years.

- However, bears highlight that persistent exposure to tariff-related cost swings and post-pandemic cyclical demand dips could challenge the pace or magnitude of margin rebound.

Cost Structure Poised for Change

- Management aims for $30 to $40 million in annualized cost savings from strategic moves like automation, supply chain realignment, and cost optimization programs, targeted to materialize by 2027.

- Analysts' consensus view argues Hyster-Yale’s investment in automation and digital supply chain technology could help capture future growth, even as current revenue forecasts remain muted at a 2% annual rate.

- These shifts are expected to deliver higher-margin business and support faster earnings growth, outpacing the broader market’s 16% average with a company forecast of 31.7% annual earnings growth.

- Still, critics highlight ongoing supply chain inflexibility and cyclical market weakness, particularly in Europe and the Americas, could delay the expected recovery in topline growth.

Valuation Signals Mixed Opportunity

- Hyster-Yale’s share price of $34.08 trades below its DCF fair value of $67.84 and sits lower than the analyst price target of $45.00, but the stock commands a higher price-to-earnings ratio versus the broader U.S. machinery industry.

- Analysts' consensus view highlights the valuation case depends on believing margins will rebound and earnings will reach $80.5 million by 2028, supporting a future PE ratio of 14.8x. This is below today’s 28.8x and also below the sector’s 24.7x average.

- Bulls might see current valuations as a discount window given forecasts for robust earnings growth, while skeptics caution that failure to achieve target margins or sustain cost controls would justify a lower valuation multiple.

- The 27.9% upside to the analyst target price only stacks up if earnings and margin improvement play out as forecast, underscoring the importance of execution.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hyster-Yale on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the numbers from a different angle? Bring your insights to life and build your take on Hyster-Yale in just a few minutes with Do it your way.

A great starting point for your Hyster-Yale research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Hyster-Yale’s unpredictable margins and slower revenue growth raise concerns about the company’s ability to deliver steady performance across different market cycles.

If you’re looking for consistency, try stable growth stocks screener (2074 results) and focus on companies that demonstrate reliable revenue and earnings growth in any environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyster-Yale might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HY

Hyster-Yale

Through its subsidiaries, designs, engineers, manufactures, sells, and services a line of lift trucks, attachments, and aftermarket parts worldwide.

Established dividend payer with slight risk.

Market Insights

Community Narratives