- United States

- /

- Aerospace & Defense

- /

- NYSE:HXL

What Hexcel (HXL)'s CFO Transition Means for Shareholders

Reviewed by Sasha Jovanovic

- Hexcel recently announced the resignation of Chief Financial Officer Patrick Winterlich, with Michael C. Lenz appointed as Interim CFO effective November 30, 2025, following a transition period that began on November 19, 2025.

- Lenz’s extensive leadership experience at FedEx and American Airlines could support investor confidence in Hexcel’s financial management and continuity during this period of change.

- We’ll explore how Michael Lenz’s leadership and financial expertise may influence Hexcel’s investment narrative and outlook going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Hexcel Investment Narrative Recap

For anyone considering Hexcel as an investment, the core belief centers on the ongoing recovery in commercial aerospace production and the company’s ability to capture this growth through its advanced composites portfolio. The recent CFO transition to Michael C. Lenz is not expected to materially affect near-term triggers such as aircraft production ramp-ups or alleviate the risks tied to concentrated exposure to major customers like Airbus and Boeing.

Of recent announcements, Hexcel’s revised annual sales forecast to US$1.88 billion stands out, putting a sharper spotlight on exposure to supply chain volatility and production schedules, a key short-term catalyst and risk. The guidance cut reiterates how sensitive Hexcel’s results remain to external shocks in aerospace manufacturing cycles.

On the other hand, investors should be aware that persistent delays or changes in large customer orders could...

Read the full narrative on Hexcel (it's free!)

Hexcel's outlook projects $2.5 billion in revenue and $284.0 million in earnings by 2028. This scenario assumes a 10.0% annual revenue growth rate and a $196.0 million earnings increase from the current earnings of $88.0 million.

Uncover how Hexcel's forecasts yield a $75.79 fair value, in line with its current price.

Exploring Other Perspectives

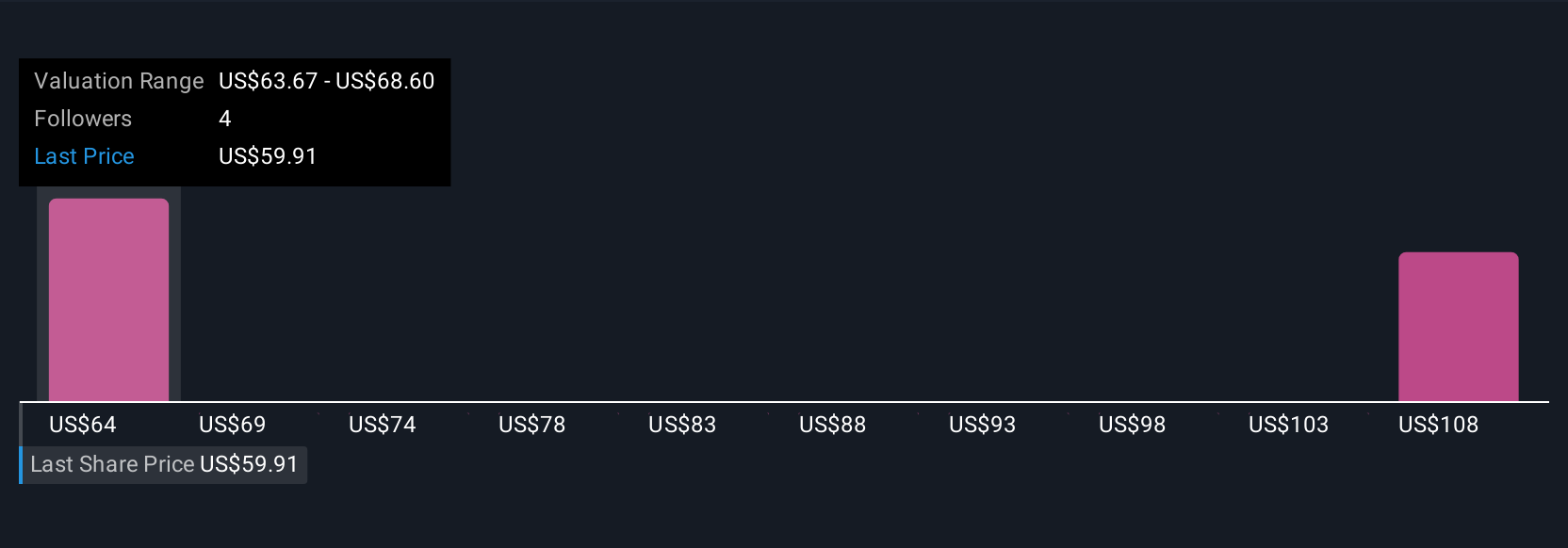

Simply Wall St Community members place Hexcel’s fair value in a wide US$75.79 to US$96.46 range, with just two opinions represented. However, ongoing customer concentration means opinions about growth potential can differ widely based on risk appetite and expectations for supply chain stability.

Explore 2 other fair value estimates on Hexcel - why the stock might be worth as much as 29% more than the current price!

Build Your Own Hexcel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hexcel research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hexcel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hexcel's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hexcel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HXL

Hexcel

Develops, manufactures, and markets carbon fibers, structural reinforcements, honeycomb structures, resins, and composite materials and parts for use in commercial aerospace, space and defense, and industrial applications.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success