- United States

- /

- Aerospace & Defense

- /

- NYSE:HWM

Howmet Aerospace (HWM) Valuation in Focus as Veteran CFO Plans 2025 Retirement and Successor Named

Reviewed by Simply Wall St

Howmet Aerospace (HWM) is drawing attention following news that Ken Giacobbe, the company’s Chief Financial Officer for over two decades, will retire at the end of 2025. Patrick Winterlich, who joins from Hexcel, will take over in December.

See our latest analysis for Howmet Aerospace.

The leadership transition comes at a time of strong stock momentum for Howmet Aerospace, with a 1-year total shareholder return of over 96% and share price up 79% year-to-date. The company’s ability to consistently generate substantial long-term gains, delivering an impressive 454% total return over three years, suggests investor confidence remains high even as it navigates management changes and sector-wide shifts.

The aerospace and defense sector is full of companies making strategic moves and posting impressive results. To discover other standouts in the space, check out See the full list for free.

With shares trading near all-time highs and analysts’ targets offering only a modest premium from this level, the key question for investors is whether there is still upside left or if the market has already accounted for Howmet’s future growth.

Most Popular Narrative: 6.4% Undervalued

With analysts assigning a fair value above the latest close, the consensus leans positive. The contrast between current market enthusiasm and these projections sets the stage for deeper discussions about future prospects.

The shift towards newer, fuel-efficient aircraft and ongoing replacement of aging fleets are driving strong demand for advanced, lightweight components and fasteners. This is positioning Howmet for expanded content per aircraft and higher net margins over the next several years.

Want to see the bold assumptions behind this valuation? The secret sauce of this narrative is rapid profit growth paired with a premium profit multiple. Don’t miss the surprising benchmarks that analysts believe will set the tone for Howmet’s future.

Result: Fair Value of $211.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply chain disruptions or unexpected slowdowns in aerospace demand could quickly challenge even the most optimistic profit and margin projections for Howmet.

Find out about the key risks to this Howmet Aerospace narrative.

Another View: What Do Valuation Ratios Say?

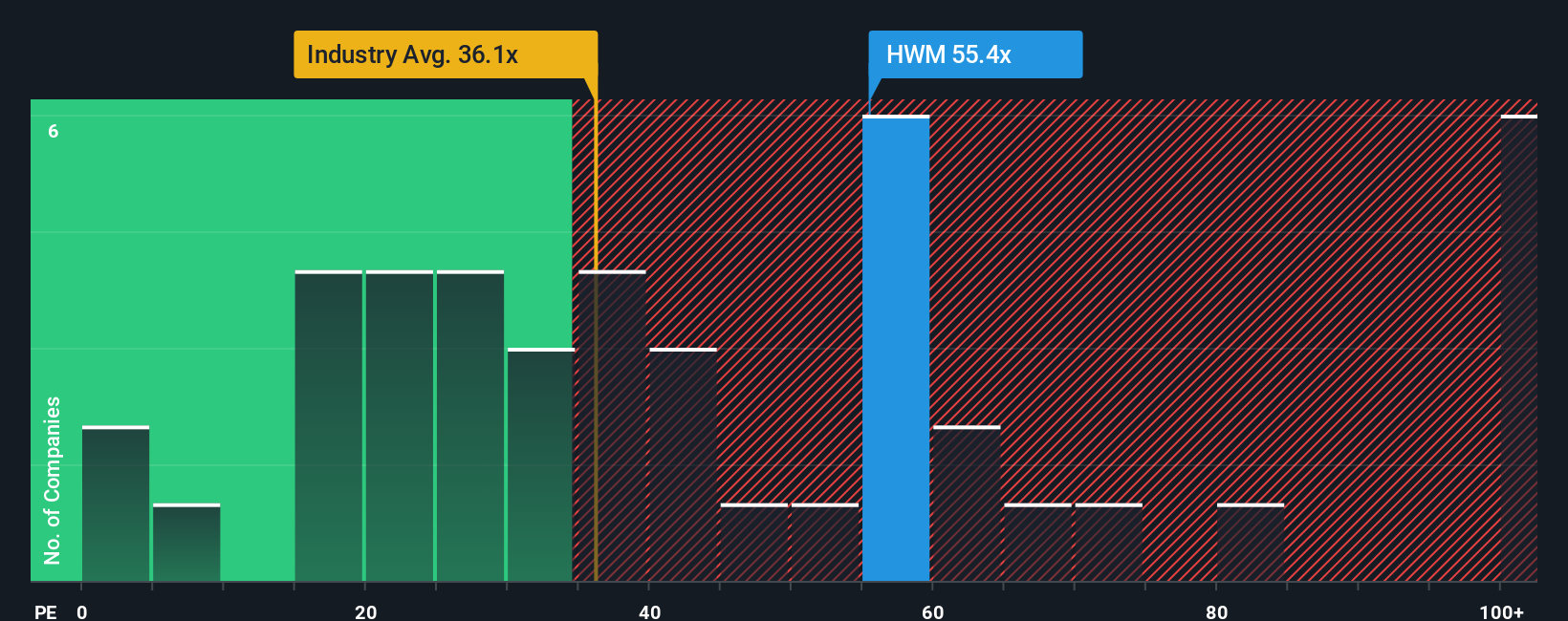

Looking at Howmet’s valuation through the lens of its price-to-earnings ratio tells a different story. The company trades at 57.4 times earnings, which is significantly higher than the US Aerospace & Defense industry average of 39.6x, its peer average of 30.2x, and even above its fair ratio of 36x. This premium signals that investors have high expectations for future growth, but also raises the risk of a pullback if those expectations are not met. Could the current multiples be stretched too far, or is there more upside yet to come?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Howmet Aerospace Narrative

If you think there’s more to the story, dive into the data and shape your own narrative in just a few minutes. Do it your way

A great starting point for your Howmet Aerospace research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you’re ready to seize more opportunities, try these handpicked stock ideas, all backed by data and updated daily. Sharpen your investment strategy before the next big move slips by.

- Boost your income with steady yields and see which companies are offering attractive opportunities through these 17 dividend stocks with yields > 3%.

- Stay ahead of the curve by targeting cutting-edge innovation and growth with these 27 AI penny stocks.

- Catch undervalued gems with strong cash flow potential before they’re on everyone’s radar by using these 877 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Howmet Aerospace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HWM

Howmet Aerospace

Provides advanced engineered solutions for the aerospace and transportation industries in the United States, Japan, France, Germany, the United Kingdom, Mexico, Italy, Canada, Poland, China, and internationally.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives