- United States

- /

- Aerospace & Defense

- /

- NYSE:HWM

Howmet Aerospace (HWM): Evaluating Valuation After Jim Cramer’s Endorsement Boosts Sentiment

Reviewed by Simply Wall St

Recent endorsements by Jim Cramer have put Howmet Aerospace (HWM) in the spotlight. He emphasized the company's resilience within the aerospace sector and encouraged investors to hold their shares. This commentary has potential to shape near-term investor sentiment.

See our latest analysis for Howmet Aerospace.

Howmet Aerospace’s share price has pulled back slightly in the past month, though strong momentum remains thanks to a robust year-to-date share price return of nearly 85%. The company’s recent redemption of preferred stock landed alongside eye-catching news coverage, but longer-term investors have seen the biggest rewards. With a five-year total shareholder return of more than 710%, this has been a standout performer in the sector.

If you’re tracking moves in aerospace, now is a great moment to uncover opportunities with our curated See the full list for free.

Given that Howmet Aerospace has already surged nearly 85% this year, investors are left to wonder if the current price accurately reflects its future prospects or if there is still potential for further gains.

Most Popular Narrative: 11.9% Undervalued

Howmet Aerospace’s narrative-driven fair value stands at $232 per share, noticeably above its last close price. This prompts investors to consider what factors are fueling this optimism and whether it can hold up over the long term.

The record high commercial aircraft backlog and accelerating global air travel, especially in Asia Pacific and Europe, are fueling increased production rates (for example, 737 MAX and A320). This is leading to sustained and growing demand for Howmet's structural engine components and supports higher revenues and multi-year visibility on earnings.

Want to know the secrets fueling this bullish price target? The real story is in bold industry projections and ambitious growth targets. Wondering which headline-making assumptions underpin the narrative? Click through to unveil the key numbers shaping this undervaluation call.

Result: Fair Value of $232 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain disruptions or unexpected slowdowns in aircraft build rates could present challenges to Howmet Aerospace’s strong growth narrative and future profitability outlook.

Find out about the key risks to this Howmet Aerospace narrative.

Another View: Looking at the Numbers Through a Different Lens

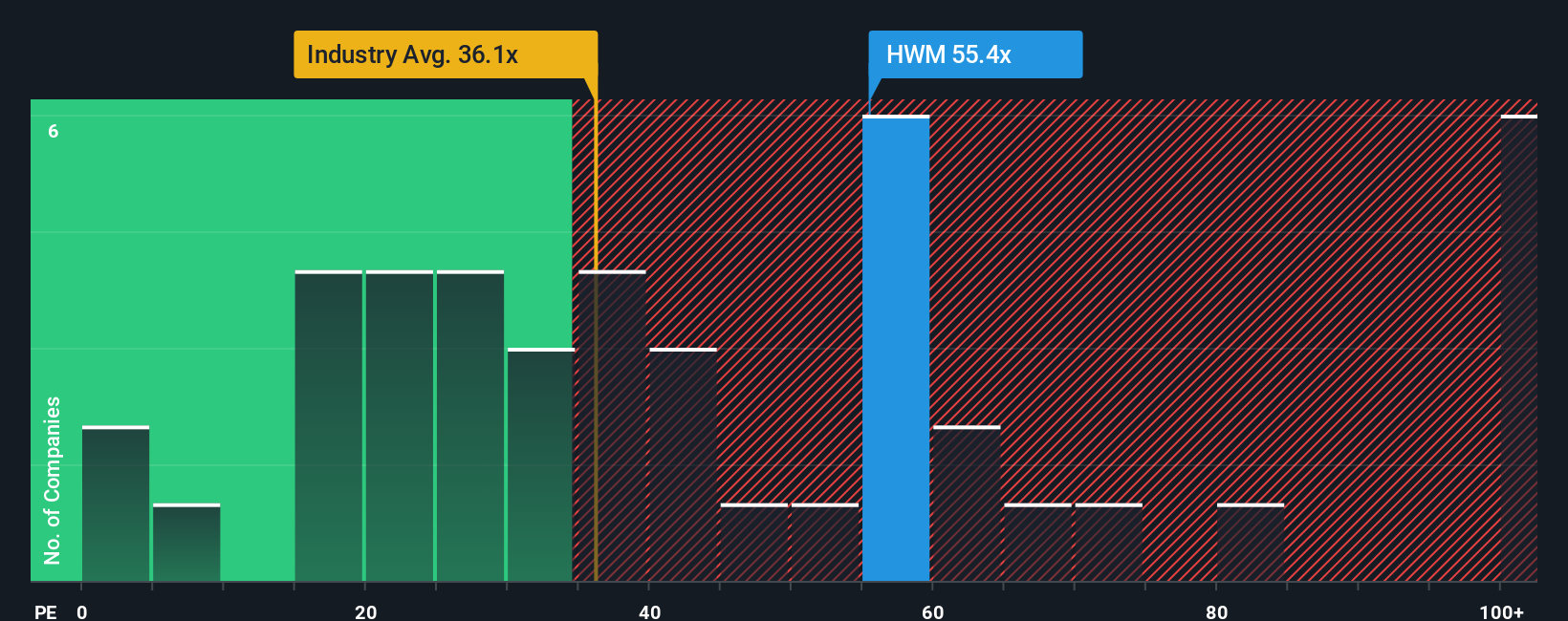

While the narrative approach points to undervaluation, our model based on the company’s price-to-earnings ratio presents a different perspective. Howmet Aerospace trades at 56.8x earnings, a significant premium to both its industry peers (27.1x) and the sector average (38.3x). The fair ratio is 35.4x, indicating that the current level could entail valuation risk if sentiment changes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Howmet Aerospace Narrative

If you see things differently or want to dig into the numbers yourself, crafting your own story is fast and simple. Just take a few minutes to get started and Do it your way.

A great starting point for your Howmet Aerospace research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Standout Investment Ideas?

Unlock opportunities that others might overlook. Let Simply Wall Street’s Screeners point you toward high-potential stocks with promising growth or value characteristics.

- Catch the momentum early with these 916 undervalued stocks based on cash flows and see which companies have prices positioned for a potential rebound based on their cash flows.

- Secure steady income streams when you access these 15 dividend stocks with yields > 3% featuring stocks with dividend yields above 3%.

- Ride the innovation wave by checking out these 25 AI penny stocks and see which dynamic companies are driving breakthroughs in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Howmet Aerospace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HWM

Howmet Aerospace

Provides advanced engineered solutions for the aerospace and transportation industries in the United States, Japan, France, Germany, the United Kingdom, Mexico, Italy, Canada, Poland, China, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026