- United States

- /

- Aerospace & Defense

- /

- NYSE:HWM

Does Howmet’s 84.7% Surge Signal More Growth After Recent Aerospace Contract Wins?

Reviewed by Bailey Pemberton

- Ever wondered whether Howmet Aerospace is still a good deal after its incredible run? Let’s dive in and see if there’s value left on the table or if this is a stock to be cautious about.

- Howmet’s share price has soared lately, climbing 1.3% over the past week and an impressive 84.7% year-to-date, with a staggering 755% return over the last five years.

- Much of this surge reflects recent headlines, including new aerospace contract wins and optimism about growth in the commercial aircraft sector. Investors are reacting to industry shifts and Howmet’s sizable backlog of orders, keeping the spotlight firmly on its future potential.

- Despite all that momentum, Howmet Aerospace scores a 0 out of 6 on our valuation checks, meaning it isn’t currently undervalued by any measure we track. Yet there might be more to the valuation story than just those numbers. Up next, we’ll explore traditional valuation methods and tease out an even smarter approach by the end of this article.

Howmet Aerospace scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Howmet Aerospace Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to today's value. This approach provides an intrinsic value based on the company's ability to generate cash over time, making it a widely used tool in assessing whether a stock is attractively priced.

For Howmet Aerospace, the latest reported Free Cash Flow stands at $1.37 billion. According to analyst forecasts and Simply Wall St extrapolations, Free Cash Flow is expected to grow steadily, reaching $2.45 billion by 2029 and climbing toward $3.26 billion in 2035. While analysts provide estimates for the next five years, projections beyond that give further context based on historical growth rates.

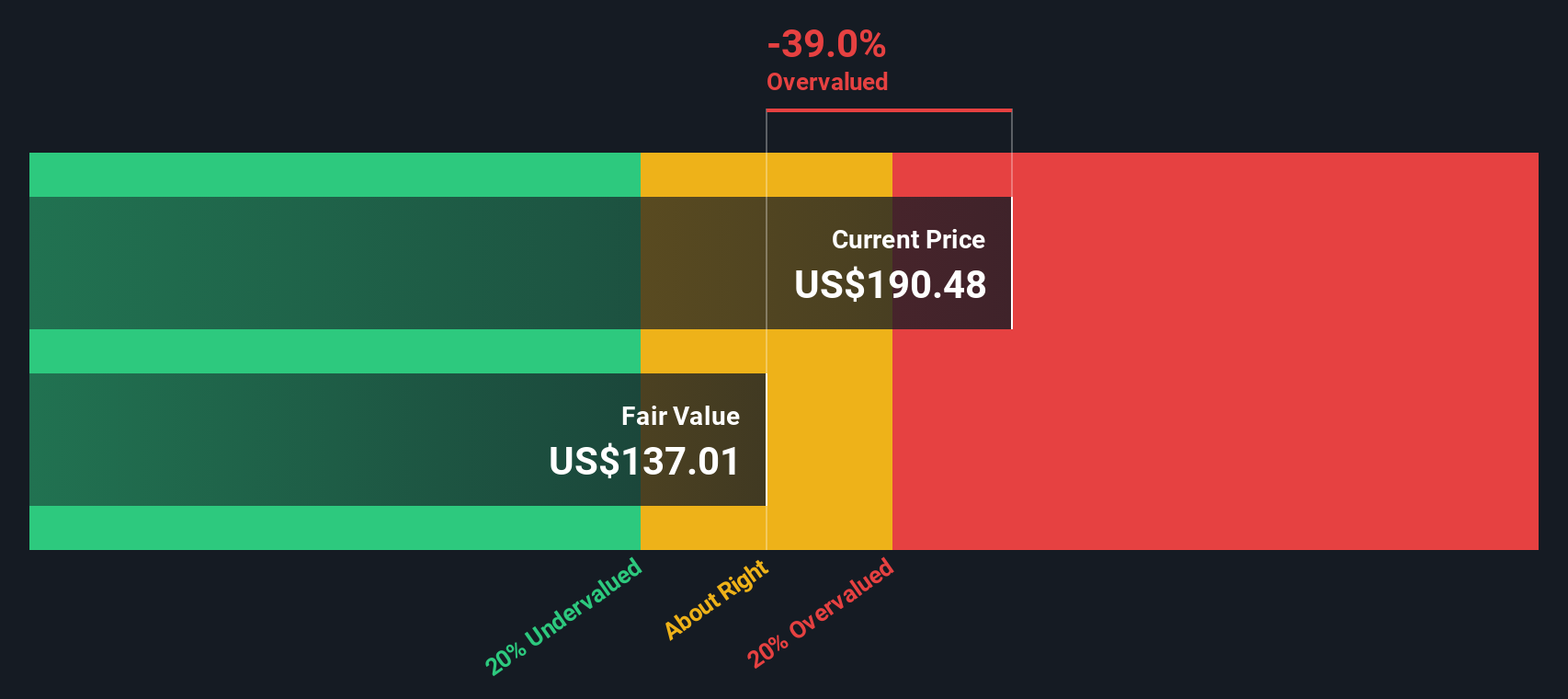

Based on the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value per share comes in at $136.17. However, at current market levels, this implies a 50.3% premium compared to its DCF-based fair value. In other words, the stock appears significantly overvalued by this measure.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Howmet Aerospace may be overvalued by 50.3%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Howmet Aerospace Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is one of the most reliable benchmarks for valuing mature, profitable companies like Howmet Aerospace. It measures what investors are willing to pay for each dollar of earnings and is particularly meaningful when a company consistently generates positive earnings.

When determining whether a stock's PE is reasonable, it is important to consider growth expectations and risks. Higher expected earnings growth or lower risk can justify a higher PE, while slow growth or higher risk usually signal a lower "normal" or “fair” multiple.

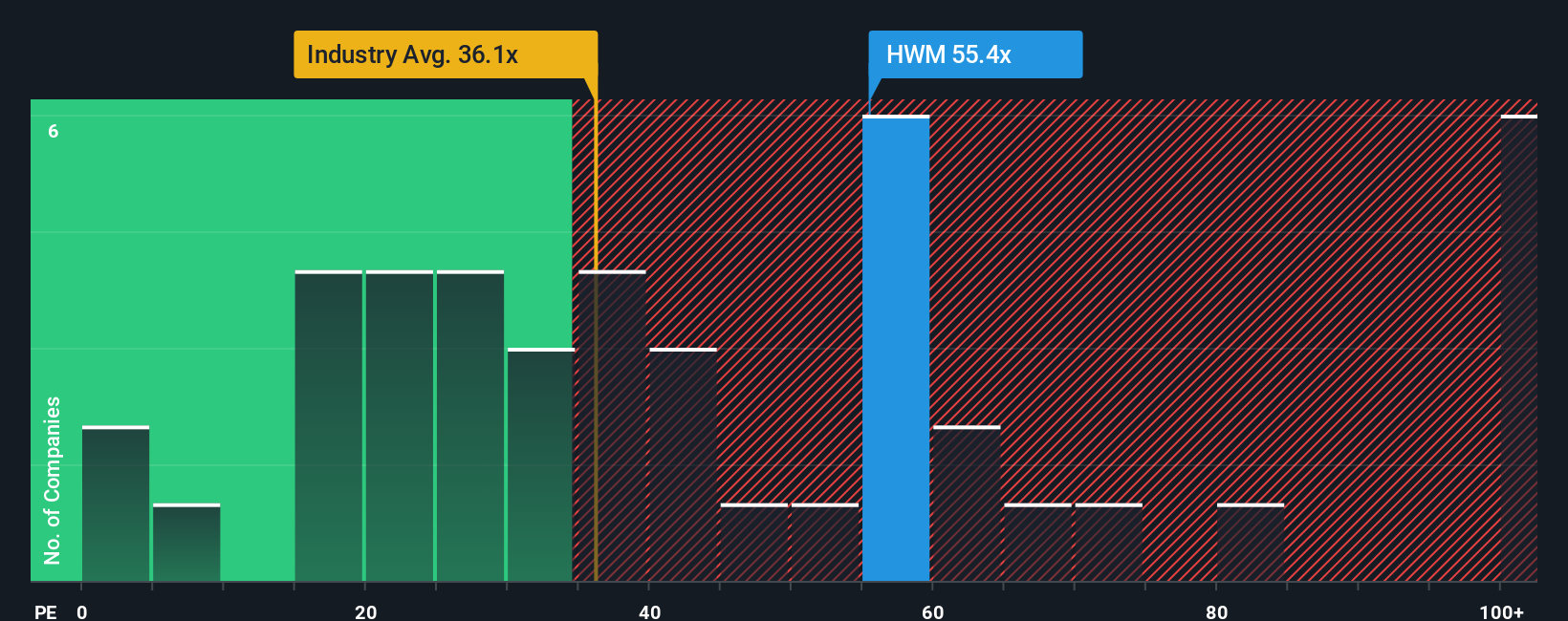

Howmet Aerospace currently trades at a PE ratio of 56.8x, which stands out compared to both the peer average of 28.0x and the Aerospace & Defense industry average of 38.4x. At first glance, this premium may seem excessive in relation to its sector and peers.

Simply Wall St’s proprietary "Fair Ratio" cuts through the noise. It suggests a PE of 35.4x for Howmet, reflecting not just overall industry averages but also the company’s expected earnings growth, profit margins, size, and risk profile. Because this fair ratio combines all these essential factors, it gives a more nuanced view than simply comparing to peers or the industry as a whole.

With Howmet’s PE ratio well above its Fair Ratio, the shares appear overvalued by this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Howmet Aerospace Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective about a company, connecting your expectations (like future revenue, earnings, and margins) with your sense of fair value. This process turns forecasts into a simple, actionable story about where a business is headed.

Narratives link the “what” (the company’s business story and market trends) with the “how” (your forecast numbers) and the “so what” (your fair value and what you’d do next). They make the investing process more meaningful by letting you see the company through your own lens, then compare your valuation to the current share price. This can help you decide when to buy, hold, or sell.

On Simply Wall St’s Community page, which is used by millions, Narratives are always easy to create, share, and update as new news or earnings come in. Narratives can look very different even for the same stock. For example, the most optimistic view on Howmet Aerospace projects a fair value near $225 per share thanks to sustained margin expansion and strong global demand. In contrast, the most cautious perspective sees as little as $186 per share, highlighting risks from supply chain challenges and commercial aircraft cycles.

Do you think there's more to the story for Howmet Aerospace? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Howmet Aerospace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HWM

Howmet Aerospace

Provides advanced engineered solutions for the aerospace and transportation industries in the United States, Japan, France, Germany, the United Kingdom, Mexico, Italy, Canada, Poland, China, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success