- United States

- /

- Electrical

- /

- NYSE:HUBB

Hubbell (HUBB): Examining Valuation Following Board-Backed Dividend Increase

Reviewed by Simply Wall St

Hubbell (HUBB) just announced an 8% bump to its dividend, raising the annual payout to $5.68 per share. This move underscores the company’s confidence in its ongoing financial health.

See our latest analysis for Hubbell.

Hubbell's share price, at $434.39, has shown modest momentum lately, with a solid 3.43% year-to-date return. While the company delivered an impressive 225% total shareholder return over five years, its one-year total return slipped slightly. The recent dividend hike, along with a steady track record of growth, suggests management is keen to reassure investors and spark renewed optimism around Hubbell’s long-term potential.

If the dividend boost has you thinking about growth stories, this is a great moment to broaden your scope and discover fast growing stocks with high insider ownership

With the share price hovering near record highs and management signaling optimism through dividend growth, the big question is whether Hubbell remains undervalued or if future gains are already reflected in the current price.

Most Popular Narrative: 5.8% Undervalued

At $434.39 per share, Hubbell trades just below the most widely-followed narrative’s estimated fair value of $461.36. With analysts projecting steady earnings gains, this fair value hinges on expectations of further margin expansion and growth outpacing recent hurdles.

Hubbell's Electrical Solutions segment is achieving mid-single-digit organic growth and improved operating margins, supported by strong demand in data centers and continuing efforts in business simplification. These factors are expected to support long-term margin expansion and are likely to positively impact revenue and net margins.

Curious about what powers this bullish forecast? The narrative’s value rests on bold growth assumptions, surging earnings, and a future profit multiple that reflects industry leaders. Want the numbers and logic that justify such optimism? Tap deeper to discover the surprising drivers behind the fair value.

Result: Fair Value of $461.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising raw material costs and new tariffs might pressure margins. This could make it tougher for Hubbell to hit the optimistic growth targets ahead.

Find out about the key risks to this Hubbell narrative.

Another View: Multiples Paint a Cautious Picture

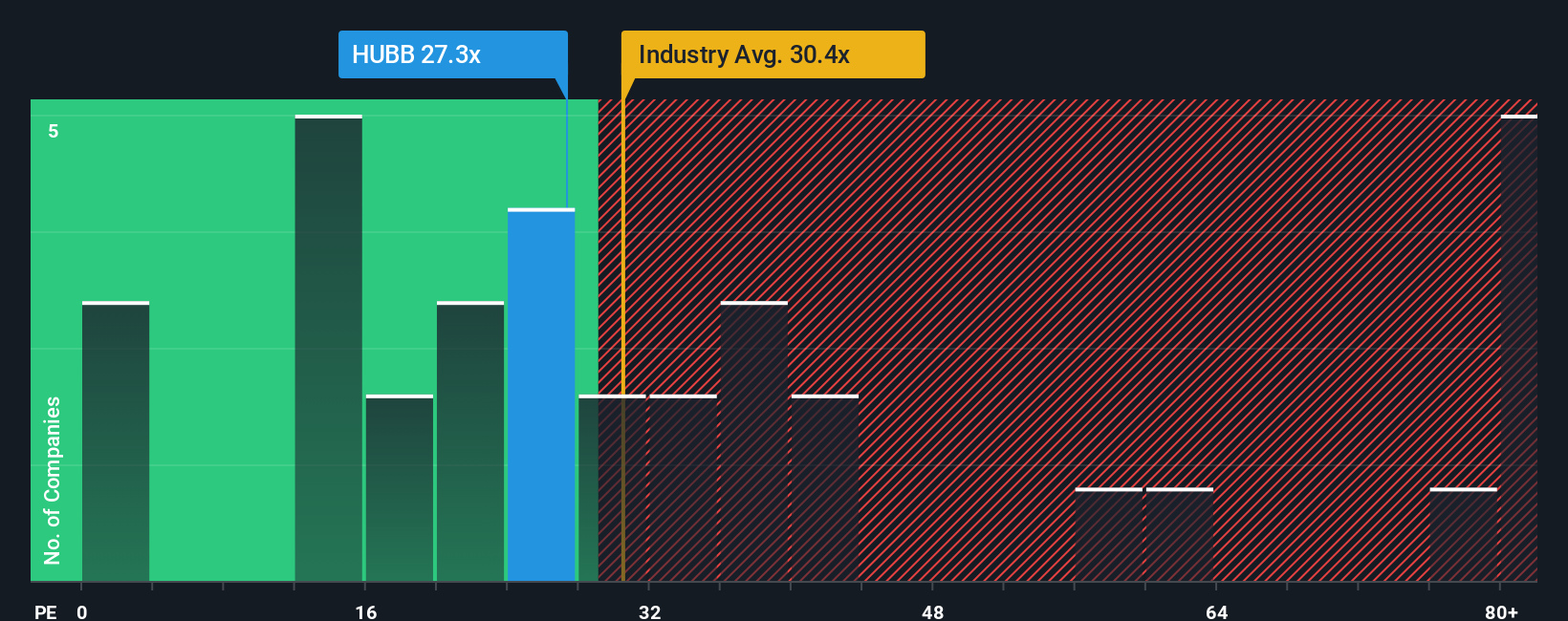

While fair value estimates suggest Hubbell is undervalued, a look at its price-to-earnings ratio tells a more nuanced story. At 27.8x, Hubbell trades below both its industry average of 30.8x and its peer average of 41x. However, it stands above its fair ratio of 24.9x, which suggests that high expectations may already be reflected in the price. This raises the question of whether investors face more risk than opportunity from here.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hubbell for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hubbell Narrative

If this outlook does not quite fit your perspective or you are set on digging into the numbers firsthand, you can shape your own narrative in just a few minutes, from your unique point of view: Do it your way

A great starting point for your Hubbell research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stop waiting for opportunity to land in your lap. Expand your research and put your money where it matters with these standout strategies everyone should consider.

- Capture potential big wins by following these 3567 penny stocks with strong financials that are poised for strong financial performance and unexpected upside.

- Fuel your portfolio’s future with these 27 AI penny stocks tipped to lead the charge in artificial intelligence breakthroughs and tech innovation.

- Secure your edge in the market by zeroing in on these 877 undervalued stocks based on cash flows with solid cash flow and compelling upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hubbell might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBB

Hubbell

Designs, manufactures, and sells electrical and utility solutions in the United States and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives