- United States

- /

- Electrical

- /

- NYSE:HUBB

Evaluating Hubbell's (HUBB) Valuation After a Period of Steady Performance

Reviewed by Simply Wall St

See our latest analysis for Hubbell.

After a stretch of muted movement, Hubbell’s share price has edged up about 3% year-to-date, while its one-year total shareholder return stands nearly flat. However, its three- and five-year total shareholder returns have been stellar, showing long-term momentum even as recent enthusiasm fades a bit.

If you’re curious what other stocks are showing enduring momentum and inside ownership, now is a good moment to discover fast growing stocks with high insider ownership

With modest recent gains but impressive multi-year returns, investors are now left wondering if Hubbell’s current valuation leaves room for further upside or if the market has already factored in all its future growth potential.

Most Popular Narrative: 10.1% Undervalued

Hubbell’s most widely followed narrative implies that its fair value is $481, compared to the most recent closing price of $432.82. This creates a story of potential upside driven by a combination of organic growth and earnings execution.

Hubbell's Electrical Solutions segment is achieving mid-single-digit organic growth and improved operating margins, bolstered by strong demand in data centers and continuing efforts in business simplification. These factors are expected to support long-term margin expansion, positively impacting revenue and net margins.

Want to know what’s fueling that price target? The secret lies in ambitious growth forecasts and bigger profit margins. But there’s an extra twist: a financial lever that could flip the story. Find out what unexpected market dynamic is underpinning the narrative’s fair value.

Result: Fair Value of $481 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Weakening demand in grid automation or failure to offset rising raw material costs could challenge Hubbell’s upbeat growth outlook.

Find out about the key risks to this Hubbell narrative.

Another View: What Do Earnings Ratios Indicate?

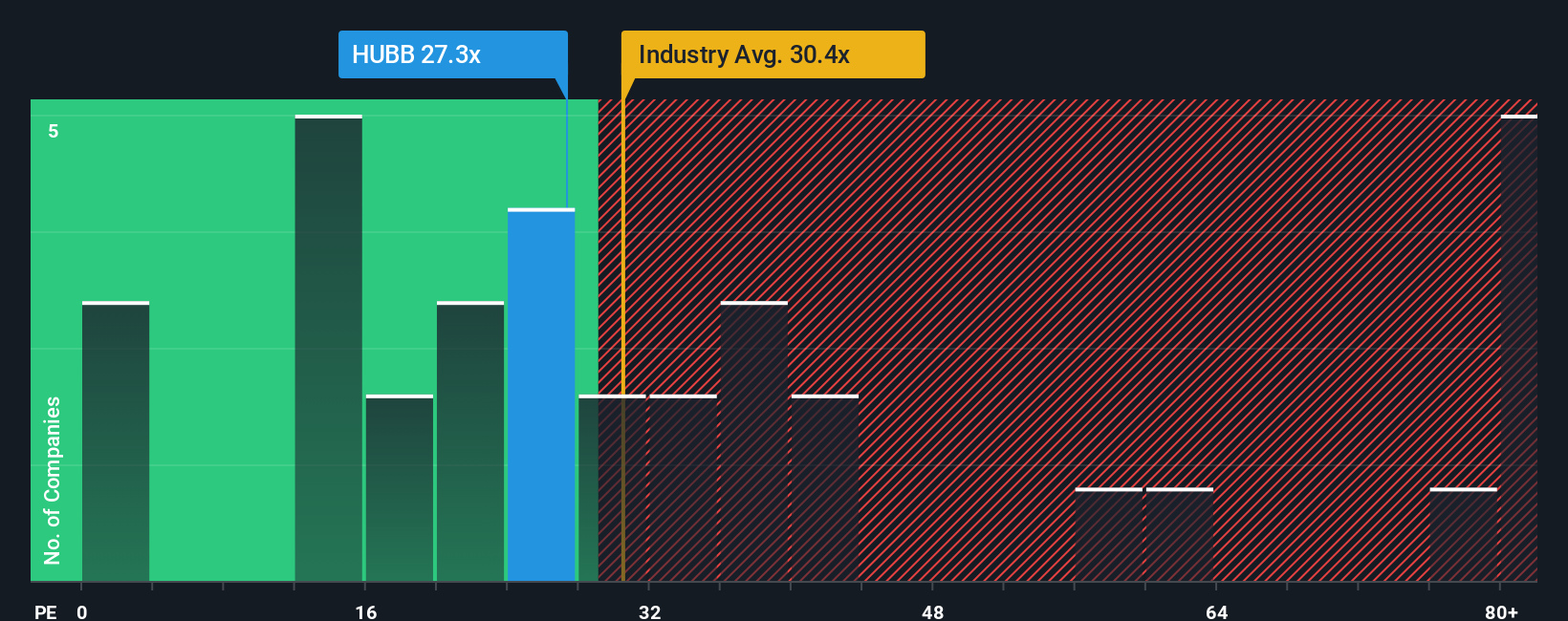

While the narrative and price targets point to undervaluation, another angle—looking at earnings ratios—tells a nuanced story. Hubbell's price-to-earnings ratio sits at 26.8x, which is lower than the Electrical industry average of 29.4x and far below its peer group’s 40.3x. However, it remains a touch above its fair ratio of 25.1x, suggesting that even modest optimism could be baked in. Is the market leaving the door open for upside, or could a change in sentiment bring the price closer to fair value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hubbell Narrative

If you want to challenge the current outlook or dive deeper with your own perspective, it’s easy to shape your own conclusions in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Hubbell.

Looking for More Investment Ideas?

Every smart investor knows opportunities never wait. Put yourself ahead of the crowd by spotting stocks that fit your goals before everyone else does.

- Tap into tomorrow’s breakthroughs by checking out these 26 quantum computing stocks, where innovation is pushing boundaries far beyond today’s market standards.

- Unlock high-yield potential with these 16 dividend stocks with yields > 3%, which offers consistent performance and attractive returns for income-focused portfolios.

- Stay ahead of tech trends and gain an advantage with these 25 AI penny stocks, highlighting businesses at the forefront of intelligent automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hubbell might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBB

Hubbell

Designs, manufactures, and sells electrical and utility solutions in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives