- United States

- /

- Machinery

- /

- NYSE:HLIO

What Does the Recent Pullback Mean for Helios Technologies in 2025?

Reviewed by Bailey Pemberton

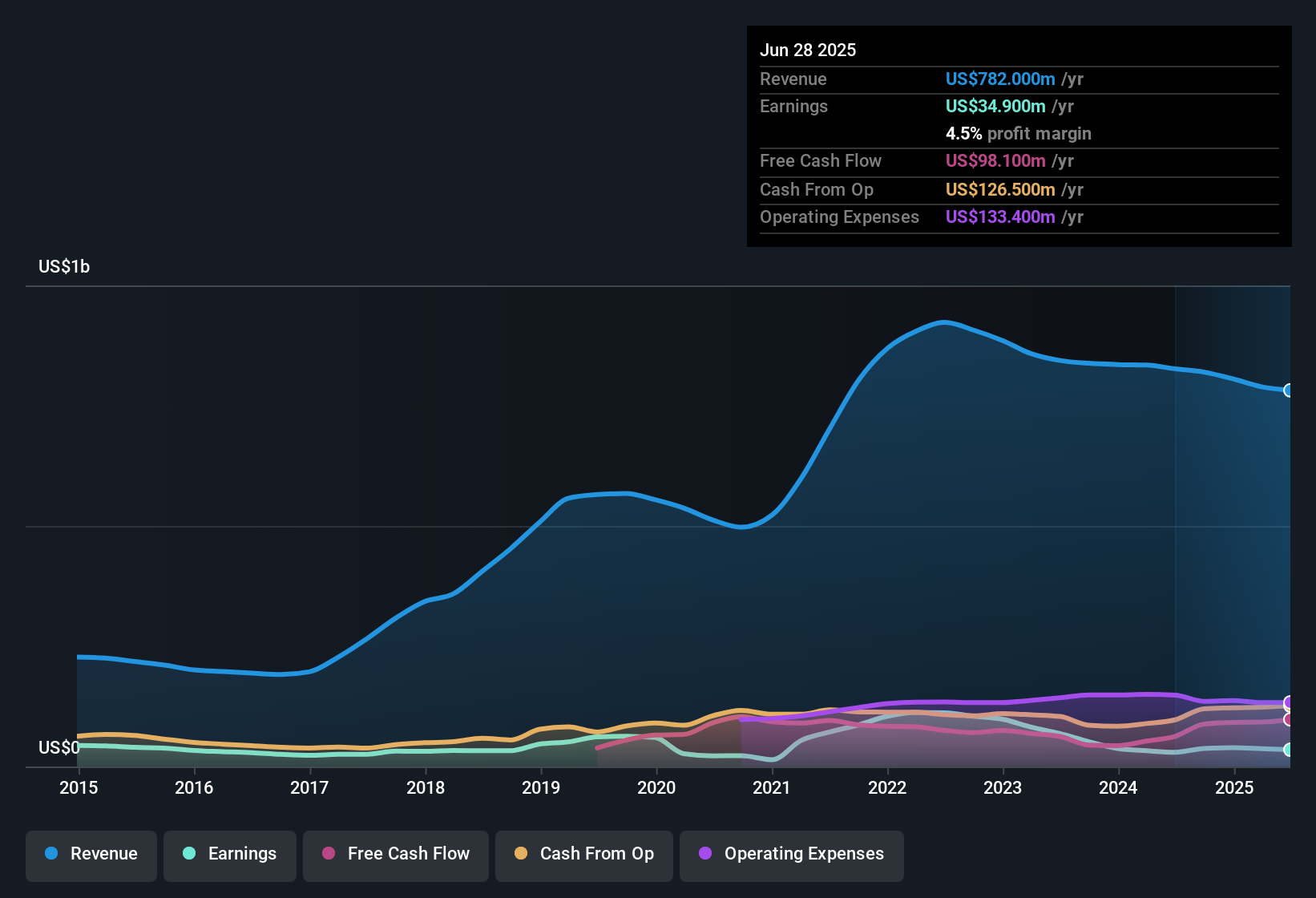

If you are thinking about what to do with Helios Technologies stock right now, you are not alone. With shares recently closing at $52.18, a fair number of investors are wondering whether now is the time to buy, hold, or look elsewhere. Over the past year, Helios has delivered a 9.4% gain, with its year-to-date return even stronger at 17.6%. That kind of performance definitely catches the eye, especially compared to the broader market. Still, the last month has seen a minor pullback of 6.1%, and over the last week, shares dipped by 0.9%, reminding us that volatility can show up when you least expect it.

While there has not been a single headline shaking up Helios’s price, broader market factors such as increased optimism around industrial technology companies may be playing a role in boosting long-term confidence. On the other hand, cautious sentiment can lead to short-term corrections like the one we are seeing now. The bigger question, though, is whether the stock's current price fairly reflects its value.

To help answer that, let’s shift focus to valuation. Helios Technologies currently holds a value score of 2 out of 6, which means it registers as undervalued by two of the six main valuation checks. In the following section, I will break down each valuation method to see what is driving this score and explain what it really means for investors deciding on their next move. And just in case the classic ratios do not tell the whole story, stick around to discover an even smarter way to size up Helios’s true value.

Helios Technologies scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Helios Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to today's dollars. This approach allows investors to assess what the business might truly be worth based on its ability to generate profit over time.

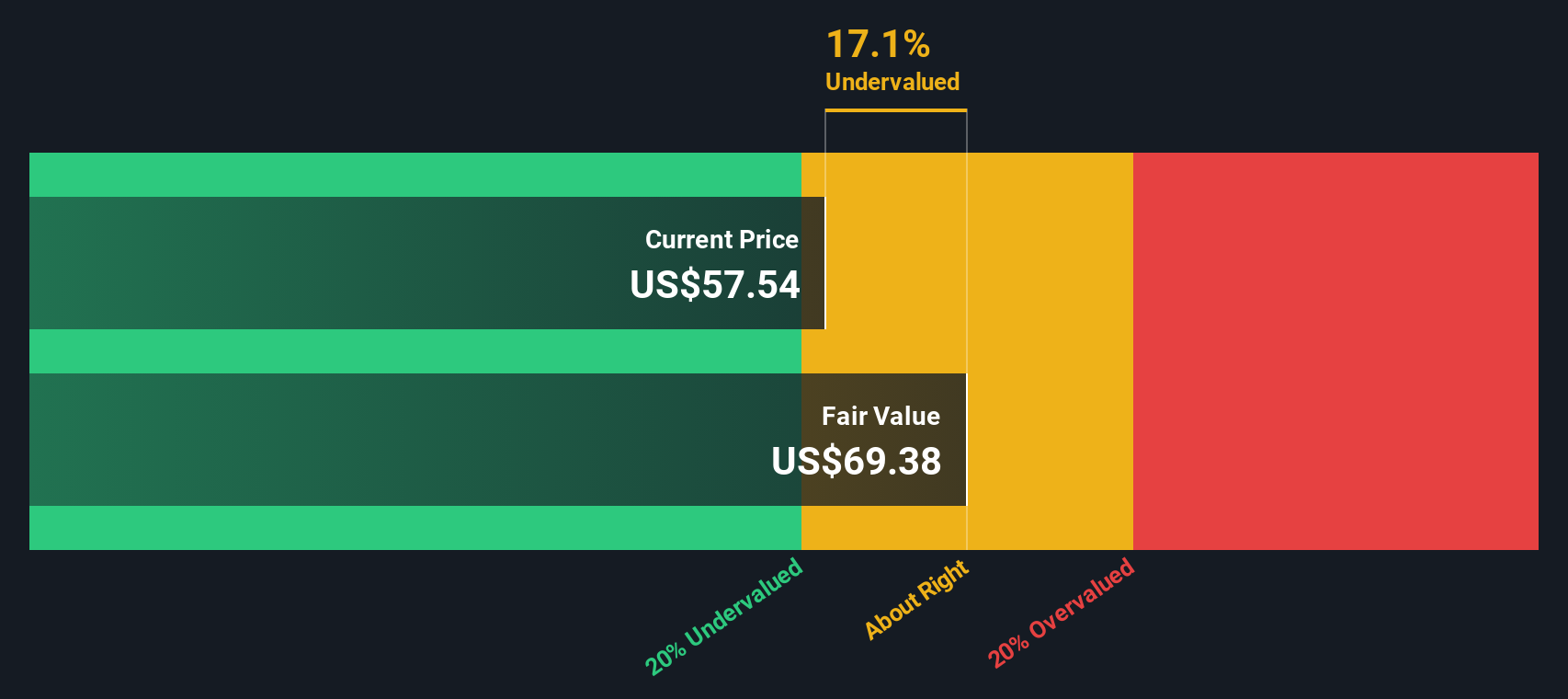

For Helios Technologies, the model uses current Free Cash Flow (FCF) of $93.3 million and considers analyst forecasts for the next five years, after which future amounts are extrapolated. Over the next decade, FCF is projected to grow from $86.95 million in 2026 to $179.35 million by 2035, based on a blend of analyst estimates and reasonable assumptions about long-term growth rates. All calculations are made in US dollars.

According to this method, Helios’s intrinsic value per share is calculated at $69.07, which is significantly above the current share price of $52.18. This suggests the market may be undervaluing the company by roughly 24.5% based on its long-term earnings potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Helios Technologies is undervalued by 24.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Helios Technologies Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to valuation metric for profitable companies because it tells investors how much they are paying for each dollar of earnings. It is especially helpful when a business has established, ongoing profits, as it ties the share price directly to the bottom line.

Not all PE ratios should be treated equally, however. Companies growing quickly or those with stable, predictable earnings often command higher PE ratios, while riskier or slower-growing firms typically trade at lower multiples. What counts as a “fair” PE depends on these growth expectations as well as the stability and quality of earnings.

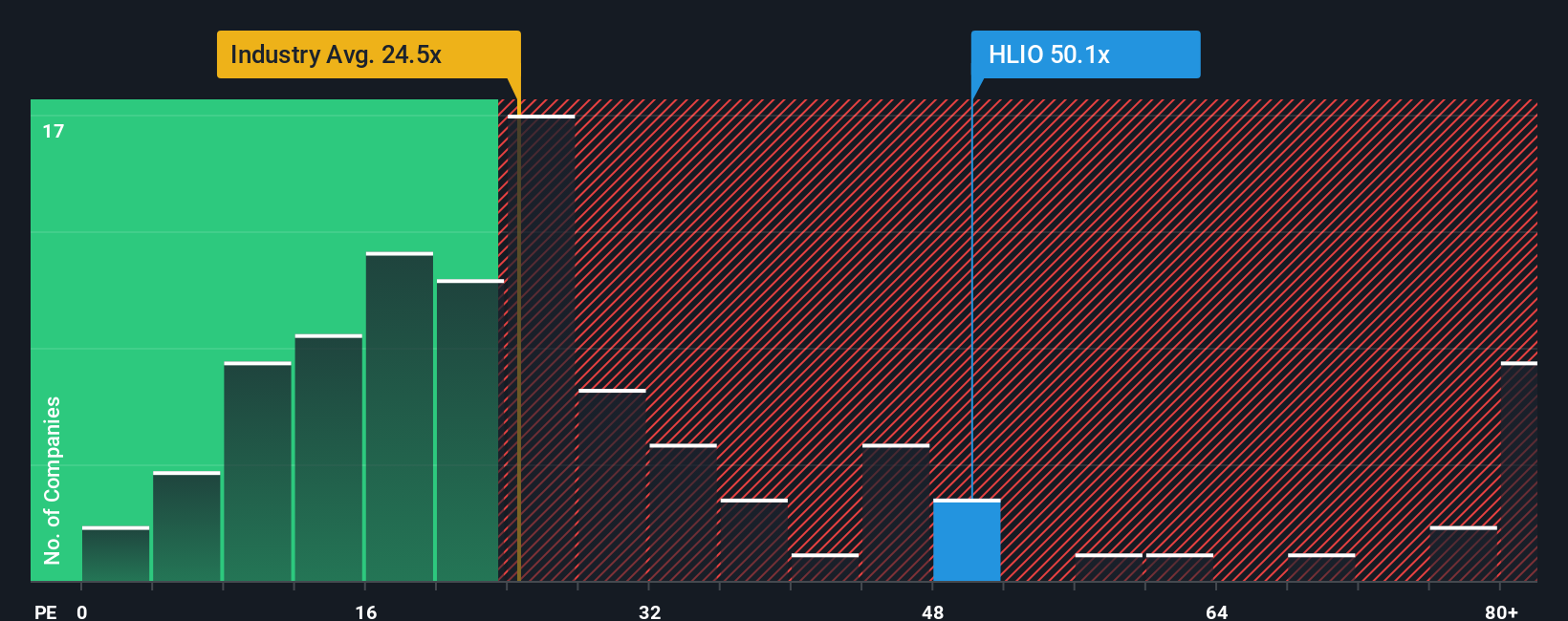

Helios Technologies currently trades at a PE ratio of 49.6x. This is notably above both its peer group average of 38.6x and the machinery industry average of 24.1x. On the surface, this could make the shares appear expensive using traditional benchmarks.

Simply Wall St’s Fair Ratio steps in at 40.8x for Helios, reflecting the company’s growth outlook, profitability, risk profile, market cap, and broader industry trends. Unlike plain comparisons to industry or peers, the Fair Ratio is tailored, providing a more accurate sense of what investors should pay given the company’s unique characteristics.

The current PE ratio is about 8.8x above the Fair Ratio, which points to shares trading above what would be considered fair value. This signals a potential premium for Helios’s future prospects or a risk of overvaluation.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Helios Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your investment story for a company, combining your unique view on its future prospects with your own assumptions about revenue, earnings, and fair value. This approach turns numbers into a clear forecast that fits your perspective.

Rather than relying solely on static metrics, Narratives connect what you know about a company, such as Helios Technologies’ pivot toward electrification or new leadership, to a set of financial outcomes and then compare your estimated fair value to the current market price. The tool is easy to use and freely available to millions of investors on Simply Wall St’s Community page, helping you make buy or sell decisions that suit your goals and expectations.

What makes Narratives stand out is that they update dynamically when fresh news, analyst targets, or earnings are released, so your valuation always keeps pace with the real story. For example, one investor might build a bullish Narrative for Helios based on rapid product innovation and margin expansion, leading to a fair value above $73.00. Another, more cautious user, may highlight risks from industry shifts and assign a fair value close to $55.00, showing that the best valuation is the one that truly fits your outlook.

Do you think there's more to the story for Helios Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helios Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLIO

Helios Technologies

Provides engineered motion control and electronic controls technology solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives