- United States

- /

- Machinery

- /

- NYSE:HLIO

Helios Technologies (HLIO): Evaluating Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Helios Technologies.

Helios Technologies’ 1-month share price return of 9.2% stands out, especially after a choppy week, and builds on steady year-to-date momentum. Over the longer term, its total shareholder returns have been more modest. This suggests recent gains may signal renewed confidence or expectations for stronger growth ahead.

If this kind of rebound has you exploring what else is on the move, now’s a smart time to broaden your investing search and discover fast growing stocks with high insider ownership

Given Helios Technologies’ recent momentum and the fact that shares trade around 18% below analyst price targets, the real question is whether a further run is coming or if the market has already priced in the upside.

Most Popular Narrative: 12% Undervalued

With the narrative’s fair value coming in at $60.60 versus a last close of $53.08, the narrative signals significant upside from today’s price. The assumptions behind this valuation reflect both ambitious growth drivers and some real business challenges. Let’s take a glance at what the narrative’s authors see as the biggest catalyst.

Rapid product innovation and industry electrification position Helios for growth, margin expansion, and increased market share in evolving automation and control solutions. Operational restructuring, diversified revenue streams, and improved capital allocation enhance financial stability, efficiency, and potential for higher long-term earnings.

Want to see what makes this forecast so bullish? The numbers behind this valuation rely on a bold turnaround, new products, margin leaps, and a profit engine that rivals sector leaders. Think you know how high earnings and margins could go? Find out what bold projections underpin the narrative's price target.

Result: Fair Value of $60.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent end-market volatility and slower adoption of advanced technologies could quickly challenge Helios Technologies’ bullish outlook and threaten future revenue growth.

Find out about the key risks to this Helios Technologies narrative.

Another View: A Look at Multiples

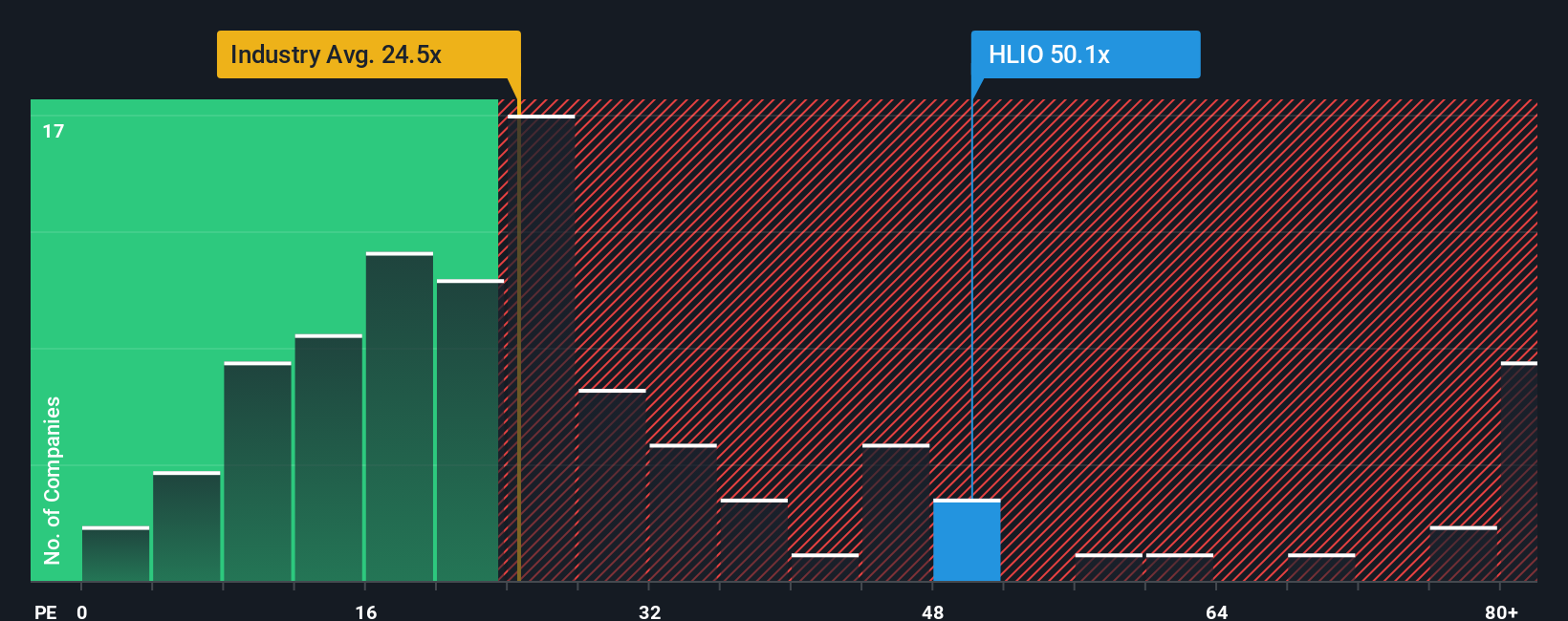

While the narrative suggests Helios Technologies is undervalued, its price-to-earnings ratio tells a different story. At 52.2x, the company trades well above both the industry average of 24.1x and peer average of 31.6x, and even exceeds the fair ratio estimate of 32.2x. This could indicate investors are pricing in high expectations, or it could be a risk sign the market is overlooking.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Helios Technologies Narrative

If you see things differently or want to dive deeper into the details, you can build your own story in just a few minutes. Do it your way.

A great starting point for your Helios Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit yourself to just one opportunity when there is a world of high-potential stocks just a smart search away. Give your portfolio an edge by exploring these tailored strategies:

- Uncover hidden gems with untapped growth by scanning these 3585 penny stocks with strong financials, which offer both value and financial strength.

- Strengthen your returns by targeting reliable income from these 14 dividend stocks with yields > 3%, featuring companies with yields above 3% and resilient business models.

- Capitalize on future-defining healthcare innovations through these 32 healthcare AI stocks, which highlights medical AI leaders transforming the industry.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helios Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLIO

Helios Technologies

Provides engineered motion control and electronic controls technology solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives