- United States

- /

- Machinery

- /

- NYSE:HLIO

Does Helios Technologies' Recent Automation News Signal Room for More Gains in 2025?

Reviewed by Bailey Pemberton

If you have Helios Technologies on your watchlist, you're probably wondering if now is the time to buy, hold, or move on. The stock has caught some attention recently, climbing 5.5% over the past week and tallying an impressive 28.7% gain year-to-date. That kind of momentum can make it tempting to jump in. Before you do, let's look at what might be fueling these moves and whether the underlying value justifies today's price.

Market sentiment around Helios Technologies has shifted as the company announced a new suite of industrial automation solutions, signaling strategic moves into higher-growth sectors. Investors seem to be reacting positively, as demonstrated not only by the recent short-term bump, but also by a solid 20.4% increase over the last year. There is also an undeniable long-term appeal, with shares up 35.6% over the past five years. This suggests ongoing confidence in Helios' ability to execute.

But recent gains don’t always mean the stock is a bargain. In fact, when we apply six established valuation checks, Helios scores 1 out of 6 for being undervalued. This is a hint to dig deeper. Price appreciation and news-driven enthusiasm might not tell the whole story.

We will break down the different valuation approaches in the next section. At the end, you will find a perspective that goes beyond numbers to offer a clearer take on what Helios Technologies may really be worth.

Helios Technologies scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Helios Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) analysis estimates a company's value by forecasting all future cash flows and then discounting those amounts back to today using a required rate of return. This approach focuses directly on how much cash Helios Technologies is likely to generate, making it a widely used method for intrinsic valuation.

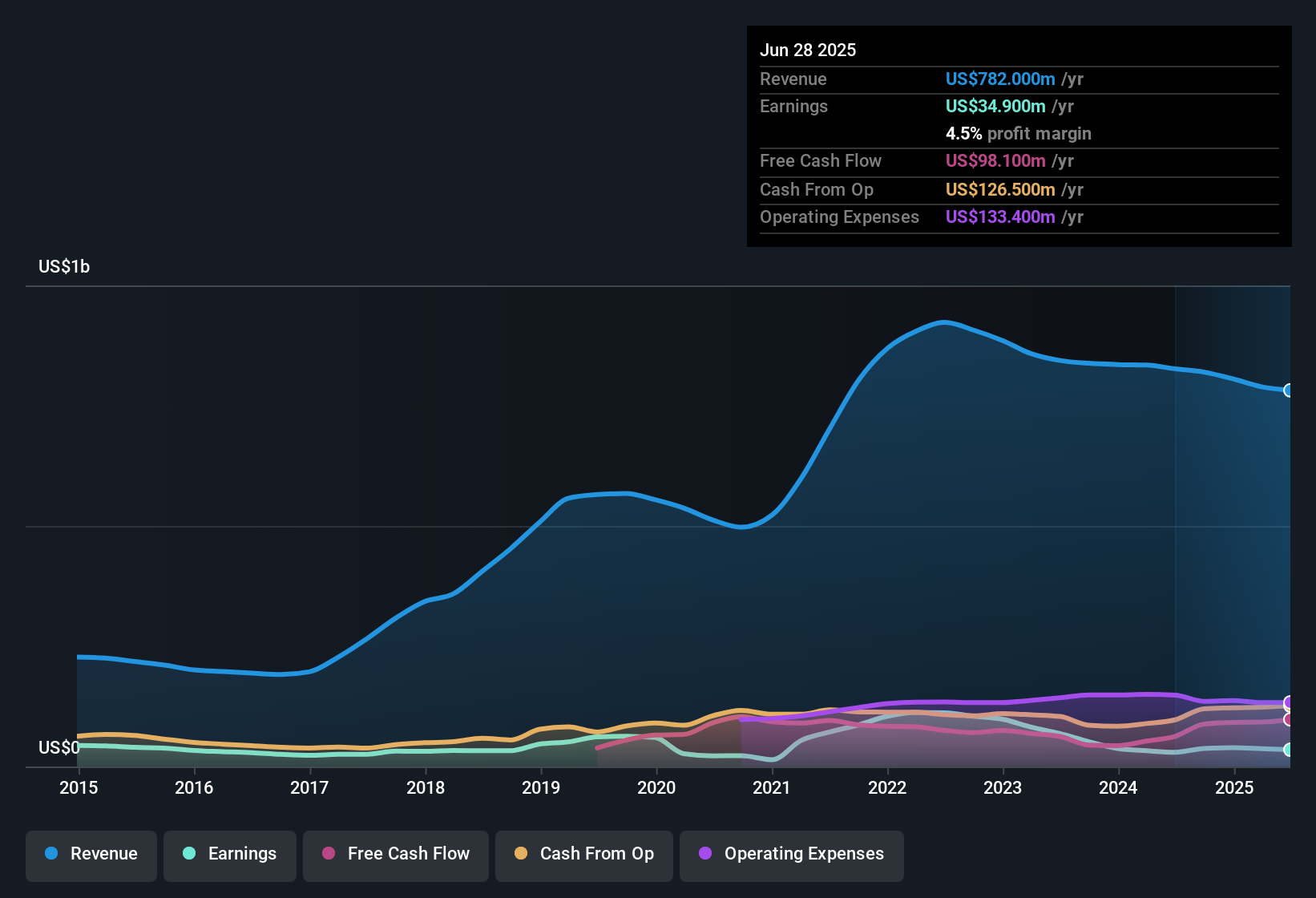

Starting with current free cash flow of $93.3 million, Helios is projected to steadily increase its cash generation. Analyst estimates extend out five years, after which additional projections are made based on industry trends and company performance. By 2029, free cash flow is forecast to reach $127.8 million. Beyond that point, the model continues extrapolating further growth using reasonable assumptions.

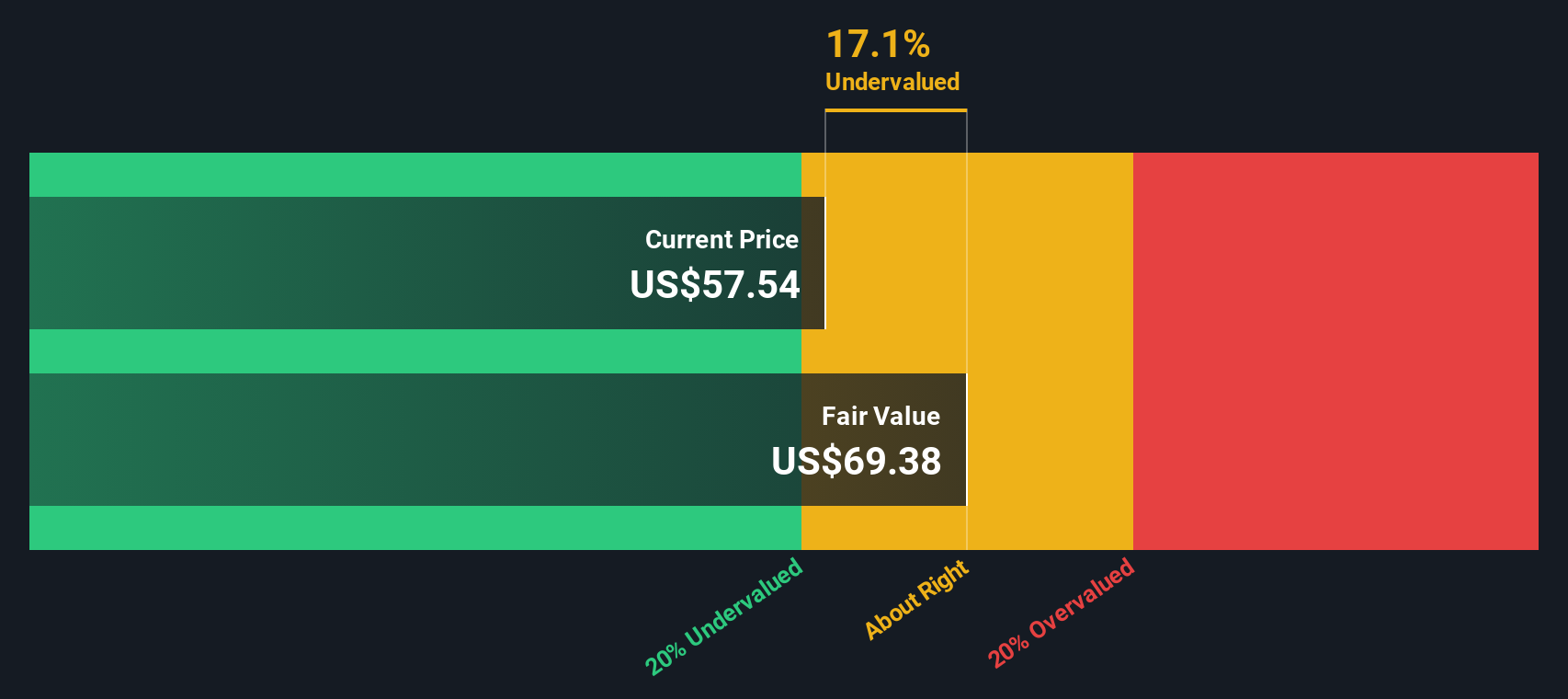

Applying the DCF model to all available projections, the estimated intrinsic value for Helios shares comes to $69.38. Compared to the current trading price, this implies the stock is 17.7% undervalued based on future cash flows discounted to today's dollars.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Helios Technologies is undervalued by 17.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Helios Technologies Price vs Earnings (PE)

The price-to-earnings (PE) ratio is a go-to metric when analyzing profitable companies like Helios Technologies, as it directly relates a company's stock price to its bottom-line profits. Investors often prefer the PE ratio because it puts current pricing in context with what the business is actually earning.

Growth expectations and the level of risk are crucial in shaping what counts as a “normal” or “fair” PE ratio. Companies expected to deliver faster earnings growth or with more resilient business models typically command higher PE ratios. In contrast, slower-growth or riskier firms tend to trade at lower multiples.

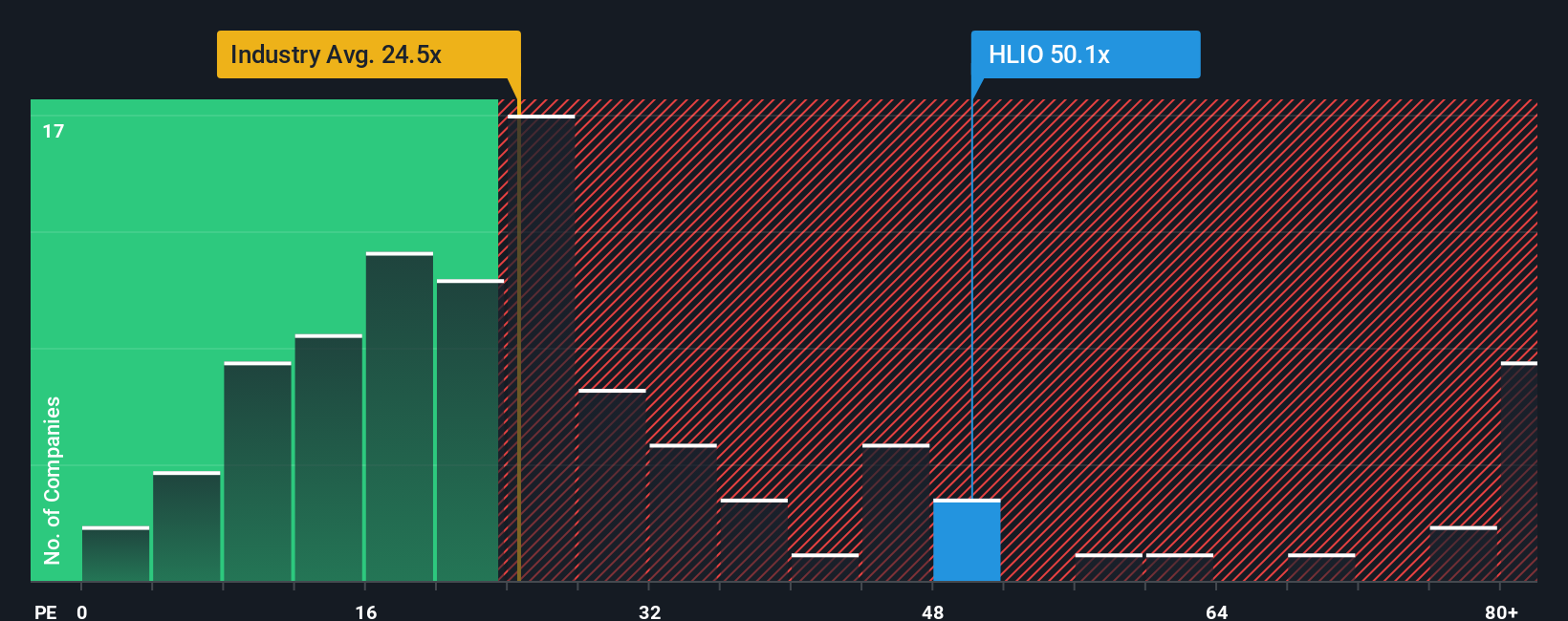

Right now, Helios Technologies trades at a PE ratio of 54.2x. This is substantially above the machinery industry’s average of 24.7x and also higher than its peer group’s average of 39.6x. While this headline number might suggest a premium price tag, surface-level comparisons only tell part of the story.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. Calculated at 41.9x for Helios, the Fair Ratio estimates what a justified PE multiple should be by factoring in the company’s unique growth profile, profit margin, industry, risk, and overall market cap. Unlike simple peer or industry averages, the Fair Ratio provides a more tailored benchmark specific to Helios.

Comparing Helios’ actual PE ratio (54.2x) to its Fair Ratio (41.9x) reveals the stock is trading at a notable premium to where it arguably should be. This suggests the market may be pricing in high expectations that are not fully supported by current fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Helios Technologies Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective about a company, combining your fair value estimate and your outlook for future revenue, earnings, and margins. This creates a financial forecast that is grounded in your unique insights. Narratives connect the dots between a company’s story, a specific financial model, and a clear estimate of fair value, helping you see not just what the numbers are, but the reasons behind them.

Simply Wall St's Narratives make it easy for anyone, from seasoned investors to beginners, to build and update their own forecasts quickly and visually right on the Community page, and millions of users already do exactly that. By setting your Narrative, you see whether Helios Technologies is undervalued or overvalued compared to your expectations, giving you timely, informed signals about when it might be right to buy or sell. What’s more, Narratives update dynamically as news or earnings reports are released, so your view stays current without any extra effort.

For example, some investors believe Helios can reach $73.00 per share if digital innovation accelerates and margins rise, while others see more downside risk and set their fair value around $55.00. The Narrative you choose helps you act confidently and stay focused on your own reasoning, not just market noise.

Do you think there's more to the story for Helios Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Helios Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLIO

Helios Technologies

Provides engineered motion control and electronic controls technology solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion