- United States

- /

- Machinery

- /

- NYSE:HI

How Investors May Respond To Hillenbrand (HI) Achieving Profit Growth Despite Lower Sales

Reviewed by Sasha Jovanovic

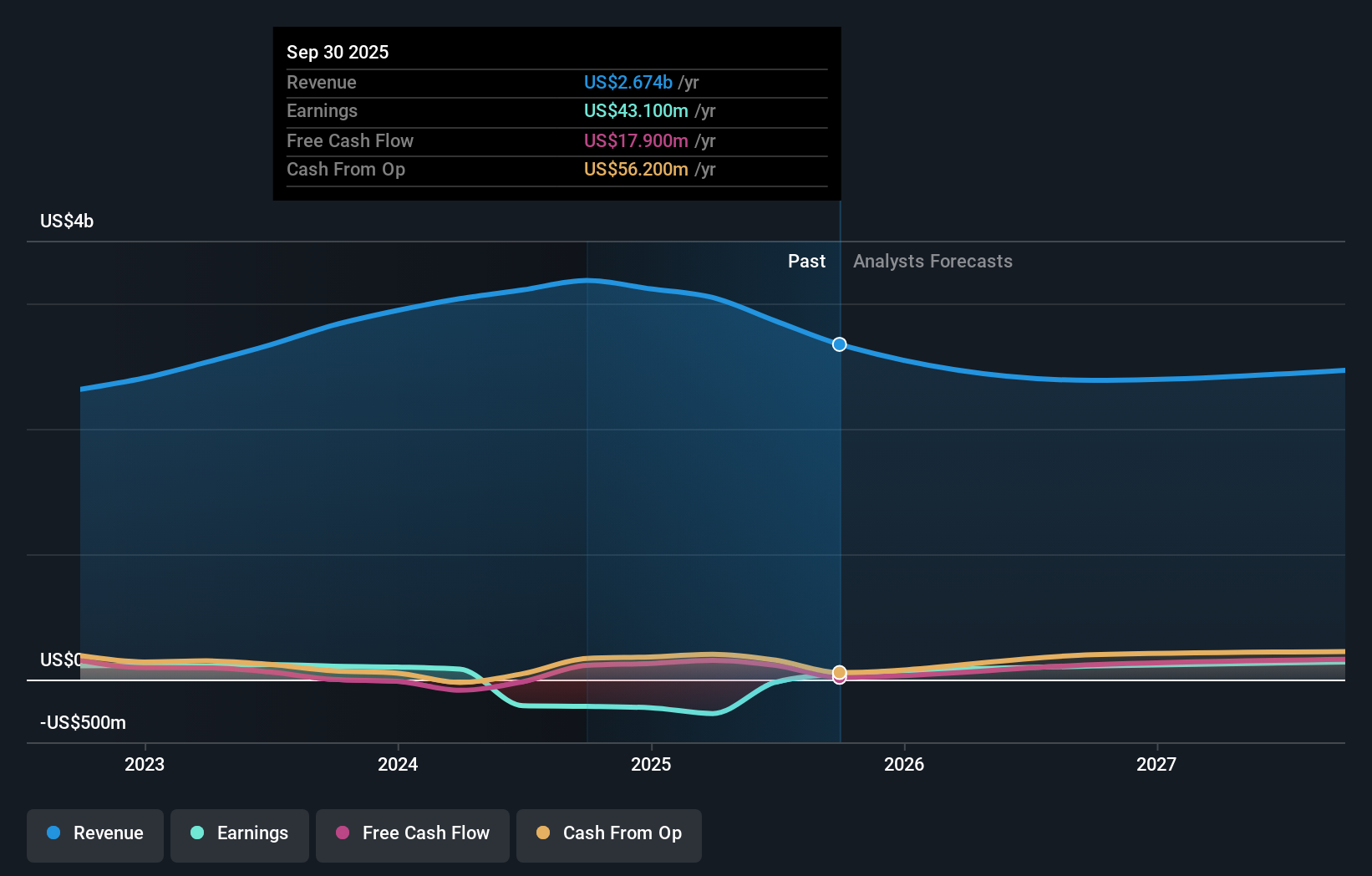

- Hillenbrand reported its fourth quarter and full-year earnings for the period ended September 30, 2025, revealing fourth quarter sales of US$652.1 million and a quarterly net income of US$75.7 million, compared to US$837.6 million in sales and US$14.6 million in net income a year ago.

- Despite a decline in annual sales, the company's transition from a net loss to net income signals significant operational improvements over the past year.

- We'll explore how the sharp turnaround in net income and earnings per share informs Hillenbrand's updated investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Hillenbrand Investment Narrative Recap

To be a Hillenbrand shareholder today, you need to believe in the company's ability to convert its improved profitability into sustainable, long-term growth, despite ongoing challenges from macroeconomic uncertainty and industry headwinds. The recent earnings turnaround solidifies the short-term catalyst of rebounding order activity, but does little to diminish the persistent risk around financial flexibility and debt management, which remain key focus areas for the near-term outlook.

One announcement especially relevant to these results is the definitive agreement for Lone Star to acquire Hillenbrand at US$32 per share. This proposed acquisition could meaningfully affect short-term share price movements and future prospects, making the company's improved earnings profile more significant for the deal's progression and ultimate value to shareholders.

In contrast, investors should also be aware that high net leverage and weak cash conversion continue to present...

Read the full narrative on Hillenbrand (it's free!)

Hillenbrand's narrative projects $2.3 billion in revenue and $225.8 million in earnings by 2028. This requires a 6.5% yearly revenue decline and a $246.3 million increase in earnings from the current level of -$20.5 million.

Uncover how Hillenbrand's forecasts yield a $33.00 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community valuations put Hillenbrand's fair value in a wide US$33 to US$46.74 range. Amid these varied views, ongoing integration and debt-related risks could influence how you weigh the potential for sustained profitability.

Explore 2 other fair value estimates on Hillenbrand - why the stock might be worth as much as 47% more than the current price!

Build Your Own Hillenbrand Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hillenbrand research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hillenbrand research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hillenbrand's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hillenbrand might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HI

Hillenbrand

Operates as an industrial company, and processing equipment and solutions in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026