- United States

- /

- Building

- /

- NYSE:HAYW

Hayward Holdings (HAYW) Is Up 14.2% After Raising Full-Year Guidance on Strong Q3 Results – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

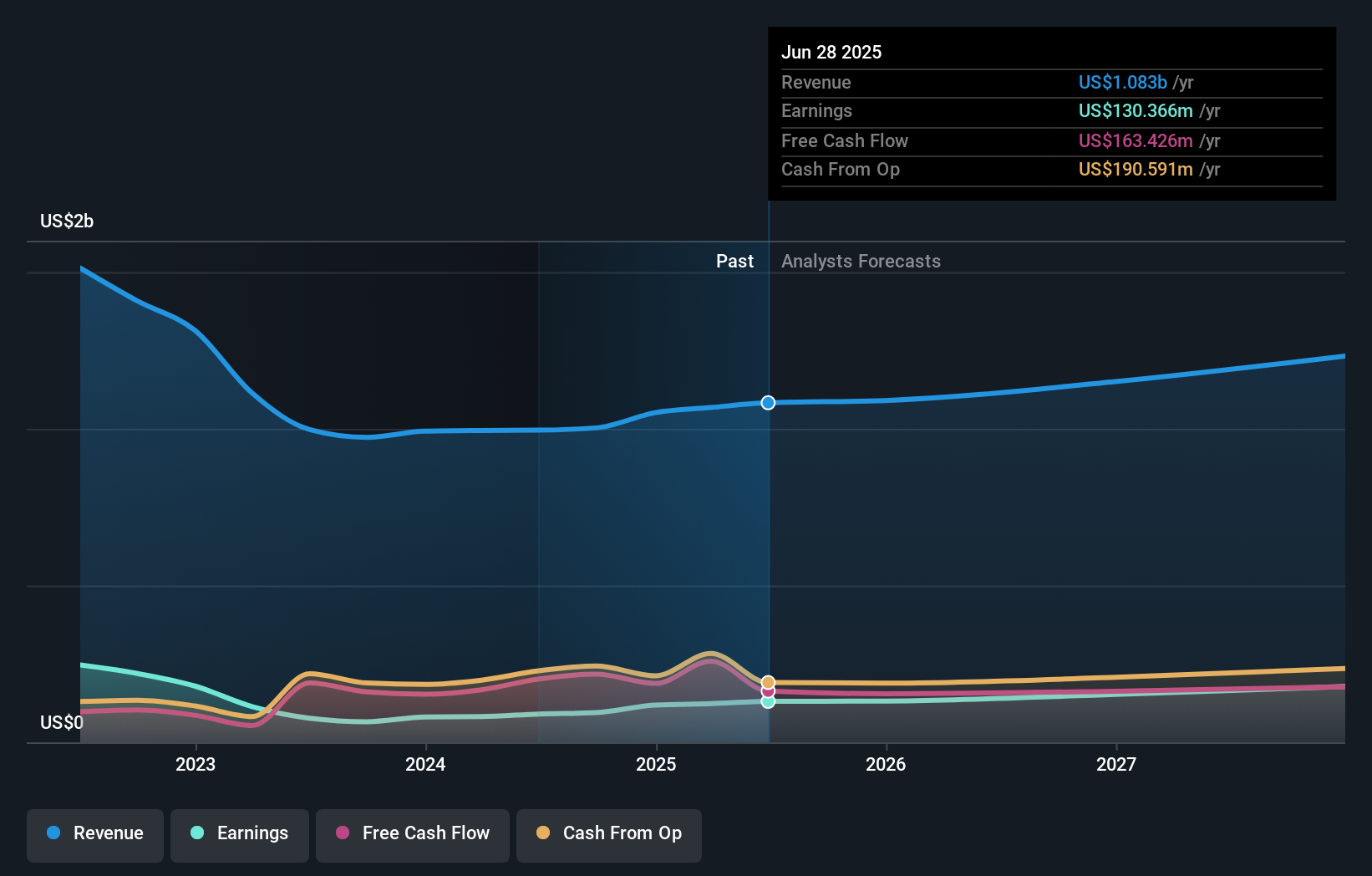

- On October 29, 2025, Hayward Holdings reported its third quarter results, with sales rising to US$244.34 million and net income increasing to US$24.03 million, both ahead of the same period a year ago; the company also raised its full-year 2025 guidance, now expecting net sales between US$1.095 billion and US$1.11 billion.

- This marked improvement in profit margins and upgraded outlook was attributed to growth across regions, increased efficiency, and successful supply chain realignment efforts.

- We will examine how Hayward’s stronger full-year guidance and third quarter performance shape its future investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Hayward Holdings Investment Narrative Recap

For Hayward Holdings, confidence in ongoing efficiency gains, resilient aftermarket demand, and the company’s push into automation is central to any bullish thesis. The latest earnings beat and improved guidance bolster the near-term catalyst of margin expansion, but do not meaningfully diminish the heightened risk linked to Hayward’s reliance on the residential aftermarket, where consumer spending priorities and pool replacement cycles remain crucial headwinds.

The company’s raised 2025 net sales guidance, now between US$1.095 billion and US$1.11 billion, is the most directly relevant recent announcement, reflecting outperformance driven by both regional demand and cost controls. This updated outlook strengthens the margin expansion story, but investors should still weigh how sustained consumer hesitancy on upgrading entire pool equipment versus repairs could influence future results.

However, as consumer demand patterns can shift quickly, investors should be aware of potential challenges if the repair-over-replacement trend persists...

Read the full narrative on Hayward Holdings (it's free!)

Hayward Holdings' outlook anticipates $1.3 billion in revenue and $198.0 million in earnings by 2028. This implies a 5.8% annual revenue growth rate and a $67.6 million increase in earnings from the current $130.4 million level.

Uncover how Hayward Holdings' forecasts yield a $16.64 fair value, a 3% downside to its current price.

Exploring Other Perspectives

One Simply Wall St Community member’s fair value estimate for Hayward Holdings comes in at US$16.64. As you consider this perspective, remember the company’s reliance on discretionary spending for major aftermarket pool upgrades could affect future performance if consumer behaviors change, so explore multiple viewpoints before forming your opinion.

Explore another fair value estimate on Hayward Holdings - why the stock might be worth just $16.64!

Build Your Own Hayward Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hayward Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Hayward Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hayward Holdings' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hayward Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAYW

Hayward Holdings

Designs, manufactures, and markets a portfolio of pool equipment and associated automation systems in North America, Europe, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives