- United States

- /

- Trade Distributors

- /

- NYSE:GWW

W.W. Grainger (GWW): A Fresh Look at Valuation After Recent Share Price Moves

Reviewed by Simply Wall St

W.W. Grainger (GWW) recently caught the attention of investors after its shares saw some movement, even though there was no clear headline event influencing sentiment. The company’s track record and recent returns are sparking fresh conversations about valuation.

See our latest analysis for W.W. Grainger.

Grainger’s share price has edged lower in recent months, with a year-to-date decline of 7.45%. However, zooming out puts this volatility in perspective. Despite a one-year total shareholder return of -10.18%, investors who held for the last three or five years have seen robust gains of over 84% and 191% respectively. The recent dip might reflect changing expectations around growth or risk, but the longer-term track record remains impressive for those focused beyond the short term.

If you’re curious to see what other companies are gaining momentum, consider expanding your search and discover fast growing stocks with high insider ownership

With Grainger’s longer-term growth and recent slide, the key question emerges: is the current share price a hidden bargain for value-focused investors, or is the market already factoring in all future growth prospects?

Most Popular Narrative: 7.5% Undervalued

At $964.07, W.W. Grainger shares are valued below the most widely followed narrative’s fair value of $1,041.77. This has sparked debate about future upside and what could drive a reassessment. The narrative’s foundation goes beyond simple price comparisons and instead intertwines structural market trends with Grainger’s evolving business model.

The acceleration of digital transformation in B2B/industrial commerce is expanding the addressable market for Grainger's online platforms (especially Zoro and MonotaRO), driving faster-than-industry top-line gains, operating leverage, and margin expansion as e-commerce penetration rises.

What role does digital growth really play in this story? The narrative relies on powerful shifts in how buyers source industrial supplies. It also expects profit margins to remain strong as the market continues to evolve. Interested in the surprising quantitative assumptions behind this projected fair value? The full narrative reveals which growth and margin forecasts are fueling the optimism.

Result: Fair Value of $1,041.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure from tariffs or a weakened MRO market could quickly challenge current optimism and change how investors assess future upside.

Find out about the key risks to this W.W. Grainger narrative.

Another View: Are Market Multiples Signaling Something Different?

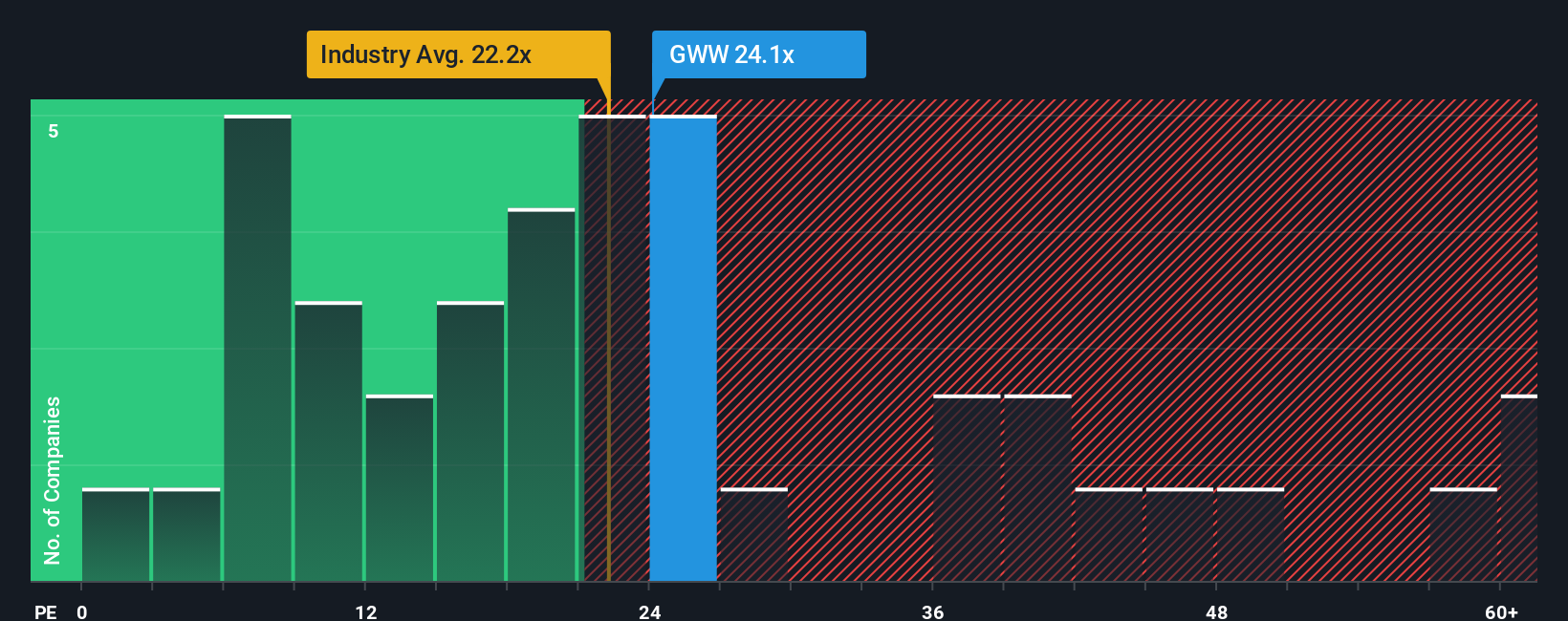

Taking a step back from fair value estimates, the market’s current valuation for Grainger based on its price-to-earnings ratio tells a subtler story. Trading at 24x earnings, in line with its peer average but above the US Trade Distributors industry average of 22.6x, Grainger appears somewhat expensive. It is also just above its fair ratio of 23.9x, suggesting less obvious upside and a possible valuation risk if the market realigns. Does this raise red flags about how much future growth is already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own W.W. Grainger Narrative

Feel free to dig into the numbers yourself and craft a story of your own. Putting together a custom take on Grainger takes just a few minutes. Do it your way

A great starting point for your W.W. Grainger research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Staying ahead of the market means acting on trends other investors might miss. See what’s possible by targeting these powerful themes using our top screeners:

- Power up your portfolio with income potential by exploring these 17 dividend stocks with yields > 3%, which features yields above 3%.

- Future-proof your strategy by tracking innovation with these 27 AI penny stocks, giving you exposure to significant breakthroughs in artificial intelligence.

- Enhance your value focus by reviewing these 876 undervalued stocks based on cash flows to find companies where current prices may not reflect their true cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W.W. Grainger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GWW

W.W. Grainger

Distributes maintenance, repair, and operating products and services primarily in North America, Japan, and the United Kingdom.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives