- United States

- /

- Machinery

- /

- NYSE:GTES

The Bull Case For Gates Industrial (GTES) Could Change Following Launch of Eco-Friendly Data Center Cooling Solution

Reviewed by Sasha Jovanovic

- Earlier this week, Gates Corporation launched Data Master Eco, a next-generation liquid cooling solution designed for hyperscale data centers and high-performance computing, emphasizing significant energy savings and a halogen-free, environmentally conscious manufacturing process.

- This launch underscores Gates' push into sustainable, AI-optimized infrastructure solutions that cater to the rising technical and environmental demands of the global digital economy.

- We'll examine how Gates’ focus on energy-efficient liquid cooling for data centers could influence the company's investment narrative and future growth outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Gates Industrial Investment Narrative Recap

To be a shareholder in Gates Industrial, you need to believe the company can successfully shift its revenue base from slow-growing legacy end markets toward higher-growth opportunities in data centers and AI-driven infrastructure. The new Data Master Eco launch increases Gates' relevance to this space and reflects longer-term potential, but it likely does not materially shift near-term catalysts or alter the biggest risk: ongoing softness in traditional industrial and construction OEM markets could still weigh on topline results.

Of Gates’ recent announcements, the introduction of Data Master MegaFlex, a new, large-diameter cooling hose for high-volume liquid supply in data centers, aligns closely with the catalyst of expanding data center liquid cooling demand. This product complements the Data Master Eco line and reinforces Gates’ push to diversify its business, even as traditional automotive and industrial segments remain under pressure.

Yet, it is important to consider that, despite these promising developments, persistent weakness in North America and EMEA industrial demand remains a risk that investors should be aware of...

Read the full narrative on Gates Industrial (it's free!)

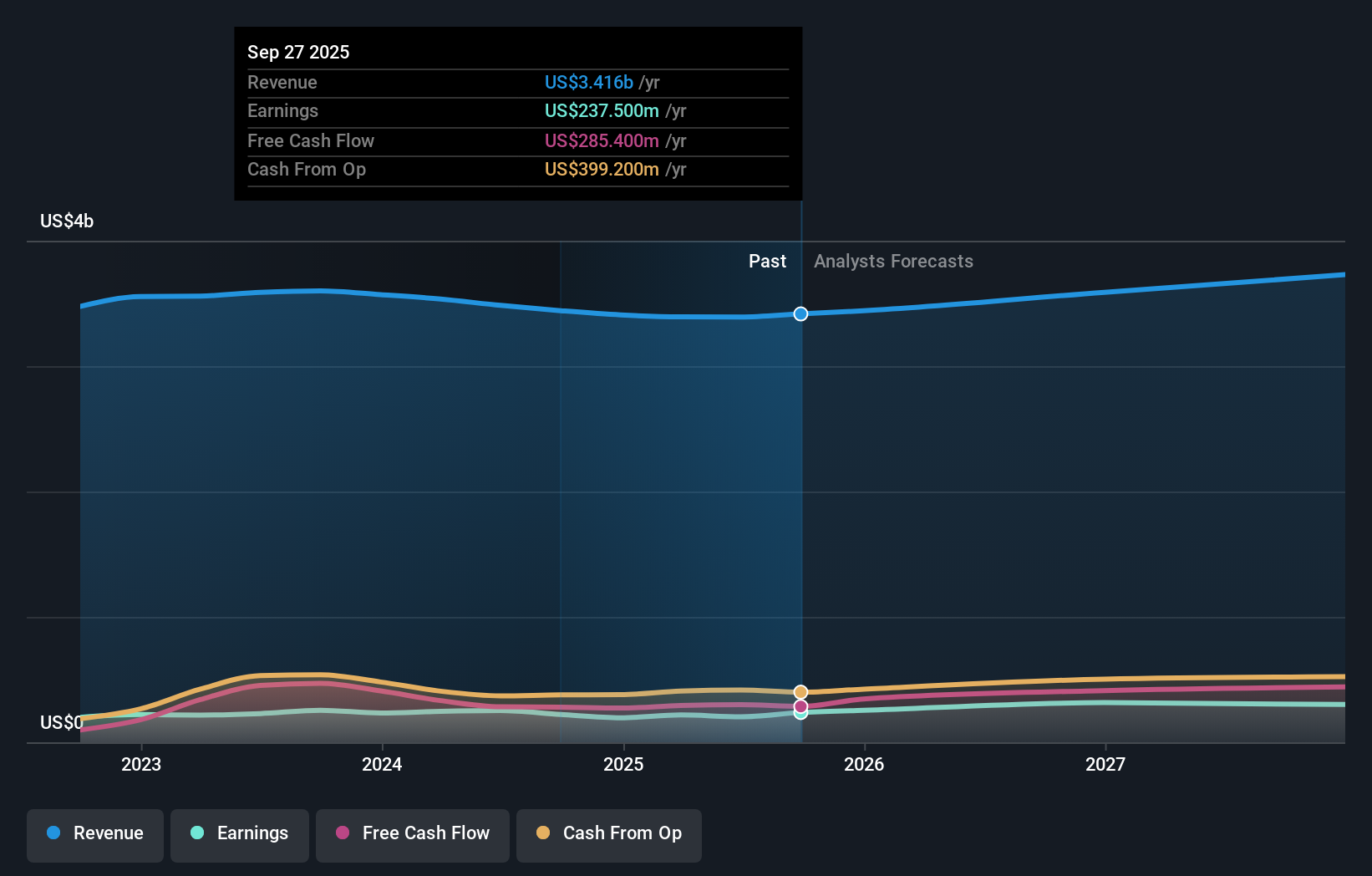

Gates Industrial's narrative projects $3.8 billion revenue and $395.4 million earnings by 2028. This requires 4.2% yearly revenue growth and a $191.9 million increase in earnings from $203.5 million today.

Uncover how Gates Industrial's forecasts yield a $28.82 fair value, a 31% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provides a single, consistent fair value estimate of US$28.82 for Gates Industrial, revealing limited divergence in individual retail investor views. While optimism around data center catalysts may influence future opinions, you’ll find that investors can interpret growth opportunities and risk factors very differently, explore an array of viewpoints for a fuller picture.

Explore another fair value estimate on Gates Industrial - why the stock might be worth as much as 31% more than the current price!

Build Your Own Gates Industrial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gates Industrial research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gates Industrial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gates Industrial's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GTES

Gates Industrial

Manufactures and sells engineered power transmission and fluid power solutions worldwide.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives