- United States

- /

- Electrical

- /

- NYSE:GNRC

Generac Holdings (GNRC) Profit Margins Hold Steady, Challenging Concerns Over Earnings Quality

Reviewed by Simply Wall St

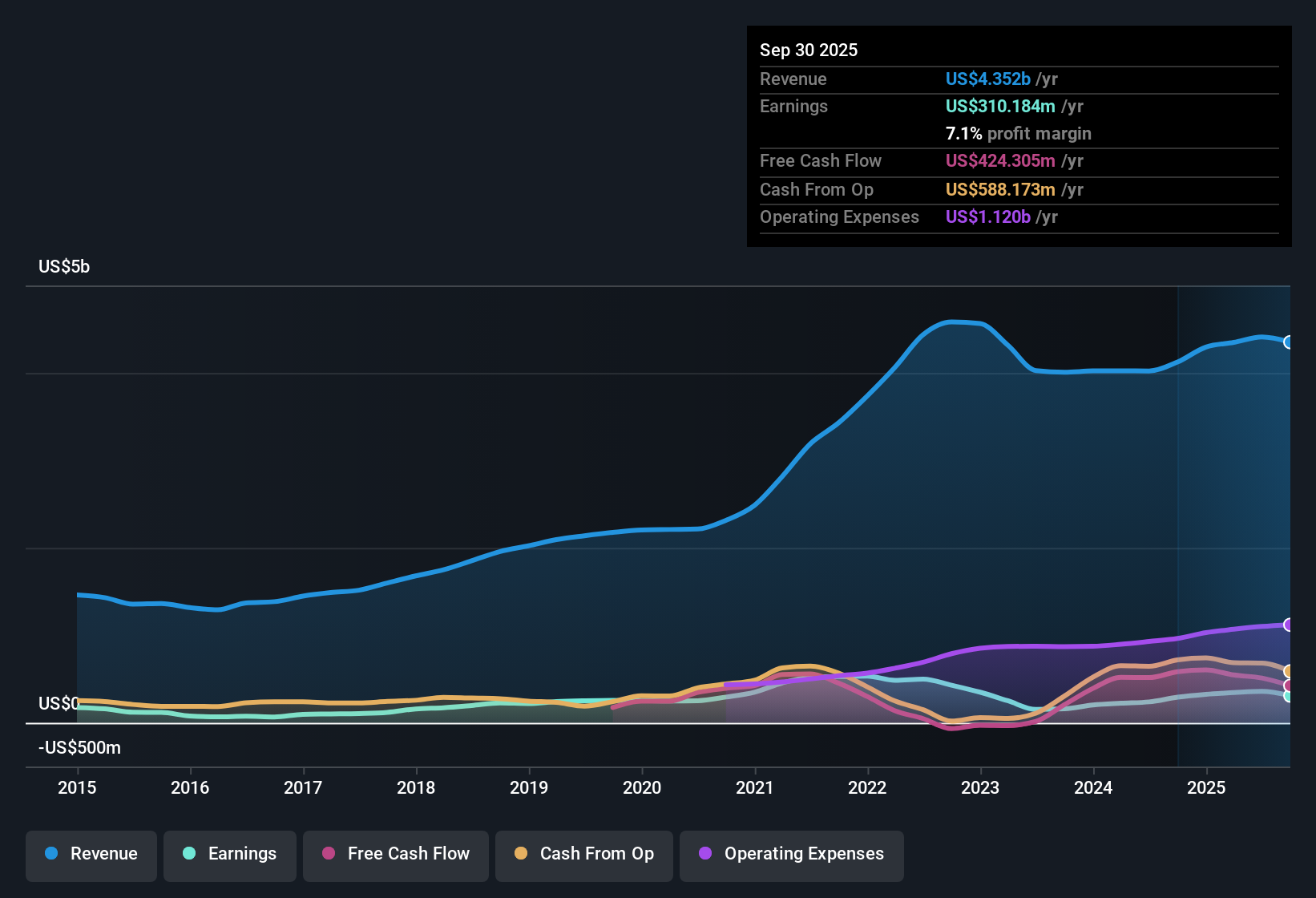

Generac Holdings (GNRC) posted high quality earnings this quarter, with net profit margins holding steady at 7.1%, matching last year’s figures. Despite earnings declining at an average rate of 11.3% per year over the last five years, the latest report shows a 6.1% earnings growth over the past year. Earnings are forecast to increase 22% annually from here, outpacing both the expected 8.8% revenue growth and the broader US market’s outlook. The shares currently trade at $165.78, which is below the estimated fair value of $194.69. Investors have a classic setup to weigh: robust projected profit growth against a history of profit declines and slower revenue growth relative to the market.

See our full analysis for Generac Holdings.Next up, we’ll put these headline numbers side by side with the leading narratives from the Simply Wall St community to see which stories hold up and which assumptions may need a rethink.

See what the community is saying about Generac Holdings

Margin Expansion in Sight: Profit Margins Forecast to Rise from 8.2% to 10.8%

- Profit margins are projected to improve notably from 8.2% today to 10.8% over the next three years. This reflects assumptions of ongoing cost control and pricing power.

- According to the analysts' consensus view:

- Generac’s margin gains are seen as sustainable due to structural improvements, such as price realization and supply chain efficiencies.

- Consensus narrative argues that industry trends like data center investment and distributed energy demand support a steadier margin profile. This counters earlier concerns about earnings cyclicality.

Building on these expectations for higher profitability, analysts see Generac’s leverage on margin as a key reason for its projected earnings growth to outpace revenue gains.

📊 Read the full Generac Holdings Consensus Narrative.P/E Discount to Peers, But Premium to Industry

- Generac’s price-to-earnings ratio stands at 31.4x, which is above the US Electrical industry’s 29.4x and below peers’ 39.1x. This suggests the company is valued between industry and peer averages.

- The analysts' consensus view notes:

- Analysts see Generac’s current multiple as justified if future earnings targets are met, especially with profit margins likely to increase and stability from recurring revenue streams.

- However, a valuation tradeoff remains. While shares are less expensive than the peer group, they are not at an industry-wide bargain. Continued execution on growth is seen as critical for potential upside.

DCF Fair Value Offers Further Upside

- Shares trade at $165.78, which is below the DCF fair value estimate of $194.69. This indicates potential upside if analysts’ growth forecasts are realized.

- The analysts' consensus view highlights:

- Consensus price target for the company is $209.59, about 26% above the current share price, though target ranges vary based on expectations for revenue growth and margin expansion.

- The need for sustained top-line momentum and successful delivery on margin forecasts is seen as crucial to closing the gap toward DCF and analyst price targets.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Generac Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Share your perspective and shape your personal narrative in just a few minutes: Do it your way

A great starting point for your Generac Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Generac’s projected margin improvements look promising, its earnings growth has historically trailed revenue and market averages. This signals inconsistent performance over time.

If you prefer companies with a track record of robust, steady gains, use stable growth stocks screener (2113 results) to focus on businesses consistently expanding revenue and earnings through every cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GNRC

Generac Holdings

Designs, manufactures, and distributes energy technology products and solution worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives