- United States

- /

- Trade Distributors

- /

- NYSE:GIC

US Market's Undiscovered Gems To Watch November 2025

Reviewed by Simply Wall St

As the U.S. market navigates a challenging landscape marked by consecutive declines in major indices and heightened scrutiny on tech valuations, investors are keenly observing how these dynamics impact small-cap stocks. With economic uncertainty looming and interest rate adjustments under discussion, identifying promising opportunities requires a focus on companies with solid fundamentals and growth potential that can withstand broader market pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

We'll examine a selection from our screener results.

One and one Green Technologies (YDDL)

Simply Wall St Value Rating: ★★★★★★

Overview: One and one Green Technologies Inc, with a market cap of $276.39 million, is a company based in the Philippines that specializes in the recycling, production, and trading of recycled scrap metals.

Operations: YDDL generates revenue primarily through the recycling and trading of scrap metals. The company has a market cap of $276.39 million.

One and One Green Technologies has shown impressive earnings growth of 214% over the past year, outpacing the Metals and Mining industry average of 3.5%. The company reported a net income of US$3.83 million for the first half of 2025, an increase from US$2.4 million in the previous year, with sales rising to US$28.13 million from US$18.67 million. Despite being debt-free and having high-quality non-cash earnings, its shares remain highly illiquid. Recently added to the NASDAQ Composite Index post-IPO, it raised $10 million by offering shares at $5 each with a discount per security at $0.35.

- Unlock comprehensive insights into our analysis of One and one Green Technologies stock in this health report.

Gain insights into One and one Green Technologies' past trends and performance with our Past report.

Peoples Financial Services (PFIS)

Simply Wall St Value Rating: ★★★★★★

Overview: Peoples Financial Services Corp. offers commercial and retail banking services with a market capitalization of $468.55 million.

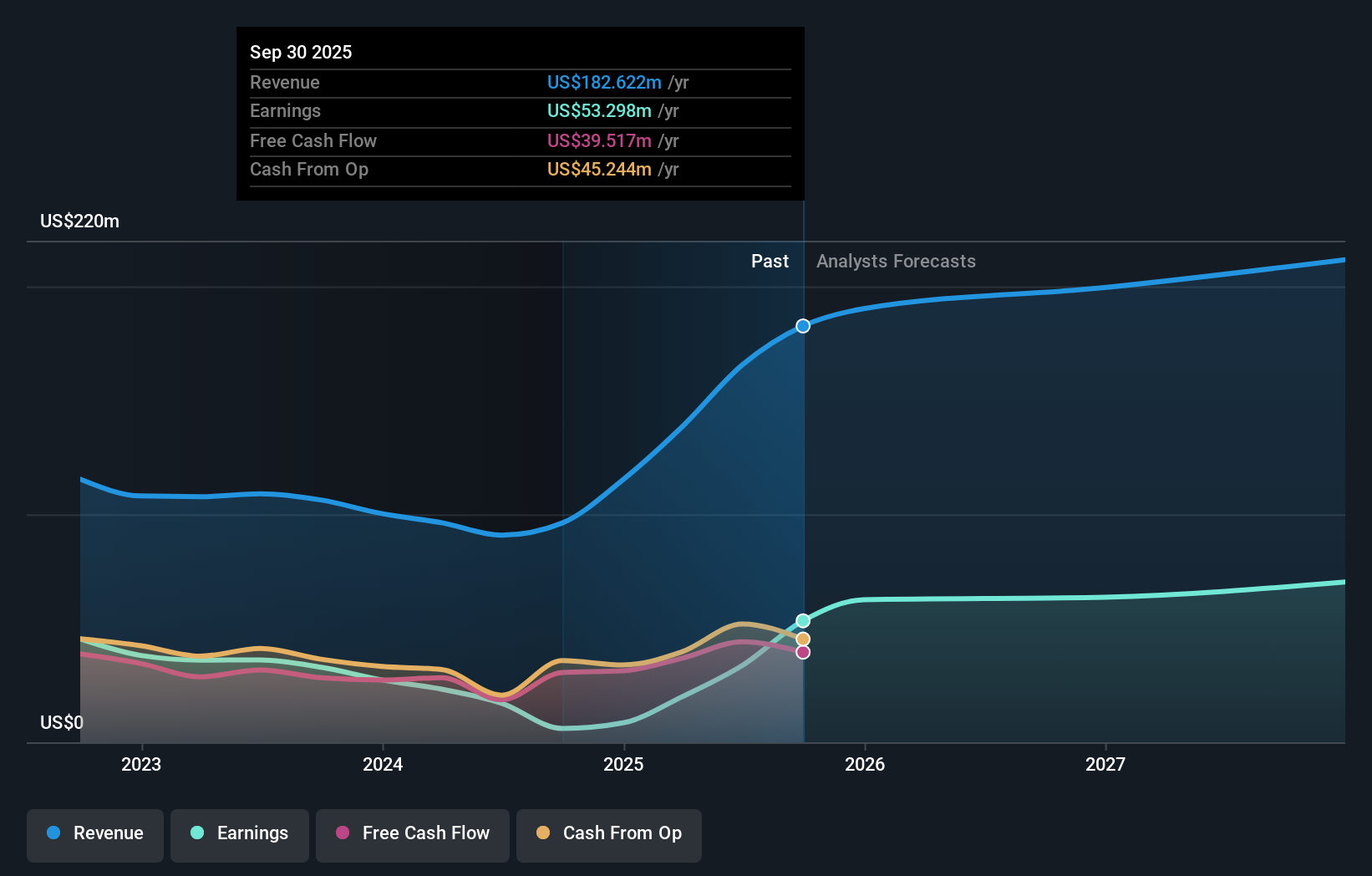

Operations: The primary revenue stream for Peoples Financial Services comes from its banking services, generating $182.62 million. The company's financial performance is reflected in its net profit margin, which stands at 28%.

Peoples Financial Services, with total assets of US$5.2 billion and equity of US$509.3 million, is making waves with its impressive earnings growth of 782.3% over the past year, far outpacing the industry average of 18.2%. The bank's financial health is underpinned by a solid net interest margin of 2.8% and a robust allowance for bad loans at 261%, covering non-performing loans which stand at just 0.4%. Trading at a significant discount to its estimated fair value by about 38%, it also benefits from low-risk funding sources comprising mainly customer deposits, which make up 92% of liabilities.

Global Industrial (GIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Global Industrial Company operates as an industrial distributor of MRO products in the United States and Canada, with a market cap of approximately $1.03 billion.

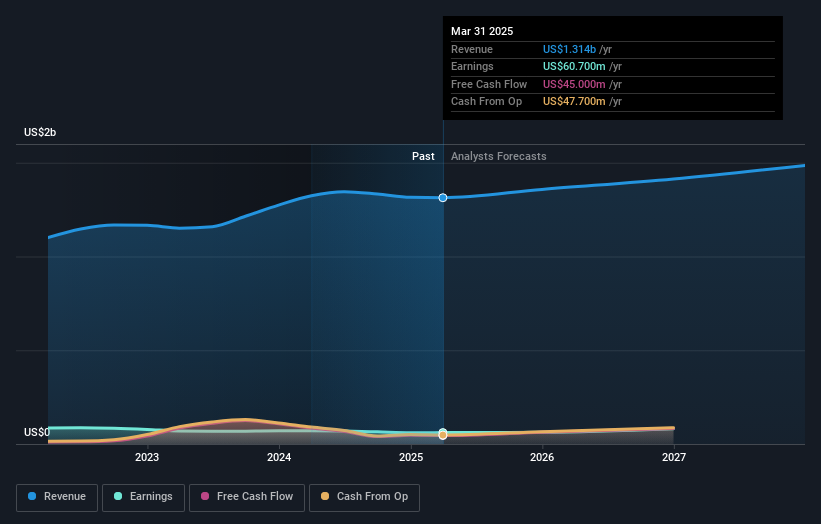

Operations: Global Industrial generates revenue primarily from its Industrial Products Group, which contributed $1.34 billion. The company's focus on distributing MRO products in North America supports its financial structure.

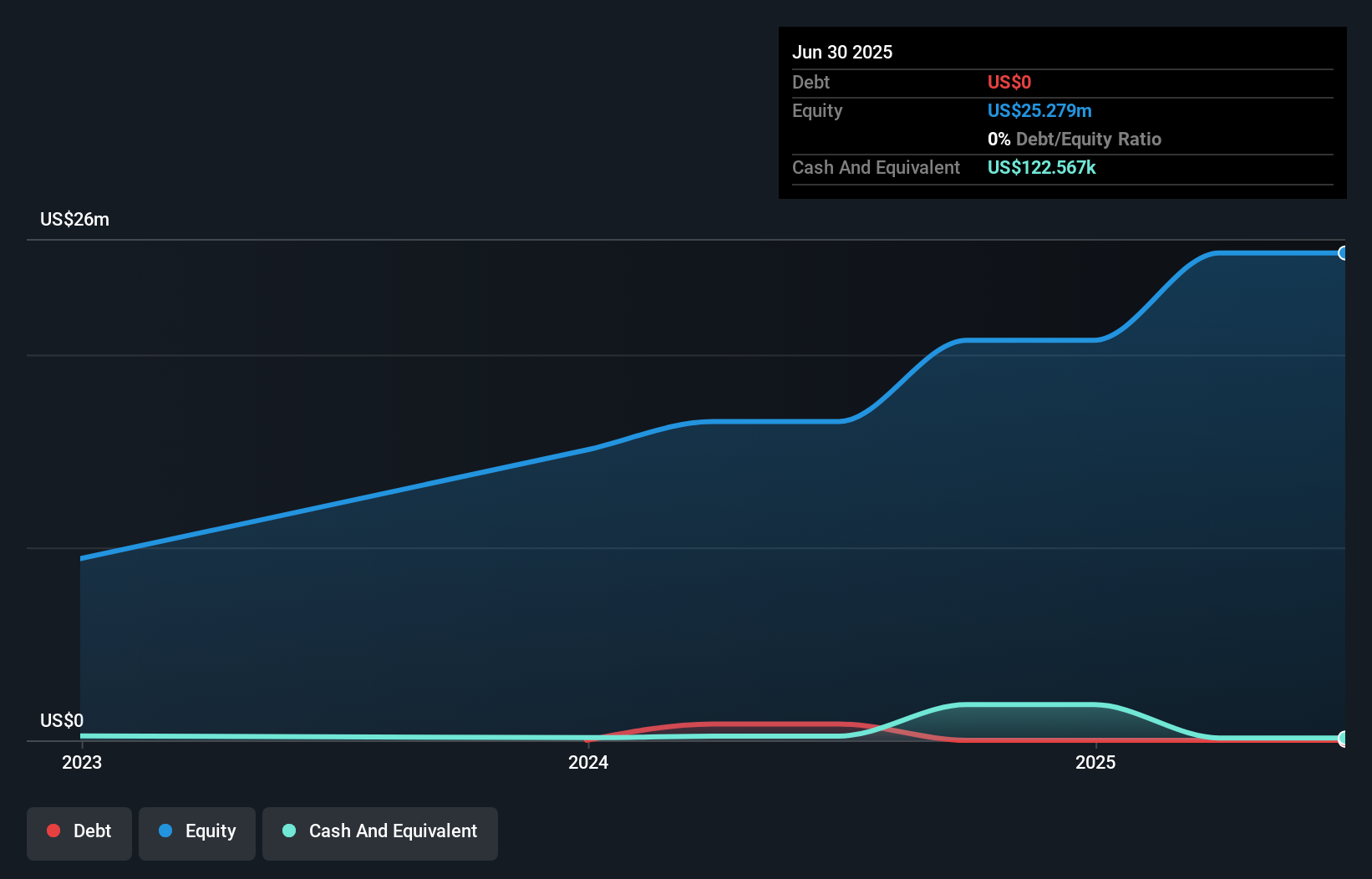

Global Industrial is making waves with its strategic focus on high-value accounts and digital transformation in the MRO sector. The company reported third-quarter sales of US$353.6 million, up from US$342.4 million the previous year, alongside a net income increase to US$18.8 million from US$16.8 million. With no debt and an asset-light model, Global Industrial seems well-positioned for future growth despite facing rising costs and competition challenges that could affect profit margins currently at 4.9%. Analysts see potential with earnings per share reaching US$0.48 compared to last year's US$0.44, suggesting a fair valuation around $37 per share against a target of $38.

Summing It All Up

- Investigate our full lineup of 294 US Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GIC

Global Industrial

Through its subsidiaries, operates as an industrial distributor of various industrial and maintenance, repair, and operation (MRO) products in the United States and Canada.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives