- United States

- /

- Trade Distributors

- /

- NYSE:GIC

Global Industrial (GIC) Margin Gain Reinforces Value Narrative as Shares Trade Below Fair Value Estimates

Reviewed by Simply Wall St

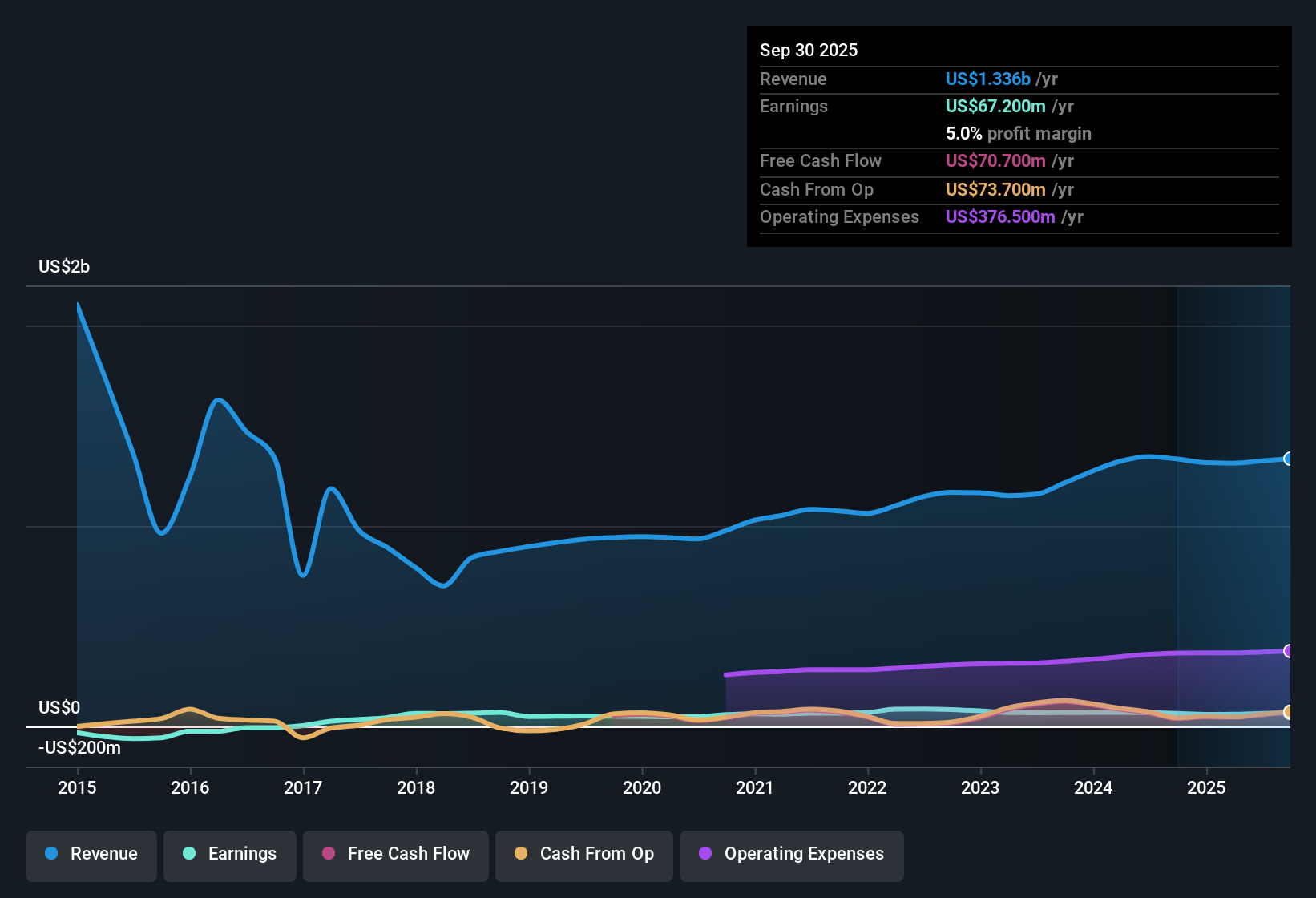

Global Industrial (GIC) delivered net profit margins of 5.1%, a slight improvement from last year’s 4.9%, and posted earnings growth of 4.2% for the year after facing a five-year average decline of 0.8%. Shares are trading at $28.75, which sits well below one estimate of fair value at $49.02. High-quality earnings and lower-than-average valuation multiples are prompting investors to take a second look. With earnings projected to grow at 11.02% per year and no major risks identified, investors are focused on the company’s rewarding combination of margin gains and relative value.

See our full analysis for Global Industrial.Now, let’s see how these latest results compare with the broader narratives investors and analysts are following. Some expectations may be confirmed, while others could be put to the test.

See what the community is saying about Global Industrial

Operating Margins Target 6.8% by 2028

- Analysts expect profit margins to rise from 4.9% today to 6.8% in three years, projecting Global Industrial will increase net profitability even as topline revenue growth trails the industry average.

- Analysts’ consensus view points out that this forecast is underpinned by the company's focus on higher-value accounts, ongoing digital transformation, and efforts to broaden its industrial and MRO product categories. These factors are expected to help the company capture a larger share of the market.

- However, the consensus also notes that much of the recent margin expansion has benefited from favorable inventory valuation and freight cost timing, which may not persist. As these factors unwind, the company could encounter temporary gross margin compression.

- The consensus further observes that the move towards high-value strategic customers comes with increased exposure to sector-specific downturns, which could create more variability in revenue and ultimately margins if economic or competitive conditions change.

- Investors watching whether margin gains hold as supply chain headwinds return can see how the evolving strategy plays out in the latest consensus view. 📊 Read the full Global Industrial Consensus Narrative.

Asset-Light Model Enables M&A Flexibility

- The company operates with an asset-light distribution model and zero debt, with strong cash flow that provides capacity for strategic acquisitions to accelerate expansion into new industrial and MRO product categories.

- Consensus narrative highlights that ongoing supply chain automation and a healthy balance sheet position Global Industrial to benefit from industry consolidation and operational efficiencies, supporting both near-term flexibility and long-term earnings growth.

- The ability to deploy cash for targeted M&A or technology investments is seen as a core enabler for capturing new markets, especially as organizations ramp up spending on infrastructure, regulatory compliance, and workplace safety.

- Analysts agree that the absence of debt reduces financial risk, giving the company freedom to respond to sector shifts and competitive pressures without the constraints of heavy borrowing.

Valuation Discount Stands Out Versus Industry

- Global Industrial trades at a price-to-earnings ratio of 16.3x, which is below both US Trade Distributors as a whole (22.3x) and the peer group (32.6x). This discount is underscored by fair value estimates: the DCF fair value is $49.02, significantly higher than the current $28.75 share price, while the analyst target is $38.00.

- According to the consensus narrative, this valuation gap strengthens the case that Global Industrial may be undervalued, especially when considering consistent profit growth and improving margins.

- Yet, since the forecast annual earnings growth rate of 11.02% lags the US market's expected 15.6% pace, some investors may hesitate to award a higher multiple even with margin tailwinds.

- The consensus view encourages investors to check if sector headwinds cap upside or if patient holders could benefit as valuation metrics revert to industry norms.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Global Industrial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something others may have missed? In just a few minutes, you can craft your own narrative and share your unique perspective. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Global Industrial.

See What Else Is Out There

Despite improving profit margins, Global Industrial’s earnings growth is forecast to trail the broader US market and may be vulnerable if economic conditions worsen.

For investors seeking steadier upward trends, use stable growth stocks screener (2121 results) to find companies delivering consistent revenue and profit growth through changing cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GIC

Global Industrial

Through its subsidiaries, operates as an industrial distributor of various industrial and maintenance, repair, and operation (MRO) products in the United States and Canada.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives