- United States

- /

- Machinery

- /

- NYSE:GGG

What Graco (GGG)'s Acquisition-Fueled Q3 Growth Means for Shareholders

Reviewed by Sasha Jovanovic

- Graco Inc. recently announced its third-quarter financial results, reporting sales of US$543.36 million and net income of US$137.63 million, both up from the prior year, with growth attributed mainly to acquisitions and favorable currency trends despite continued softness in core organic sales.

- An interesting development is management's commentary that subdued North American construction activity and tariff-related costs are being offset by recent pricing actions and the company's ongoing organizational restructuring.

- We'll now explore how the reliance on acquisition-driven growth and subdued core demand may reshape Graco's investment narrative moving forward.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Graco Investment Narrative Recap

To be a Graco shareholder, you need to believe in the company’s ability to grow via acquisitions and operational efficiency, counterbalancing weaker core demand and fluctuating North American construction activity. The recent earnings update supports ongoing growth from acquisitions, but the main short-term catalyst, new product adoption in the Contractor segment, remains largely unchanged, while the persistent risk of tariff impacts and soft construction demand continues to loom. Overall, the news does not materially shift the risk-reward equation for the immediate term.

Of Graco’s recent announcements, management’s reaffirmation of full-year guidance for low single-digit organic, constant currency sales growth stands out. This guidance aligns with the view that while acquisitions and pricing actions provide a buffer, organic momentum in core businesses is still subdued, underscoring the importance of operational improvements and product innovation as nearer-term drivers for the stock.

However, what investors should notice is that despite these positive signals around acquisitions and pricing, ongoing pressures, especially from soft demand in professional construction markets, mean...

Read the full narrative on Graco (it's free!)

Graco's narrative projects $2.7 billion revenue and $641.7 million earnings by 2028. This requires 7.9% yearly revenue growth and a $159.1 million increase in earnings from $482.6 million today.

Uncover how Graco's forecasts yield a $92.44 fair value, a 14% upside to its current price.

Exploring Other Perspectives

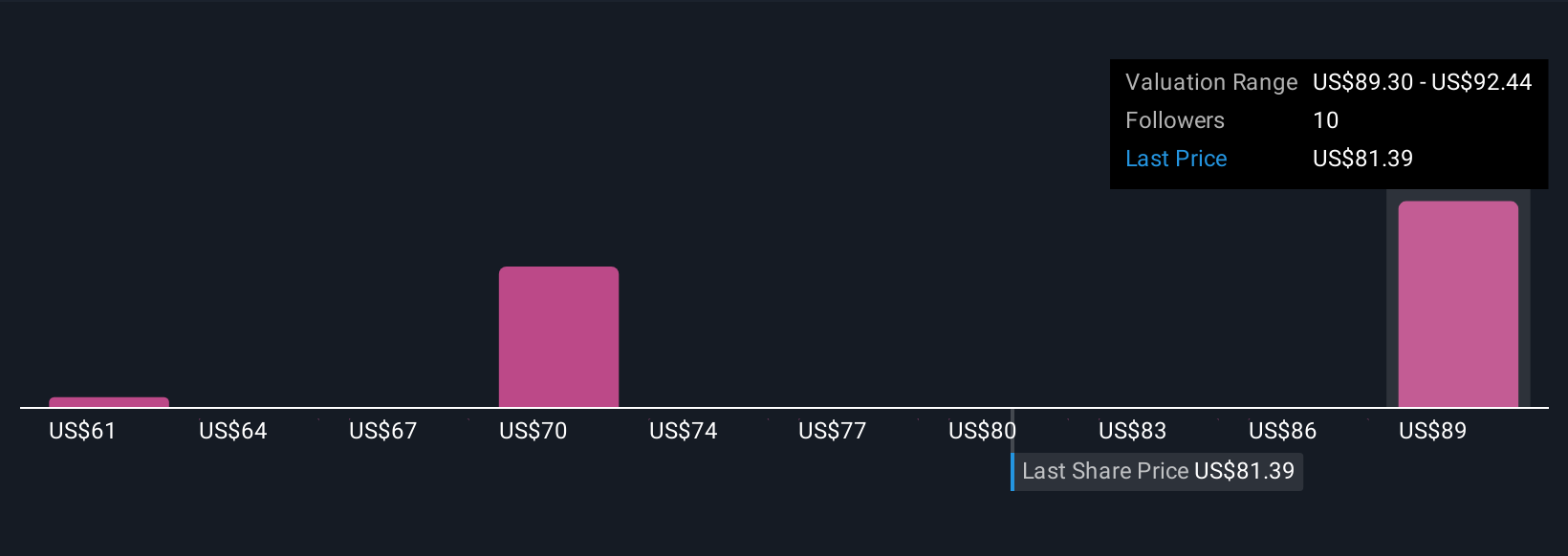

Four members of the Simply Wall St Community value Graco between US$61 and US$92.44 per share. While acquisition-driven expansion supports optimism among some, you will find significantly different views reflecting ongoing concerns about organic sales growth and tariffs.

Explore 4 other fair value estimates on Graco - why the stock might be worth 25% less than the current price!

Build Your Own Graco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Graco research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Graco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Graco's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GGG

Graco

Designs, manufactures, and markets systems and equipment used to move, measure, mix, control, dispense, and spray fluid and powder materials in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives