- United States

- /

- Machinery

- /

- NYSE:GGG

Graco (GGG): Assessing Valuation After Q3 Acquisition-Driven Growth and Revenue Miss

Reviewed by Simply Wall St

Graco (NYSE:GGG) released its third-quarter results, reporting revenue growth that was mainly fueled by acquisitions. However, organic sales dipped due to ongoing softness in global construction markets, particularly across North America.

See our latest analysis for Graco.

Graco’s share price has seen modest movement this year, currently trading at $82.40 and posting a 1.65% total return over the past twelve months. While sentiment cooled after the company missed quarterly revenue expectations, Graco’s five-year total shareholder return of over 41% puts its long-run performance well ahead of inflation and many industry peers. This suggests that investors still value its profitability and steady growth-through-acquisition strategy.

If you're interested in broadening your search beyond industrial names, now’s an excellent moment to discover fast growing stocks with high insider ownership.

With Graco's recent financials reflecting both growth and headwinds, investors are left to consider whether current market prices undervalue the company's future prospects or if the outlook for continued expansion is already fully reflected.

Most Popular Narrative: 10.9% Undervalued

The most widely followed narrative prices Graco at a fair value notably above its last close, implying there is hidden upside in the company’s long-term trajectory. This viewpoint centers on the impact of strategic moves and operational decisions designed to strengthen Graco’s market edge.

The strategic decision to maintain a strong U.S. manufacturing footprint may give Graco an advantage over competitors who manufacture offshore, especially in light of ongoing trade tensions and tariffs. This could potentially improve net margins due to cost control and pricing power.

Want to understand why this outlook is so bullish? The growth assumptions go far beyond generic forecasts. The secret mix includes aggressive new product launches, integration wins, and profitability enhancements that could defy industry averages. Which key numbers set this valuation apart from the crowd? Find out what’s driving these projections and why the analysts are betting on more than just incremental gains.

Result: Fair Value of $92.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tariffs or slipping contractor margins could derail projected earnings. This reminds investors that Graco’s growth comes with real uncertainty.

Find out about the key risks to this Graco narrative.

Another View: Is Graco Actually Expensive?

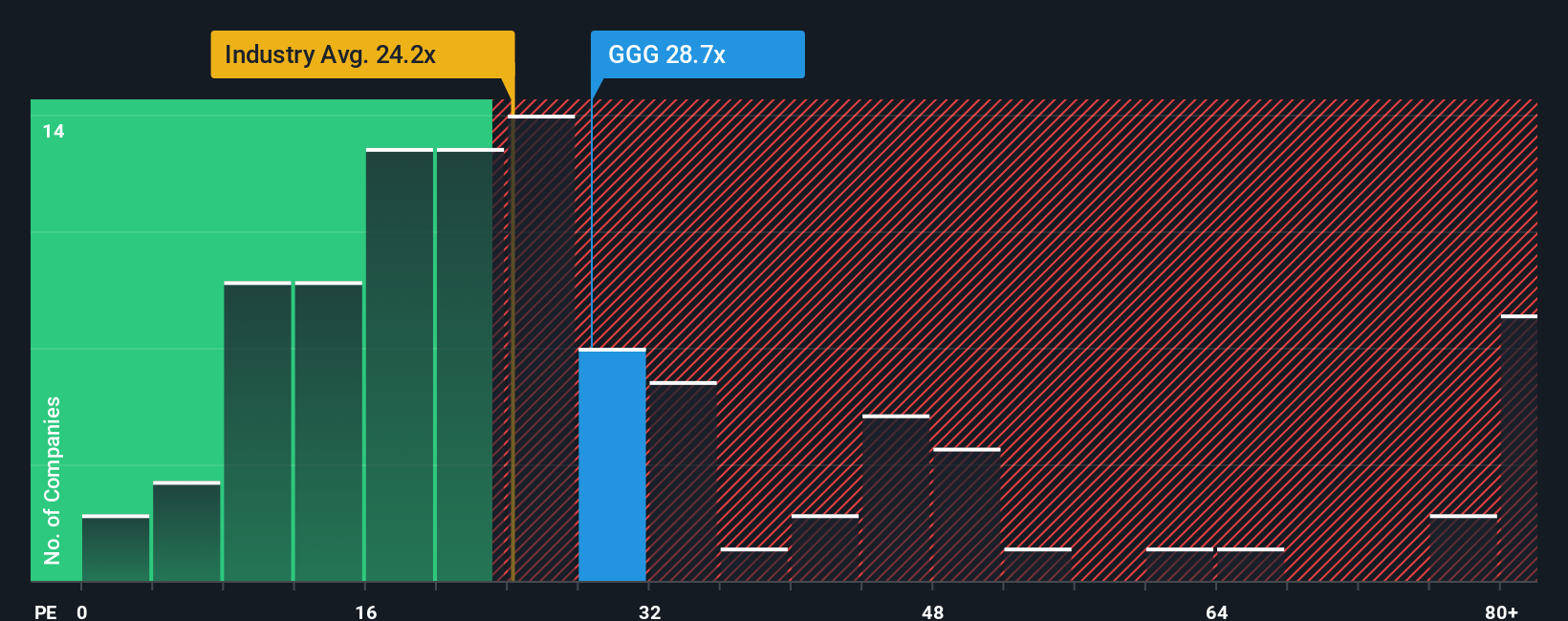

Looking from a different angle, Graco’s price-to-earnings ratio of 27.4x stands out as notably higher than both the US Machinery industry average of 24.6x and the peer average of 24.5x. This means investors are paying a premium, even relative to similar companies. The market’s “fair ratio” is estimated at just 21.1x, suggesting today’s valuation could face pressure if sentiment shifts. Does this premium signal strong confidence, or does it leave little room for error if earnings miss the mark?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Graco Narrative

If you see things differently or enjoy hands-on analysis, you can dive into the numbers and shape your own view in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Graco.

Looking for more investment ideas?

Seize your edge and beat the crowd by letting the Simply Wall Street Screener uncover investment opportunities that could sharpen your portfolio and boost your returns.

- Spot income opportunities by tracking companies with above-average yields in these 17 dividend stocks with yields > 3%, and see how steady dividends can power your long-term wealth.

- Capitalize on tech innovation and find winners transforming our future with these 27 AI penny stocks, where artificial intelligence is driving the next phase of market growth.

- Unlock value in overlooked sectors by searching for the best bargains in these 877 undervalued stocks based on cash flows, where hidden potential is waiting for smart investors to take action.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GGG

Graco

Designs, manufactures, and markets systems and equipment used to move, measure, mix, control, dispense, and spray fluid and powder materials in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives