- United States

- /

- Electrical

- /

- NYSE:GEV

The Bull Case For GE Vernova (GEV) Could Change Following First International Wind Repowering Deal in Taiwan

Reviewed by Sasha Jovanovic

- Taiwan Power Company recently announced an agreement with GE Vernova Inc. to supply 25 onshore wind repower upgrade kits in Taiwan, marking GE Vernova’s first such international contract beyond the United States and including a five-year operations and maintenance services package.

- This move highlights GE Vernova's expansion of its wind repowering expertise internationally, reinforcing its role in supporting decarbonization and energy infrastructure modernization in new markets.

- We'll examine how GE Vernova's entry into Taiwan's wind repowering market could reshape its global growth prospects and recurring revenue potential.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

GE Vernova Investment Narrative Recap

To be a shareholder in GE Vernova, you need to believe in the company’s ability to execute on global energy transition trends and scale its renewable and electrification services for recurring, higher-margin growth. The new Taiwan wind repowering deal broadens Vernova’s international footprint, but is not likely to materially move the needle on the pivotal short-term catalysts, ongoing order visibility in power generation and grid, as well as demonstrating improved Wind segment profitability. The main risk remains project delays and persistent underperformance in the Wind business, where losses and tariffs continue to pressure margins.

Among recent developments, the expansion of the Charleroi facility in Pennsylvania stands out, as it addresses a core catalyst: boosting capacity for high-voltage switchgear products vital to grid reliability and modernization. This theme directly links to GE Vernova’s backlog and aligns with global infrastructure demand, which remains a key driver for long-term earnings visibility. Yet, tariff exposure and execution risks in large-scale projects remind investors to stay focused on operational discipline...

Read the full narrative on GE Vernova (it's free!)

GE Vernova's narrative projects $48.0 billion in revenue and $5.8 billion in earnings by 2028. This requires 9.5% yearly revenue growth and a $4.6 billion earnings increase from $1.2 billion today.

Uncover how GE Vernova's forecasts yield a $678.93 fair value, a 22% upside to its current price.

Exploring Other Perspectives

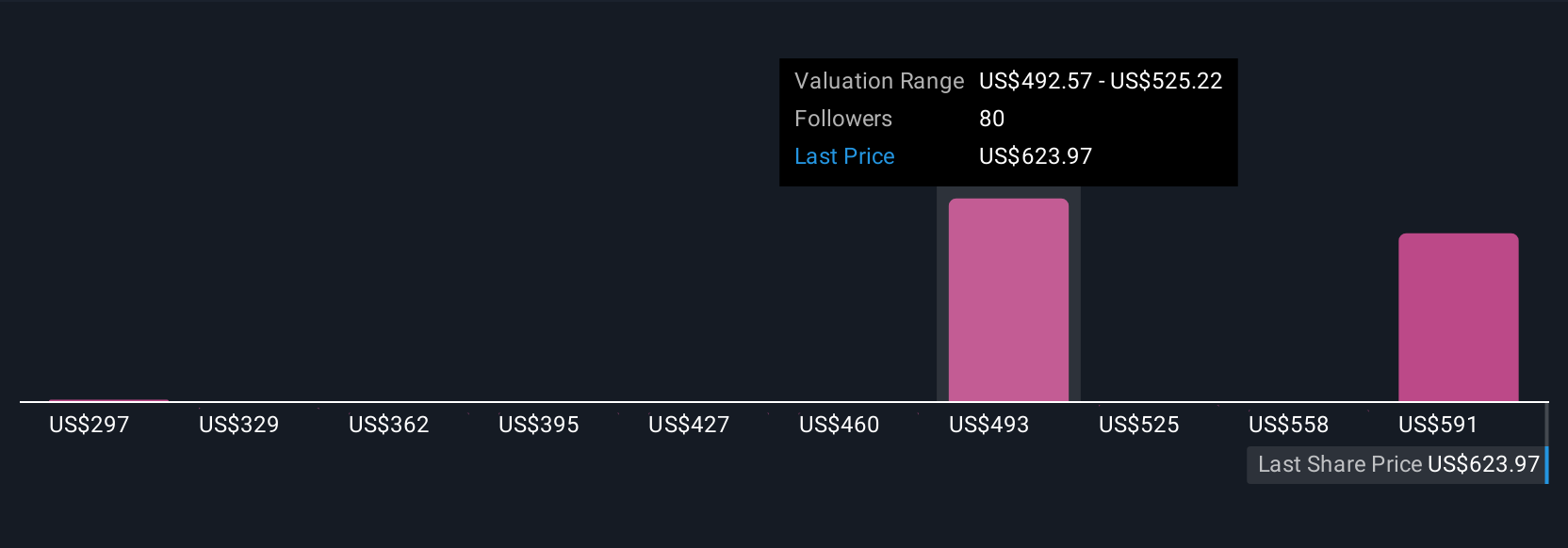

Simply Wall St Community members provided 18 separate fair value estimates, spanning US$359.90 to US$760 per share. With Wind segment performance under pressure and project-level risks highlighted, you can compare these perspectives against the company’s ability to deliver on its renewable ambitions.

Explore 18 other fair value estimates on GE Vernova - why the stock might be worth 36% less than the current price!

Build Your Own GE Vernova Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GE Vernova research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free GE Vernova research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GE Vernova's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives