- United States

- /

- Electrical

- /

- NYSE:GEV

How Analyst Support and AI Power Demand Could Shape GE Vernova's (GEV) Long-Term Growth Story

Reviewed by Simply Wall St

- Earlier this month, GE Vernova presented at the Gastech Exhibition & Conference 2025, with its CCS Product Champion, Matthew Davidsaver, addressing advances in carbon capture and storage solutions.

- An analyst upgrade following these events highlighted how GE Vernova’s positioning for expanding power demand, particularly driven by artificial intelligence, is attracting renewed investor interest and industry attention.

- We’ll explore how robust analyst support for GE Vernova’s electrification-led growth could influence its long-term investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

GE Vernova Investment Narrative Recap

If you’re considering GE Vernova, you need to believe in an extended, global wave of demand for electrification and grid modernization, fueled by data center growth and energy transition tailwinds. While the analyst upgrade and increased visibility at Gastech reinforce confidence in surging power demand as the principal near-term catalyst, they don’t fundamentally shift concerns surrounding execution risks on large infrastructure projects, which remain the company’s biggest vulnerability right now.

Among recent announcements, the Charleroi, Pennsylvania grid manufacturing expansion stands out. This move directly supports GE Vernova’s ability to sustain backlog growth and capitalize on higher-margin grid stability solutions, a core theme driving both its near-term optimism and long-term backlog conversion, even as order volatility in large projects stays top of mind.

But against this optimism, there is still the risk investors should be aware of: if major infrastructure projects are delayed or canceled, revenue and earnings could ...

Read the full narrative on GE Vernova (it's free!)

GE Vernova's outlook anticipates $48.0 billion in revenue and $5.8 billion in earnings by 2028. This requires 9.5% annual revenue growth and a $4.6 billion increase in earnings from the current $1.2 billion.

Uncover how GE Vernova's forecasts yield a $638.45 fair value, in line with its current price.

Exploring Other Perspectives

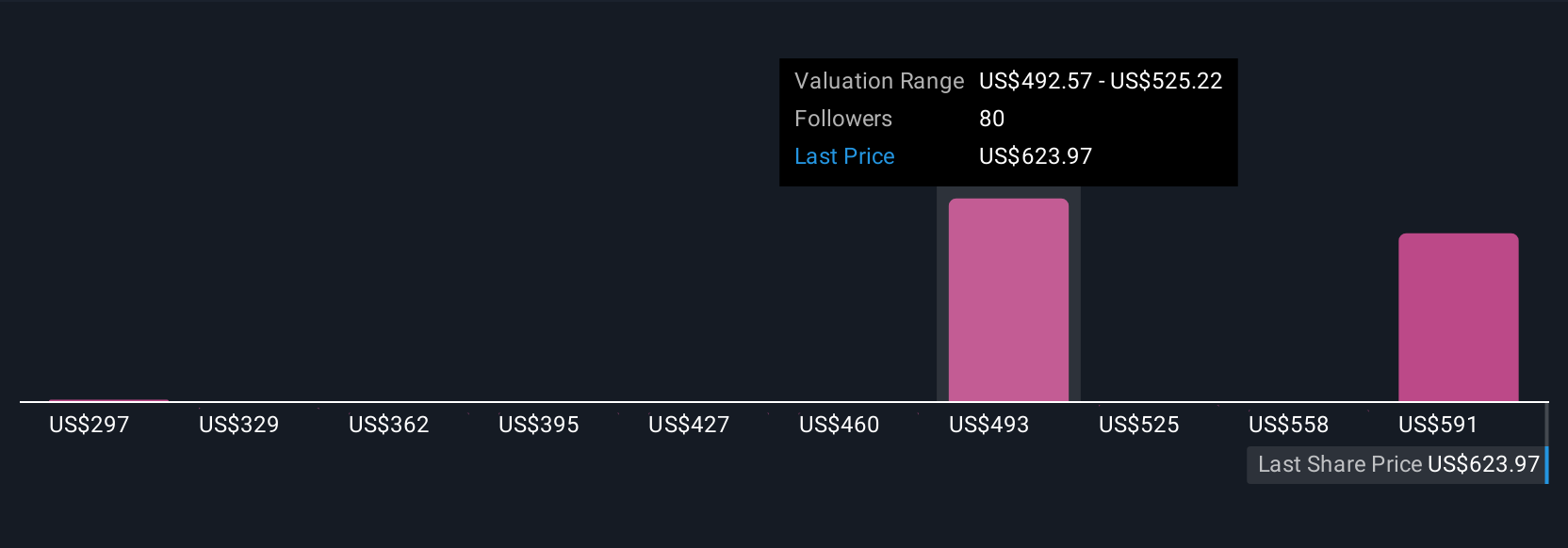

Simply Wall St Community members provided 18 independent fair value estimates for GE Vernova, ranging from US$310.26 to US$760 per share. While views vary widely, the company’s exposure to large, lumpy projects creates unpredictable earnings streams, making it essential to consider several perspectives when evaluating long-term potential.

Explore 18 other fair value estimates on GE Vernova - why the stock might be worth less than half the current price!

Build Your Own GE Vernova Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GE Vernova research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free GE Vernova research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GE Vernova's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives