- United States

- /

- Electrical

- /

- NYSE:GEV

GE Vernova (GEV): Examining Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

GE Vernova (GEV) is on investors' radar as its stock price has seen some movement recently, with a 3% gain in the past day and almost 74% year-to-date. This kind of performance tends to spark discussions about what is driving the momentum and whether it can continue.

See our latest analysis for GE Vernova.

GE Vernova’s nearly 74% year-to-date share price return signals that momentum is clearly building, with investors responding to recent price action and ongoing optimism about the company’s growth trajectory. The total return over the past year has also been strong, which reinforces that the latest moves fit within a broader story of renewed confidence in the stock’s future prospects.

If you’re curious what else might be gaining traction right now, it is a good time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares still trading below the average analyst price target, but after such a rapid rise, investors have to ask whether GE Vernova remains undervalued or if the market is already factoring in the company’s growth story.

Most Popular Narrative: 13.1% Undervalued

Analyst consensus suggests that GE Vernova's fair value stands well above the latest closing price, pointing to notable upside if projected fundamentals play out as anticipated.

Strong momentum in power generation and grid infrastructure orders, driven by rising demand for electrification and global decarbonization initiatives, is expanding GE Vernova's backlog at higher margins. This supports sustained revenue growth and future earnings visibility.

Want to know the driver behind this powerful valuation call? The core thesis hinges on a bold forecast of margin expansion and a growth trajectory that would excite any industry watcher. Which key metrics are behind this confident price target? The answers will surprise those expecting a simple story.

Result: Fair Value of $678.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, it is important to note that weaker European demand or ongoing losses in the Wind segment could undermine the optimistic case for GE Vernova.

Find out about the key risks to this GE Vernova narrative.

Another View: What Do Market Ratios Signal?

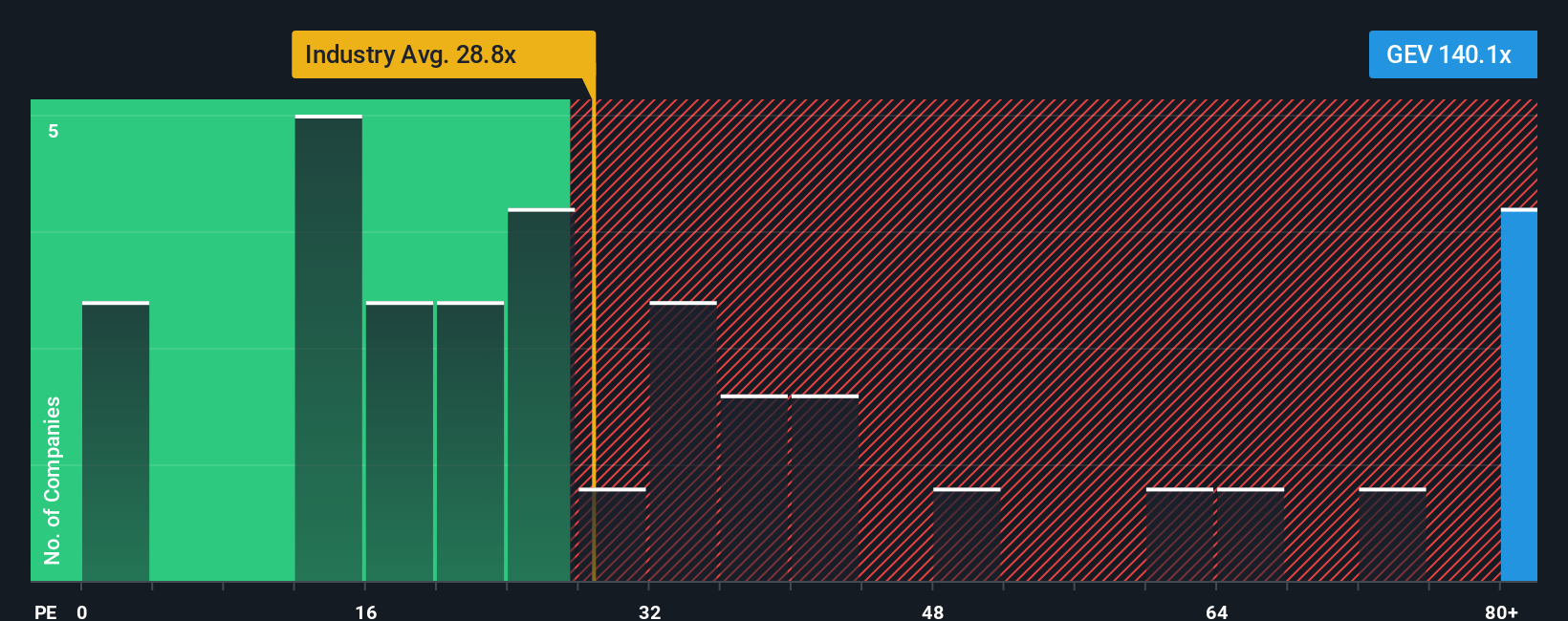

While analyst consensus points to upside, a closer look at the price-to-earnings ratio reveals a different story. GE Vernova trades at 93.9 times earnings, much higher than its industry peers at 30.9 times and the fair ratio of 77.6 times. This suggests investors are paying a significant premium, which could limit future return potential or expose the stock to risk if growth stumbles. The market is assigning a lofty valuation, raising questions about what drives this confidence.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GE Vernova Narrative

If this perspective does not match your own, or you want to dig into the numbers yourself, you can craft a custom narrative in just a few minutes with Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding GE Vernova.

Looking for More Investment Ideas?

Don’t let great opportunities slip by. Power up your portfolio by targeting companies at the forefront of tomorrow’s growth and innovation with these hand-picked ideas:

- Uncover potential high-flyers by scanning these 3579 penny stocks with strong financials, where strong financials set promising penny stocks apart from the crowd.

- Boost your search for market-beating returns by checking out these 928 undervalued stocks based on cash flows, revealing stocks currently trading below what their cash flows justify.

- Capture the future of healthcare by leveraging these 30 healthcare AI stocks to spot companies using AI to disrupt the medical landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success