- United States

- /

- Aerospace & Defense

- /

- NYSE:GE

General Electric (GE): Is There Further Upside After a 85% Share Price Rally?

Reviewed by Simply Wall St

General Electric (GE) shares have seen a steady climb this year, outpacing the broader market. Investors appear to be considering the company’s consistent revenue and income growth, which continues to shape its longer-term outlook.

See our latest analysis for General Electric.

With a year-to-date share price return of over 85%, General Electric’s impressive rally has turned heads. Momentum is clearly building, fueled by a combination of renewed growth optimism and the company’s strong track record, reflected in a remarkable 555% total shareholder return over the past three years.

If GE’s rapid rebound has you on the lookout for more opportunities, now’s the perfect time to discover fast growing stocks with high insider ownership

But with shares trading near recent highs, the critical question for investors is whether GE’s current valuation leaves room for further upside or if the market has already factored in all the future potential.

Most Popular Narrative: 4.4% Undervalued

With General Electric’s fair value estimate sitting above its last close price, bullish sentiment is emerging around the stock’s future prospects. The narrative highlights catalysts that are powering forward expectations for growth and margins.

Acceleration of next-generation engine programs (like CFM RISE with open fan technology and the GE9X), driven by airline demand for significantly improved fuel efficiency and lower emissions, positions GE to capture incremental orders and technology licensing revenue as decarbonization efforts intensify. This has the potential to positively impact long-term revenue and earnings growth.

Want to know what underpins this optimism? There is a bold outlook for both revenue and profit expansion, plus a future earnings multiple that is above the industry standard. Which financial assumptions do analysts believe will power the next leg higher? See what numbers support their surprisingly confident fair value forecast.

Result: Fair Value of $327.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain pressures or a slowdown in commercial aviation demand could quickly challenge the optimistic assumptions behind GE's strong growth outlook.

Find out about the key risks to this General Electric narrative.

Another View: Is the Valuation Stretching Too Far?

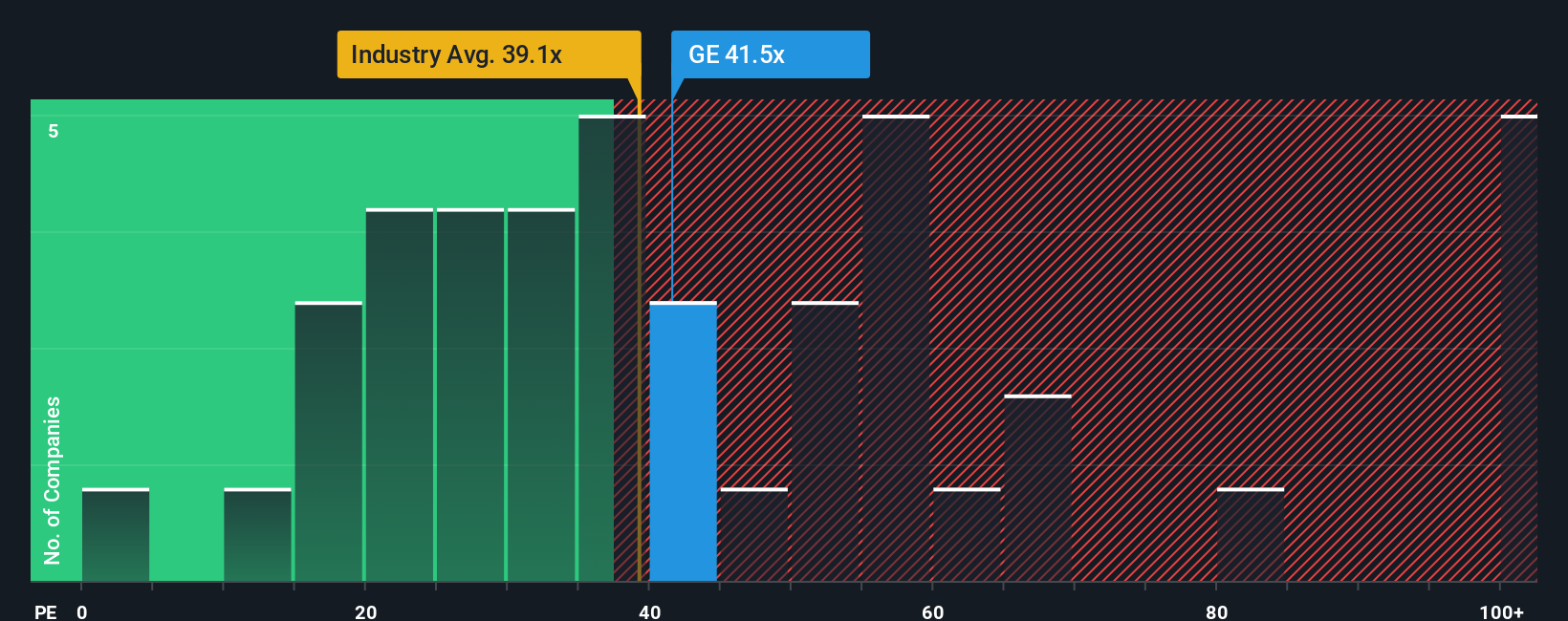

While bullish forecasts center on future growth, a look at today’s price-to-earnings ratio offers a reality check. GE trades at 41 times earnings, which is not only above the industry average of 40.9x but also much higher than the peer group’s 26.8x and the fair ratio of 35.1x. That steep premium signals investors might be paying up for the outlook. At what point could sentiment shift if expectations continue to rise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own General Electric Narrative

If you see the story differently or want your own take on the numbers, you can craft a custom view using the same data in just minutes, so Do it your way.

A great starting point for your General Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Ready for your next big opportunity? Seize the chance to uncover standout stocks handpicked by Simply Wall Street and stay ahead while others just watch.

- Capture strong yield potential and start building better passive income streams by checking out these 19 dividend stocks with yields > 3% that consistently deliver high returns.

- Tap into the explosive future of artificial intelligence and spot early movers by tracking these 27 AI penny stocks positioned at the forefront of the AI revolution.

- Find exceptional bargains by targeting these 869 undervalued stocks based on cash flows to unlock stocks trading below their true value before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GE

General Electric

General Electric Company, doing business as GE Aerospace, designs and produces commercial and defense aircraft engines, integrated engine components, electric power, and mechanical aircraft systems.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives