- United States

- /

- Aerospace & Defense

- /

- NYSE:GE

General Electric (GE): Examining Valuation After Strong Share Price Momentum and Investor Optimism

Reviewed by Simply Wall St

See our latest analysis for General Electric.

General Electric’s share price has shown impressive momentum, climbing over 13% in the last quarter and delivering a year-to-date gain of over 80%. With a one-year total shareholder return of 73% and an exceptional five-year return of 541%, GE is clearly riding a wave of renewed confidence as investors continue to reward its turnaround and strong earnings performance.

If you’re interested in uncovering what else is working for investors, take this moment to discover See the full list for free.

But after such a strong run, is there still room for GE's stock to grow from here? Or has the market already factored in future gains, leaving little room for upside?

Most Popular Narrative: 11.3% Undervalued

General Electric’s most popular narrative assigns a fair value of $343.57, suggesting meaningful upside from the last close at $304.82. Here is what supports that view and could reset expectations.

“Acceleration of next-generation engine programs (like CFM RISE with open fan technology and the GE9X) driven by airline demand for significantly improved fuel efficiency and lower emissions; positions GE to capture incremental orders and technology licensing revenue as decarbonization efforts intensify, positively impacting long-term revenue and earnings growth.”

Curious what numbers justify this bullish target? The secret behind the valuation lies in robust, compounding revenue and earnings gains, backed by big profit margin assumptions and a rarified PE multiple. Do not miss the details fueling this growth thesis.

Result: Fair Value of $343.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued reliance on commercial aviation and persistent supply chain pressures could still challenge GE's positive outlook and future growth trajectory.

Find out about the key risks to this General Electric narrative.

Another View: A Look at Market Multiples

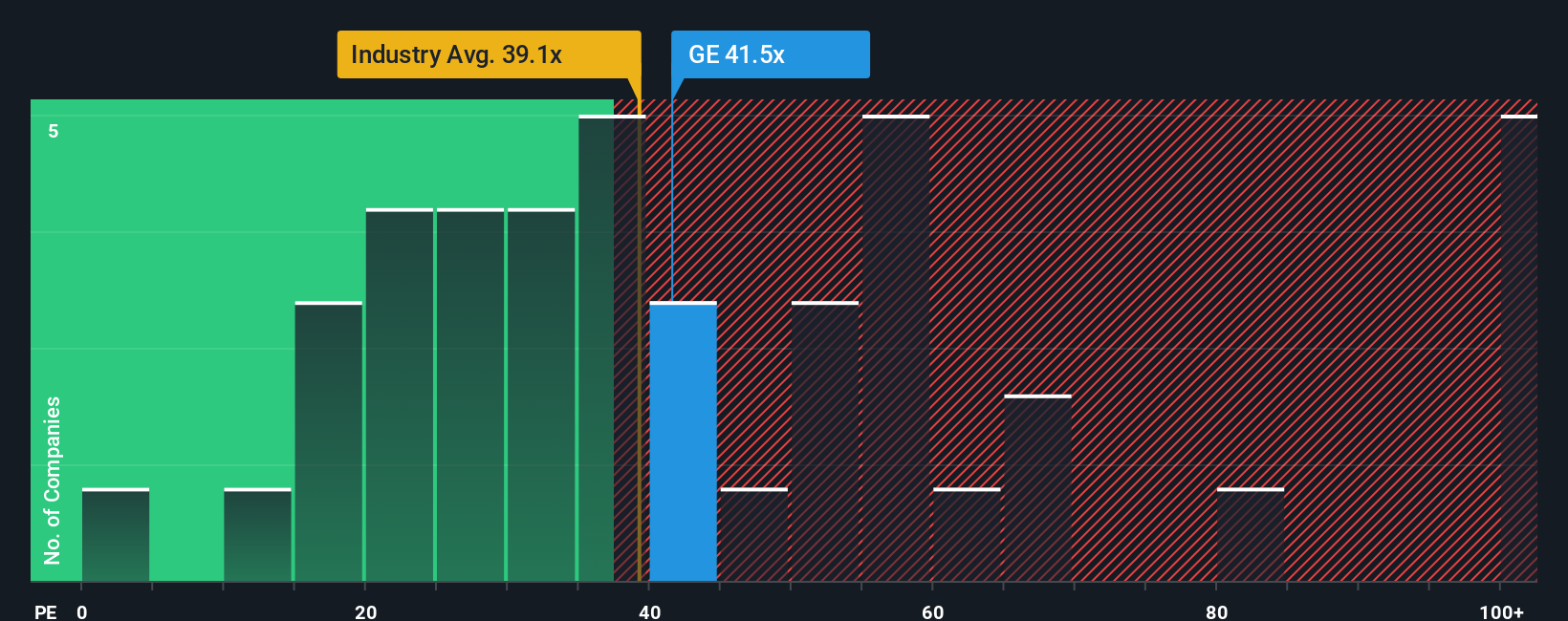

While the popular narrative suggests upside, a comparison using current price-to-earnings ratios tells a different story. GE’s ratio stands at 39.9x, above both the US Aerospace & Defense industry at 38.5x and peers at 25.8x, and higher than the fair ratio of 36x. This points to a premium valuation. Does GE truly justify such elevated expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own General Electric Narrative

If you would rather analyze the metrics yourself and draw your own conclusions, you can easily put together a personal narrative in just a few minutes. Do it your way

A great starting point for your General Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why limit yourself to just one opportunity? Hand-pick more winning stocks by using these unique investment angles and stay a step ahead in today's market:

- Capture exciting yields and grow your passive income by reviewing these 16 dividend stocks with yields > 3%, which delivers impressive returns above 3%.

- Capitalize on the AI revolution and spot ground-floor opportunities by scanning these 25 AI penny stocks before they make headlines.

- Benefit from market inefficiencies and seize bargains with these 879 undervalued stocks based on cash flows, offering strong underlying value and untapped potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GE

General Electric

General Electric Company, doing business as GE Aerospace, designs and produces commercial and defense aircraft engines, integrated engine components, electric power, and mechanical aircraft systems.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives