- United States

- /

- Aerospace & Defense

- /

- NYSE:GD

General Dynamics (GD) Reports US$13 Billion Q2 Sales and US$1 Billion Net Income

Reviewed by Simply Wall St

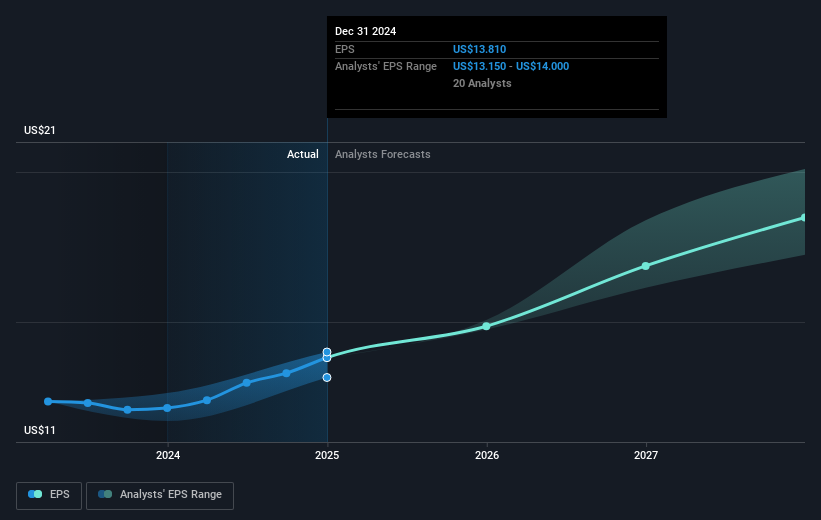

General Dynamics (GD) recently reported strong second-quarter earnings, with sales rising to $13,041 million and net income climbing to $1,014 million, marking significant year-over-year growth. This robust financial performance, alongside the affirmation of a regular quarterly dividend of $1.50 per share, likely bolstered investor sentiment, contributing to the stock's price move of approximately 12% during the last quarter. While market indices like the S&P 500 also reached new highs, General Dynamics' results highlighted specific positive momentum distinct from broader market trends. Executive changes and market conditions provided additional context to the company's positive trajectory.

Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

The recent financial results for General Dynamics, with second-quarter sales rising to US$13.04 billion and net income reaching US$1.01 billion, underscore the company's robust fiscal health and investor confidence. These strong results, coupled with a steady quarterly dividend, likely support a positive investor outlook. Over the past five years, General Dynamics shares have achieved a substantial total return of 124.75%, becoming a noteworthy performer in the aerospace and defense sector. However, in the past year, the company's stock underperformed both the industry and broader US market averages.

The certification of the G800 and enhancements in supply chain efficiency suggest a potential boost in Aerospace revenue and margins. Increased orders in the Technologies and Marine Systems segments indicate promising growth prospects, potentially impacting revenue and earnings positively. Despite the optimistic outlook, challenges such as labor disruptions and tariff impacts could pose risks to these forecasts. With the current share price at US$297.60, just slightly under the consensus price target of approximately US$305.31, the stock appears to align closely with analyst projections, indicating a potentially fair valuation by the market.

Explore historical data to track General Dynamics' performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GD

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives