- United States

- /

- Aerospace & Defense

- /

- NYSE:GD

General Dynamics (GD): Net Margin Improves, Reinforcing Bullish Valuation Narratives

Reviewed by Simply Wall St

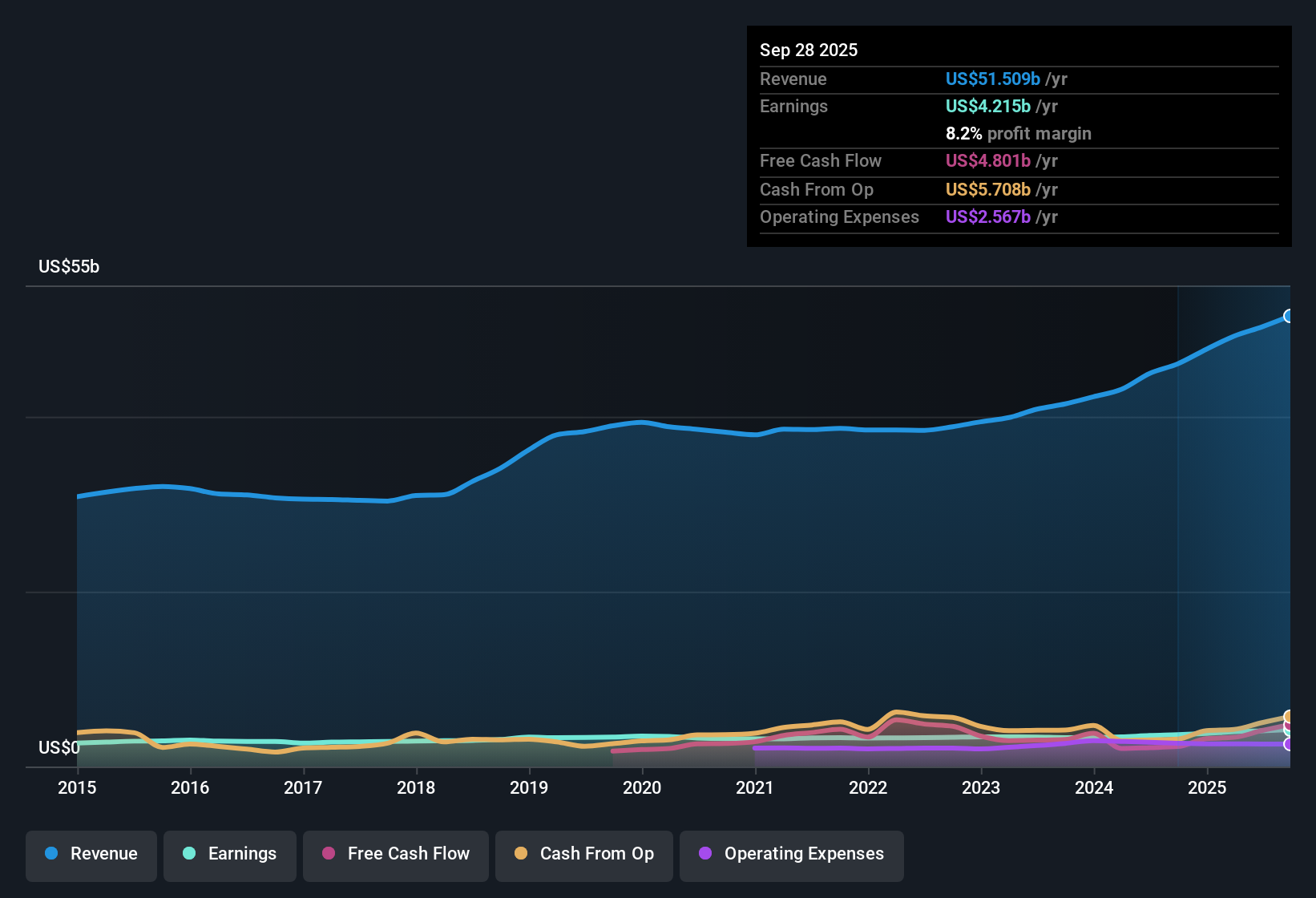

General Dynamics (GD) reported net profit margins of 8.1%, slightly higher than last year's 7.9%, indicating stronger profitability. Earnings have increased at an average rate of 4.3% per year over the past five years, with a notable 15.3% rise in the most recent year. Investors are now observing as forecasts suggest 3.4% annual revenue growth and 7.3% earnings growth per year, even though both figures trail broader US market trends.

See our full analysis for General Dynamics.Next, we will see how these earnings figures fit into current market narratives. Some perspectives are likely to be confirmed, while others may be reconsidered.

See what the community is saying about General Dynamics

Backlog Hits Record Levels Amid Global Defense Demand

- General Dynamics’ backlog has reached record highs, fueled by rising global defense spending and new multi-year contracts, especially within its Marine, Aerospace, and advanced military programs.

- Analysts' consensus view highlights:

- Multi-year order intake is being driven by expanded defense budgets and geopolitical instability. This is strengthening revenue visibility for the Marine and Aerospace segments.

- Accelerating investment in secure communications, digital modernization, and cyber defense solutions is boosting growth in Mission Systems and GDIT divisions, supporting both short and long-term margin expansion.

- Momentum in advanced military contracts not only fortifies top-line growth but also introduces the potential for higher future margins as the business transitions to higher-value offerings.

📊 Read the full General Dynamics Consensus Narrative.

DCF Fair Value Signals Upside Versus Industry Peers

- With shares trading at $350.77, General Dynamics sits below its DCF fair value of $376.41. Notably, the price-to-earnings ratio of 23.1x is well under both the peer average (37.3x) and Aerospace & Defense industry (40x).

- Analysts' consensus view observes:

- The constructive valuation is underpinned by steady earnings growth and market leadership in profitable segments. This supports current market optimism despite less aggressive revenue forecasts compared to the broader US market.

- Analyst consensus price target of $359.56 is just 2.5 percent above the current share price, signaling broad agreement that shares are fairly valued given the growth, margin, and risk context supplied in the latest data.

Margin Expansion Anticipated as Cyber and Marine Segments Scale

- Profit margins are forecast to improve from 8.1 percent now to 9.1 percent by 2026, as investments in cyber defense, digital tools, and operational efficiency compound in key business lines.

- According to the analysts' consensus narrative:

- Strategic bets on secure communications and IT modernization are already lifting productivity and margins in the Mission Systems segment. Meanwhile, scale-up of the Electric Boat and new submarine contracts is expected to realize further operating leverage for Marine Systems.

- Gulfstream’s next-generation jet models are drawing global demand, and as deliveries ramp up, product mix is set to shift toward higher-margin offerings. This supports gradual but sustained net margin improvement across the cycle.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for General Dynamics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? Shape your insights into a narrative of your own in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding General Dynamics.

See What Else Is Out There

While General Dynamics shows profitability, its earnings and revenue growth are expected to lag behind the broader US market in the coming years.

If you want to focus on companies projecting steadier and stronger expansion, check out stable growth stocks screener (2099 results) for opportunities with more consistent growth potential through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GD

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion